The holiday season is upon us, bringing with it a whirlwind of festivities, joy, and… oh, tax form filing preparations! We know this may seem a little overwhelming, but don’t worry—we’ve got you all covered!

Whether you are decking the halls or wrapping up year-end reports, our comprehensive checklist will help you navigate the filing season with ease. So, grab a cup of hot cocoa, put on your favorite holiday tunes, and let’s dig in the 1099 filing checklist.

Check List 1: Identify which 1099 forms you need to file.

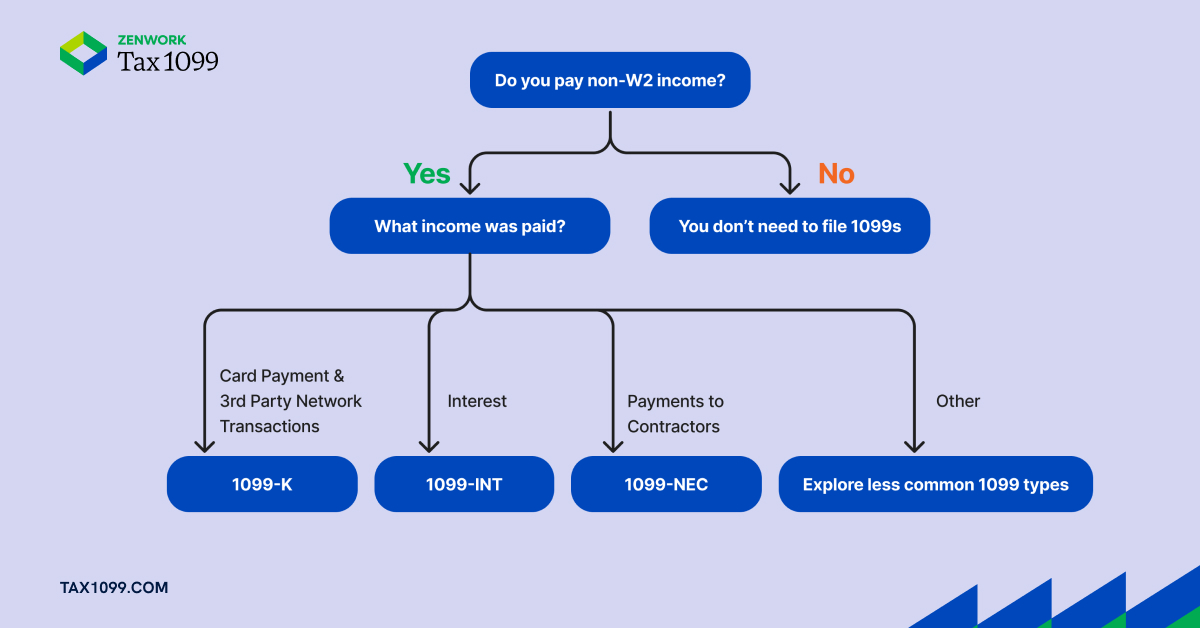

The first and foremost task on the 1099 filing checklist is to identify the required 1099 forms. Start by determining which 1099 forms are relevant for your business, as each 1099 form has a different purpose based on the type of payment and the nature of the transaction.

Let’s understand the major 1099 forms:

- 1099-NEC: Used specifically for payments to independent contractors

- 1099-MISC: Covers a broader range of payments such as rent, prizes, and awards.

- 1099-K: For payments made through third-party networks.

- 1099-DIV: For dividends and distributions paid to shareholders.

- 1099-INT: For interest income.

- 1099-R: For distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts.

This step is essential to avoid any compliance issues and ensure that all necessary information is accurately reported. So, take the time needed to review and categorize your transactions.

Check List 2: Collect all required recipient information (W9 Forms).

