If you’re running a platform or marketplace, you may be required to file 1099 tax forms with the IRS and state authorities. A 1099 tax form is used to report various types of income and payment transactions.

A 1099 tax form reports various types of income and payment transactions. Various tax forms commonly used in online marketplace transactions, include Form 1099-NEC for non-employee compensation, Form 1099-K for payment card and third-party network transactions, and Form 1099-MISC for miscellaneous income.

Common Tax Forms Required for Marketplace

Some of the most common kinds of 1099 forms include:

Form 1099-K:

Online Marketplaces are required to send sellers a Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year. The thresholds for Form 1099-K are changing each of the next 3 tax years, and Tax1099 can help you keep track of the progress.

- If the compiled payment is more than $5,000 during the tax year 2024, TPSOs (Third-Party Settlement Organizations) have to file a 1099 K form.

- For transactions in 2025 Tax Year, the threshold is reduced further, and TPSOs must report transactions where the total payments exceed $2,500 during the year.

- From 2026 tax year and onwards, the threshold drops significantly to $600 for the total payments in a calendar year.

Form 1099-NEC:

The business owner and employer who makes payments to the service provider or contractor for their services is required to report those payments to the IRS on 1099-NEC and also send a recipient copy to the service provider or contractor.

You must e-file Form 1099-NEC with the IRS, if:

- Your business has hired an independent contractor, or vendor, or a freelancer

- Your business paid the compensation to an individual who is not your employee

- Your business has paid the independent contractor in the course of business

- The total amount paid to the contractor is $600 or more in a year

- The amount was paid in exchange for services from the vendor or contractor

Form 1099-MISC:

Businesses operating in the digital marketplace should report payments made to independent contractors, freelancers, and other service providers who earn income through these platforms. Marketplaces must issue Form 1099-MISC to individuals or businesses that have received $600 or more in payments for services rendered.

What Are the Requirements for Filing Form 1099-MISC Online?

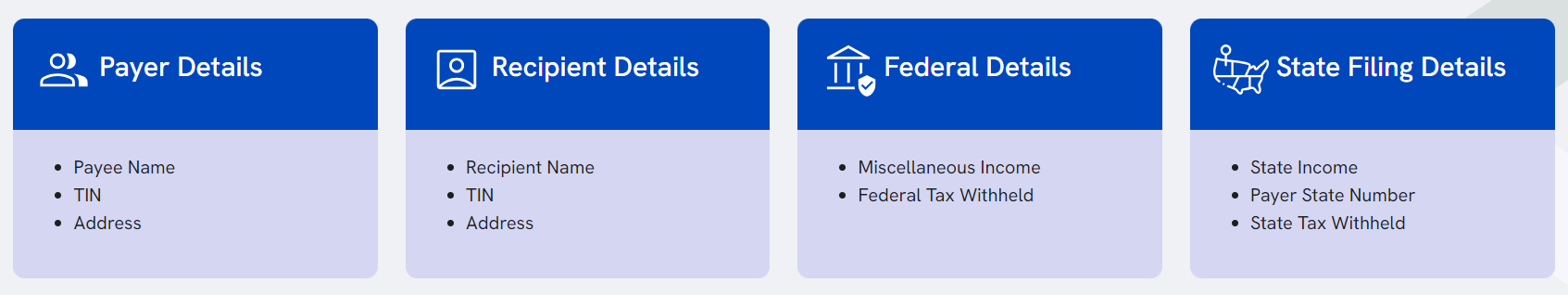

Ready to file? Here’s what you need to file Form 1099-MISC online quickly and easily!

1099 Form Filing Requirement

All online marketplaces must keep in mind all the 1099 filing requirements for 1099 tax reporting. Following are the required information for each of the parties.

Payer Information:

All payers are required to provide information, including:

- Employer Identification Number (EIN)

- Legal name of the business as registered with the IRS

- Contact information (email ID, contact number, backup contact number)

- State tax ID number (if applicable)

- Tax filing status and tax classification

- DBA (Doing Business As) name, if used

- Business website name if you have

Payee Information:

Payees need to give the following information:

- Legal name (as mentioned on tax returns)

- Business name (if it’s different from the legal name)

- Address (physical one)

- Mailing address (if different)

- Social Security Number (SSN) or EIN (Employer Identification Number)

- Payment details (amount, dates, categories, methods)

- Business entity type

- Tax exemption (if applicable)

- Contact information, such as phone number

- Tax classification status

- FATCA (Fair and Accurate Credit Transactions Act) reporting codes

How Tax1099 can help you report 1099 forms?

Best-in-class Features, Exclusively for Online Marketplaces:

- API Integration: Improve your functionality and efficiently handle tax filing within your system by incorporating Tax1099’s API.

-

Real-time TIN Matching: Validate your vendor’s taxpayer identification numbers (TIN) and Name combos via individual or bulk checks to avoid penalties.

-

Request W8/W9: Request and collect taxpayer identification numbers and other details (name, address, etc.) through W-9 or W-8 forms from your vendors and verify.

-

IRS Compliant e-Delivery: Our secured e-Delivery portal allows you to reduce expenses by eliminating paper mailing and offering easy to use delivery of forms electronically.