The fourth quarter of 2024 has ended, and businesses nationwide are preparing for the submission of Form 941. From Quarterly Federal Tax Return key updates that could impact your filing process, understanding the latest changes can save you time, money, and potential penalties. In this blog, we’ll walk you through Form 941 instructions, highlight the deadlines you need to meet, and provide the latest updates. Whether you’re a seasoned payroll professional or filing for the first time, we’ve got you covered!

New Changes to Form 941 for the 2025 Tax Year

What’s New?

- Social security for 2025 Tax Year: The social security tax rate is 6.2% each for the employee and employer. The social security wage base limit is $176,100.

| Tax Year | Wage Base Limit |

|---|---|

| 2024 | $168,000 |

| 2025 | $176,100 |

However, the Medicare tax rate, which is 1.45% each for the employee and employer, unchanged from 2024. There is no wage base limit for Medicare tax.

- Thresholds:

Social security and Medicare taxes apply to the wages of household workers you pay $2,800 or more in cash wages in 2025. Social security and Medicare taxes apply to election workers who are paid $2,400 or more in cash or an equivalent form of compensation in 2025.

The table below outlines the Social Security and Medicare tax thresholds changes from 2024 and 2025:

|

Category

|

Cash Wage Threshold (2024) | Cash Wage Threshold (2025) |

|---|---|---|

| Household Workers | $2,700 | $2,800 |

| Election Workers | $2,300 | $2,400 |

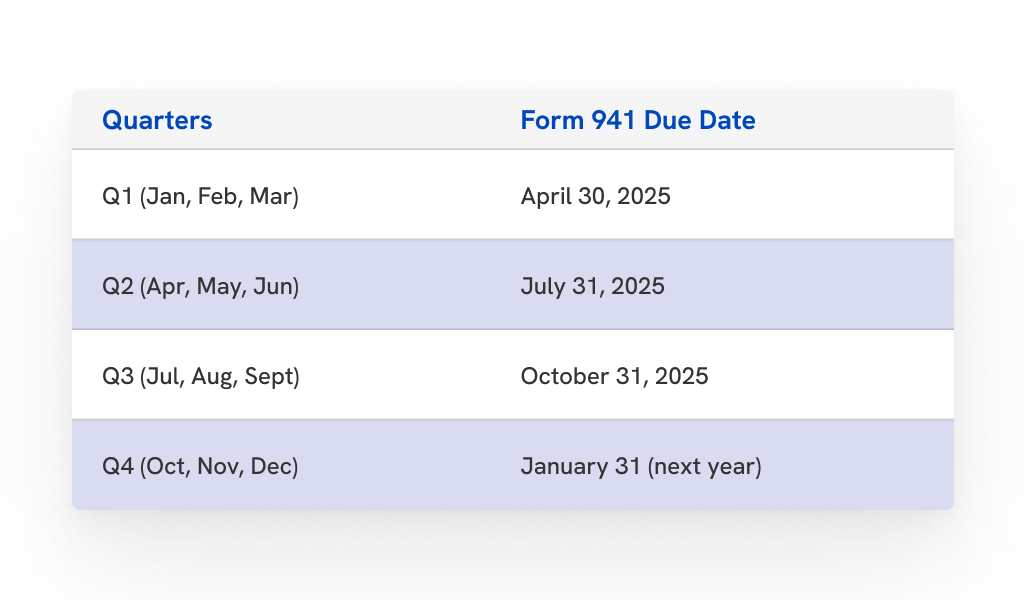

Deadline to file Form 941 for a Tax Year

Form 941 is generally due by the last day of the month following the end of the quarter. However, you must deposit the payroll taxes withheld from your employees beforehand.

Tip: Mark these dates on your calendar to ensure timely submissions and avoid penalties!

IRS Form 941 Instructions for 2024 Quarter 4

Instructions for Completing the 941 Employer’s Quarterly Federal Tax Return:

Box-by-box breakdown of IRS Form 941

Here’s a box-by-box breakdown of IRS Form 941 for a better understanding of its structure:

Part 1: This section includes all the details about employer.

Here’s a quick breakdown:

| Box/Section | Description |

|---|---|

| Part 1: Employer Information |

Includes employer name, EIN (Employer Identification Number), and basic details. |

| Box 1: Number of Employees |

Reports the total number of employees who were paid during the quarter. |

| Box 2: Wages, Tips, & Compensation |

Total wages, tips, and other compensation subject to Social Security and Medicare taxes. |

| Box 3: Federal Income Tax Withheld |

Total federal income tax withheld from employee wages during the quarter. |

| Box 4: Adjustments |

Any adjustments for sick pay, group-term life insurance, or tips. |

| Box 5: Taxable Social Security Wages |

Social Security wages subject to withholding (including limits if applicable). |

| Box 6: Taxable Medicare Wages & Tips |

Medicare wages and tips, including additional Medicare tax if required. |

| Box 7: Total Taxes Before Adjustments |

Sum of Social Security, Medicare, and income tax amounts. |

| Box 8: Current Quarter Adjustments |

Adjustments for fractions of cents, sick pay, tips, and other corrections. |

Part 2: This part deals primarily with the breakdown of tax liabilities and adjustments for the quarter. Here’s the breakdown of Part 2 of IRS Form 941:

| Box/Section | Description |

|---|---|

| Part 2: Tax Liability for the Quarter |

This part is used to report the total tax liability for the quarter. |

| Line 10: Total Taxes After Adjustments |

Sum of the total Social Security, Medicare, and federal income tax liability, including adjustments. |

| Line 11: Current Quarter Adjustment |

Report adjustments for fractions of cents, sick pay, tips, and other corrections. |

| Line 12: Total Deposits for the Quarter |

Total amount of tax deposits made during the quarter (include previous adjustments). |

| Line 13: Balance Due or Overpayment |

Amount due or any overpayment after calculating taxes, deposits, and adjustments. |

| Line 14: Monthly Tax Liability |

For semiweekly depositors: reports the total monthly liability for Social Security, Medicare, and federal income tax. |

| Line 15: Tax Deposits Due for the Quarter |

Total taxes due for the quarter, subtracting previous deposits from the total liability. |

Part 3: This section is used to allow a third party to handle any inquiries or issues the IRS may have regarding the form.

Here’s the breakdown of Part 3 of IRS Form 941:

| Box/Section | Description |

|---|---|

| Part 3: Third-Party Designee |

Allows the employer to designate a third party (such as a payroll service provider or tax preparer) to discuss the form with the IRS. |

| Line 16: Designee’s Name |

Name of the third-party designee (if applicable). |

| Line 17: Designee’s Phone Number |

Phone number of the third-party designee. |

| Line 18: Designee’s Personal Identification Number (PIN) |

PIN assigned by the IRS to the designee. |

| Line 19: Authorization |

Box to check if the employer authorizes the designee to speak with the IRS about the form. |

How to file Form 941 for Q4 with Tax1099?

To file your 941 forms with ease, follow these 3 easy steps:

Step 1: Login/ Sign-Up

To get started, you can create your free account with Tax1099 by clicking here.

Step 2: Import the Data

Quickly import your payroll and tax-sensitized data to Tax1099 manually or using Excel/ accounting software.

Step 3: Review and Submit

Validate your details, make a secure payment and submit your forms directly to the IRS.

What are you waiting for? File your Form 941 Online today with Tax1099 and avoid paying hefty penalties.