Once you know which forms to file, it’s time to gather details. If you collect W-9s as you onboard new contractors, sellers, or users (“payees”) for your platform/service, simply gather all W-9 inputs into a central location. This will help you do a quick review for the completeness of the information provided and identify if any information is missing. If you did not collect W-9 forms at the time of onboarding, you will need to reach out to all applicable parties and collect W-9 forms now.

W-9 Form collects several key information:

- Name: Individual’s or business’s legal name

- Business Name: If different from legal name

- Taxpayer Identification Number (TIN): Gather the correct SSNs (individuals) or EINs (businesses).

- Address: Current address of the individual or business.

- Federal Tax Classification: Includes options like individual/sole proprietor, C corporation, S corporation, partnership, trust/estate, etc.

- Exemptions: Any exemption code applicable for backup withholding or FATCA reporting.

Check List 3: Verify your Contractor’s Information

Once you identify the forms and collect the details, the next step is to verify the details you need to enter.

Generally, the penalty for an incorrect Form 1099 or Form W-2 filed with the IRS is $100, and the penalty for an incorrect information statement provided to the applicable taxpayer is another $100. In each case, there is a maximum penalty of $1.5 million per year (for a total maximum penalty of $3 million).

So ensure that all the W-9 forms for all contractors are up-to-date. This verification helps prevent errors that could lead to filing delays, penalties, or issues with the IRS. To check this information, start by reviewing your records to ensure all W-9 forms are current and complete. Cross-reference the details on the W-9 forms with your payment records to confirm accuracy. If any discrepancies are found, reach out to the contractors promptly to obtain the correct information. Regularly updating and verifying contractor information throughout the year can save time and reduce stress during the filing season.

TIN matching is optional, but it is one of the best practices to submit name and tax ID number combinations for each payee. It helps to flag mismatches but also prevent fraud and delays to your reporting deadlines.

Check List 4: Be aware of the 1099 deadlines.

The fourth 1099 filing checklist has to be the due dates. The penalties for late filing of 1099 forms vary based upon how late the filing is done. They range somewhere from $60 per form to $630 per form.

Here are the key deadlines for various 1099 forms for the 2024 tax year:

| 1099-NEC | January 31, 2025 | January 31, 2025 | January 31, 2025 |

| 1099-MISC | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-MISC (Boxes 8 or 10) | February 15, 2025* | February 28, 2025 | March 31, 2025 |

| 1099-INT | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-DIV | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-R | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-S | February 15, 2025* | February 28, 2025 | March 31, 2025 |

| 1099-B | February 15, 2025* | February 28, 2025 | March 31, 2025 |

| 1099-C | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-K | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-LS | February 15, 2025* | February 28, 2025 | March 31, 2025 |

| 1099-LTC | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-OID | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-PATR | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-Q | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-QA | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-SA | January 31, 2025 | February 28, 2025 | March 31, 2025 |

| 1099-SB | February 15, 2025* | February 28, 2025 | March 31, 2025 |

If the original deadline falls on a weekend or a holiday, it gets extended to the next business day. For example, February 15, 2025 falls on Saturday (weekend), so the new deadline would be February 17, 2025 (Monday).

Check List 5: State-specific filing requirements

Each state may vary Form 1099 filing requirements based on their specific regulations, such as 1099-NEC, 1099-MISC, 1099-INT, and others. Some states require direct filing with their tax agencies, while others participate in the Combined Federal/State Filing (CF/SF) Program, which allows the IRS to forward the forms to the state. It’s important to verify whether your state mandates the filing of 1099 forms and to understand the specific deadlines and procedures for each state.

Bonus 1099 Filing Checklist: Automate your 1099 filing process.

Automating your 1099 filing process can save you significant time and reduce errors. Tax1099, an IRS-authorized e-filing platform, simplifies this process by integrating with popular accounting software like QuickBooks, Xero, and FreshBooks. It automates data import, TIN matching, and form generation, allowing you to e-file directly with the IRS and participating states.

Here’s to a stress-free tax season and a joyful holiday filled with warmth and cheer! 🎄✨