Overview

The Corporate Transparency Act (CTA), designed to enhance financial transparency and combat illegal activities, is once again enforceable after a stay was issued by the U.S. Court of Appeals for the Fifth Circuit on December 23, 2024. However, recognizing the need for additional compliance time due to prior injunctions, the Department of the Treasury has extended certain reporting deadlines.

Here’s everything businesses need to know about these changes.

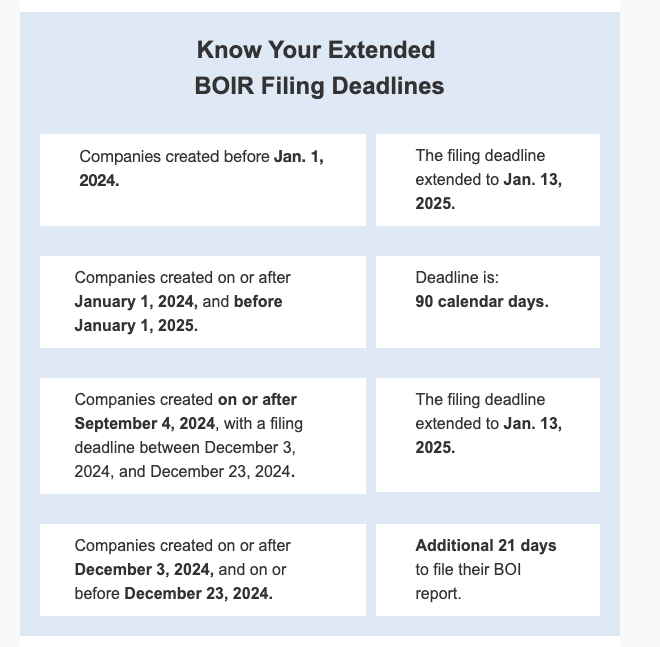

New Reporting Deadlines for BOI

To accommodate businesses affected by the temporary injunction; the Department of the Treasury has introduced the following extended deadlines:

- Companies Registered Before January 1, 2024:

These reporting companies now have until January 13, 2025, to submit their initial BOI reports to FinCEN (instead of the previous January 1, 2025, deadline).

- Reporting companies created or registered in the United States on or after Sept. 4, 2024,

Companies that had a filing deadline between Dec. 3, 2024, and Dec. 23, 2024, have until January 13, 2025, to file initial BOI reports with FinCEN.

- Reporting companies created or registered in the United States on or after Dec. 3, 2024, and on or before Dec. 23, 2024,

These reporting companies have an additional 21 days from their original filing deadline to file initial BOI reports with FinCEN.

- Reporting companies that are created or registered in the United States on or after Jan. 1, 2025, have 30 days to file initial BOI reports with FinCEN after receiving actual or public notice that their creation or registration is effective.

Exemptions for Certain Reporting Companies

As noted in the case of National Small Business United v. Yellen, certain plaintiffs, including Isaac Winkles, businesses owned by Winkles, and members of the National Small Business Association (as of March 1, 2024), are currently not required to report BOI to FinCEN.

Reporting companies that qualify for disaster relief may have extended deadlines that fall beyond Jan. 13, 2025. These companies should abide by whichever deadline falls later.

Key Court Rulings Impacting BOI Reporting

- Texas Top Cop Shop, Inc. v. Garland:

- On December 3, 2024, a preliminary injunction was granted, temporarily halting enforcement of the CTA.

- On December 23, 2024, the U.S. Court of Appeals for the Fifth Circuit issued a stay on the injunction, reinstating BOI reporting requirements pending the appeal outcome.

- Conflicting Rulings Nationwide:

-

- While some courts have upheld the CTA’s constitutionality, others continue to face challenges. The Department of Justice remains firm in defending the CTA, appealing rulings that attempt to block its enforcement.

What Does This Mean for Businesses?

Businesses must now resume preparations to comply with BOI reporting requirements, adhering to the newly extended deadlines where applicable. Companies should:

- Gather necessary ownership details, including personal and business identification data.

- Leverage platforms like Tax1099 for simplified BOI reporting and compliance.

- Stay informed about ongoing court cases and potential updates to the CTA.

Penalties for Non-Compliance

Failure to file BOI reports accurately and on time may lead to civil and criminal penalties:

- Civil Penalties: Fines of up to $500 per day for continued non-compliance.

- Criminal Penalties: Intentional failure to report may result in fines up to $10,000 and/or imprisonment for up to two years.

Businesses should take these requirements seriously and ensure timely compliance to avoid penalties.

Final Thoughts

The Treasury Department continues to defend the constitutionality of the CTA, with appeals pending in various courts. Businesses are advised to monitor legal developments closely and ensure compliance with any changes. Additionally, FinCEN is working to streamline the BOI submission process and offer resources to support businesses during this transition.

While the recent court rulings have caused temporary uncertainties, the BOI reporting requirements under the Corporate Transparency Act are now back in effect, with extended deadlines to ease compliance. Businesses should use this time wisely to prepare their BOI reports.