IRS Taxpayer Identification Number Matching aka TIN Matching is a tool that helps businesses avoid penalties and payment frauds.

What is Taxpayer Identification Number?

A Taxpayer Identification number, also known as TIN, is a nine-digit number used by the IRS to identify individual taxpayers. This unique TIN can help the IRS to figure out who needs to file taxes and pay them.

Note: The Social Security Administration (SSA) issues SSN as the type of Tax Identification Number (TIN), while the Internal Revenue Service (IRS) issues the rest of the U.S. tax identification numbers.

Types of TIN

There are five types of TINs:

- Employer Identification Number (EIN): The IRS issues EIN to corporations, trusts, and estates that need to pay taxes. It is a nine-digit number and is read as XX-XXXXXXX.

- Individual Taxpayer Identification Number (ITIN): The IRS issues ITIN to certain nonresident and resident aliens, their spouses, and their dependents who can’t get a Social Security Number (SSN). The ITIN looks like an SSN (XXX-XX-XXXX) but always starts with the digit 9. If you want to get an ITIN, you must file W-7 form and proving your resident status.

- Adoption Taxpayer Identification Number (ATIN): ATIN is used in cases of domestic adoptions when adoptive parents can’t get the child’s Social Security Number (SSN) for their tax returns. The child must be a U.S. citizen or permanent resident, and the adoption must be in progress.

- Preparer Taxpayer Identification Number (PTIN): The IRS needs a Preparer Tax Identification Number (PTIN) on each tax return submitted. Anyone who is charged for helping with a tax return must have and use a PTIN.

- Social Security Number (SSN): The SSN is the primary tax ID issued by the Social Security Administration to U.S. citizens, permanent residents, and some temporary residents. SSNs follow the format XXX-XX-XXXX. They’re necessary for legal employment in the U.S. and to access Social Security benefits and other government services.

What is IRS TIN Matching?

TIN Matching refers to the process of verifying a business, individual, non-profits, or any other entity. It lets payers or authorized agents verify TINs and name combination before submitting the information return. This way they know that they are filing with the most correct information and ensure compliance with IRS regulations. Thus, reducing the risk of errors on tax forms, and prevent fraudulent activity.

If you want to check yourself, you will have to register with IRS e-Service tool. After completing the two-step e-Services Registration process with the IRS, you can apply for TIN Matching. However, this process can be slow and time-consuming, and heavy bulk TIN lookup isn’t feasible with this service. However, IRS-authorized e-Filing service, Tax1099 can perform all these tasks for you in real-time with lightning-fast speed.

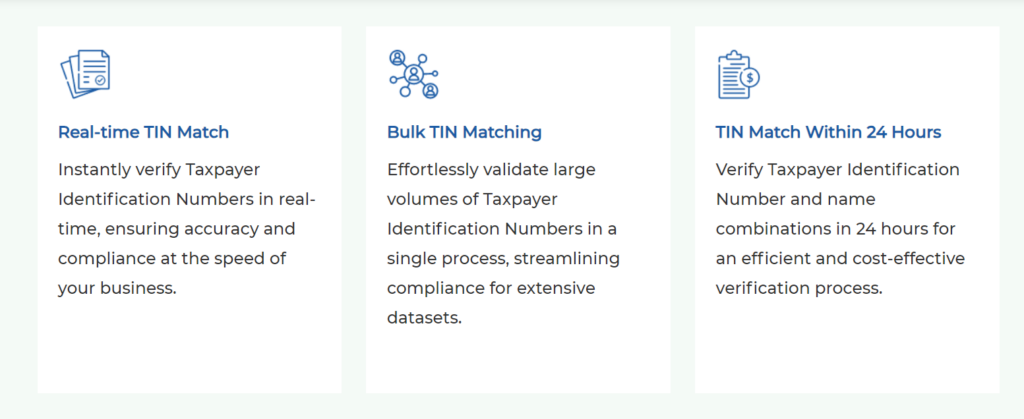

Tax1099 TIN Matching Features

Tax1099’s TIN lookup service helps you avoid getting in trouble with the IRS and paying fines.

You can avoid B notices and save up to $260 per incorrect information or late returns by proactively matching tax identification number (TIN) and name combinations.

If you find a match, you know you have the correct TIN information for that vendor. However, if the submission is rejected or shows as an unissued TIN, you need to follow up with them to collect the correct data.

Importance of TIN Matching

Let us understand the importance of TIN Matching with some use cases:

- Banking Industry: The process of opening an account for Neo banks or any traditional banking institution requires gathering customer data. Tax1099 TIN Matching can be used to verify their identities and ensure regulatory compliance.

- Lending Services: New customer onboarding is essential in any financial service. This involves collecting customer information, assessing their worth for credits, and establishing the terms of the lending agreement.

- 1099 Vendor Onboarding: Small business owners who hire freelancers and independent contractors for their projects require them to gather and verify their information. With TIN Matching, they can confidently onboard them.

- KYC/ AML Compliance: KYC (Know Your Customer) and AML (Anti-Money Laundering) are important in various businesses to avoid financial risks. You can verify the identity of customers, analyze their risk level and monitor their transactions to prevent money laundering and terrorist financing activities. The goal of TIN Matching here is to implement thorough screening measures.

How can Tax1099 Streamline TIN Matching for your Business?

Tax1099 enables an easier and better way of verifying TINs through TIN Matching or TIN Lookup.

You enter or import your vendors the same way you do to create your 1099s.

Select ‘TIN Match’ on the user dashboard and our dynamic platform takes care of the rest.

You get an ‘Accepted’ or ‘Rejected’ status for each match requested.

The generated results can then be accessed anytime through your Tax1099 account.

Ready to Automate Your Processes & Get Results Within Seconds?

For further question or support, please reach out to [email protected]