Filing a 1099 form could be a complex task especially if the business owners are not aware of its intricacies. Every business owner who hires a freelancer or contractor must file a 1099 form to be compliant with the IRS. The accurate filing of 1099 forms helps you avoid notices from the IRS and saves you from paying hefty penalties.

In this blog, we have covered everything you need to know about 1099 forms. From classifying workers as independent contractors to correctly filling out 1099 forms, you will understand it all. We have also covered how to file 1099 forms online and what to do if you make a mistake.

Key Takeaways

- A 1099 form reports non-employment income to the IRS.

- The IRS uses 1099 forms to verify income reported on Form 1040, the individual income tax return.

- Individuals do not complete 1099 forms; rather, businesses and financial institutions do.

- There are different types of 1099 forms, but the most common ones are 1099-NEC (non-employee compensation) and 1099-MISC (miscellaneous).

- The deadline for businesses to mail out 1099-NEC and 1099-MISC is Jan. 31.

- Freelancers or independent contractors should receive a 1099 from each client that paid them more than $600 over the course of a tax year.

What are 1099 forms?

1099 Forms are Information Returns that must be submitted to the IRS. These forms are filled for all non-salary income received during the tax year. If you’re a business owner, you’ll be responsible for filling these out and mailing them to any contractors you’ve worked with.

There are a variety of 1099 forms, each used to report the different kinds of non-salary income.

For a complete list of all the different versions, use the IRS’ General Instructions for Certain Information Returns.

What information must be reported on Form 1099?

Form 1099 is used to report various types of income other than wages, salaries, and tips. Here are some key details that must be reported on major types of Form 1099:

- Form 1099-NEC (Nonemployee Compensation):

- Payments of at least $600 for services performed by someone who is not your employee.

- Payments to attorneys.

- Cash payments for fish purchased from anyone engaged in the trade or business of catching fish.

- Form 1099-MISC (Miscellaneous Income):

- Rents (Box 1).

- Royalties (Box 2).

- Other income payments (Box 3), including prizes and awards.

- Medical and health care payments (Box 6).

- Payments to an attorney (Box 10).

- Crop insurance proceeds (Box 9).

- Form 1099-INT (Interest Income):

- Interest on a business debt to someone (excluding interest on an obligation issued by an individual)

- Form 1099-DIV (Dividends and Distributions):

- Dividends or other distributions to a company shareholder

Each form has specific boxes for different types of payments, so it’s important to place the payment in the correct box.

How to file a 1099 Form?

There are two copies of each Form 1099: Copy A and Copy B.

If you hire an independent contractor, you must report what you pay them on Copy A and submit it to the IRS.

You must report the same information on Copy B and send it to the contractor.

Once you’ve determined who your independent contractors are and you feel confident your books are in order, you can begin completing a 1099 form.

Steps-by-step Instructions to file a 1099 Form:

Let’s consider the most popular 1099 form, i.e. 1099-NEC and find out the step-by-step filing instructions.

If you paid an independent contractor less than $600 over the course of the financial year, you don’t need to submit Form 1099-NEC for them.

Step 1: Prepare your tax documents

Have a record of all payments made to each independent contractor during the tax year. This could include invoices, payment receipts, or reports from your accounting software.

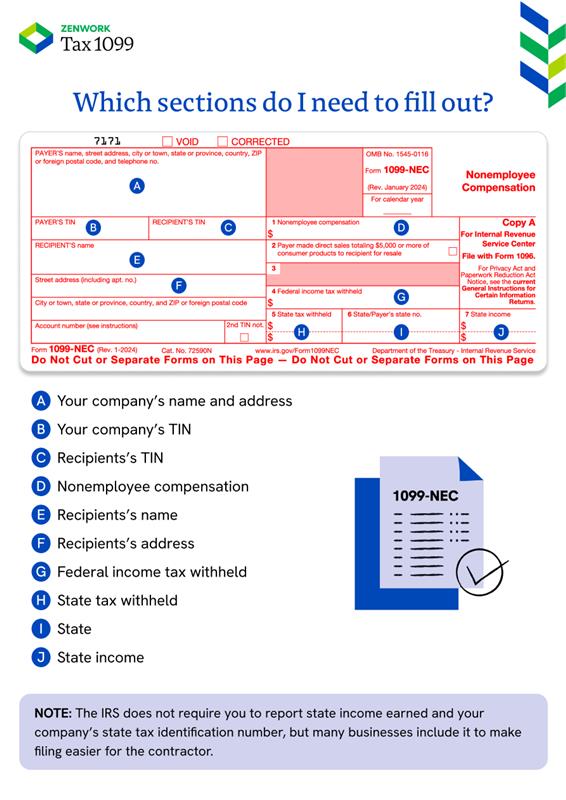

Step 2: Fill out a 1099-NEC form

Here’s a breakdown of the information required for each box:

- Payer’s name and address: In the top left corner, enter your business’s legal name exactly as it appears on your tax records. Then, enter your business’s full street address, city, state, and ZIP code.

- Payer’s TIN: Enter your business’s taxpayer identification number (TIN). This is your employer identification number (EIN).

- Recipient’s TIN: Enter the independent contractor’s TIN. This is usually their Social Security number (SSN), but it may be an EIN if they operate as a business.

- Recipient’s name: Enter the independent contractor’s full legal name exactly as it appears on their tax records.

- Recipient’s address: Enter the independent contractor’s full street address, city, state, and ZIP code.

- Box 1: Nonemployee compensation: Enter the total amount you paid to the independent contractor during the tax year. This should include all compensation for services rendered but not reimbursements for expenses.

- Box 2: Direct sales: This box is for reporting direct sales of consumer products to the independent contractor for resale. If you sold $5,000 or more of consumer products to the contractor for resale, you’ll need to mark an “X” in this box. This is not common for most businesses.

- Box 3: It is used to report any payments that are not subject to self-employment tax and are not reportable anywhere else

- Box 4: Federal income tax withheld: Enter the amount of any federal income tax withheld from the contractor’s payments. This may include taxes withheld due to a backup withholding notice from the IRS or at the independent contractor’s request.

- State information: If your state requires 1099-NEC filing, complete the relevant sections. This usually includes your state tax identification number, any state income tax withheld from the contractor’s payments, and the total amount of income earned in the state (filled in Box 5, 6 and 7).

Step 3: Submit the Form to IRS

Once your Form 1099-NEC is complete, send Copy B to all of your independent contractors no later than January 31.

If you file a physical copy of Form 1099-NEC, Copy A to the IRS, you also need to complete and file Form 1096.

Different 1099 Forms & Their Deadlines

| Tax Forms | Recipient Deadline | Paper Filing Deadline | E-file Deadline |

| 1099 NEC | Friday – January 31, 2025 | Friday – January 31, 2025 | Friday – January 31, 2025 |

| 1099 MISC (No Data in Box 8 or 10) |

Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 MISC (With Data in Box 8 or 10) |

Monday – February 17, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 A | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 C | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 DIV | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 G | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 INT | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 K | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 – PATR | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 R | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 S | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 LS | For reportable policy sale payment recipient, Monday – February 17, 2025 For issuer, Wednesday- January 15, 2025, or earlier as required by Regulations section 1.6050Y-2(d) (2)(i)(A) |

Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 OID | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099-SA | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| MA 1099 HC | For Employees- Friday – January 31, 2025 | For State of MA – Monday – March 31, 2025 | |

| 1099 Q | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |

| 1099 QA | Friday – January 31, 2025 | Friday – Feb 28, 2025 | Monday – March 31, 2025 |