The employer identification number (EIN) is one of the most important nine-digit numbers assigned by the IRS for new and existing businesses. This number is not only used for identifying the tax status of a business entity but also for filing tax returns, applying for business licenses, and several other business-related activities.

Key Points:

- If the IRS considers you to be an employer, you’ll need an EIN.

- Businesses may need a new EIN when the business changes hands or changes its structure.

- IRS will only share an EIN over the phone with someone who is authorized to receive it.

Employer Identification Number, or EIN, is mandatory for businesses that run under the jurisdiction of the United States. It is a unique nine-digit identification number that’s assigned by the IRS. Employers rely heavily on this number, which is formatted as XX-XXXXXXX, as a useful tool for filing taxes. Sometimes, the terms “Tax Identification Number” (TIN) and “EIN” are used interchangeably.

Who Needs an EIN?

Businesses need an EIN if they tick mark any of the following conditions:

- Business having a minimum of one employee

- File tax returns such as excise, employment, tobacco, alcohol or firearms

- Operate as a corporation or partnership.

- Withhold taxes on income except wages paid to a nonresident immigrant

- Obtain a tax-deferred Keogh plan for employee pensions

- Attached or involved in any of these organizations, including estates, real estate mortgage investment conduits, nonprofit organizations, trusts (other than certain revocable trusts, IRAs and for Exempt Organization Business Income Tax Returns), plan administrators and farmers’ cooperatives

What is EIN Verification?

When onboarding a new client or partner, businesses in various sectors are required to follow KYB process. The legality of the company and its proprietors are confirmed, and any possible hazards related to the partnership are evaluated. A valid EIN is necessary for a business operating in the United States to conduct certain financial and insurance-related operations as well as for lawful operation. As a result, proving the identification of the company requires first confirming the EIN.

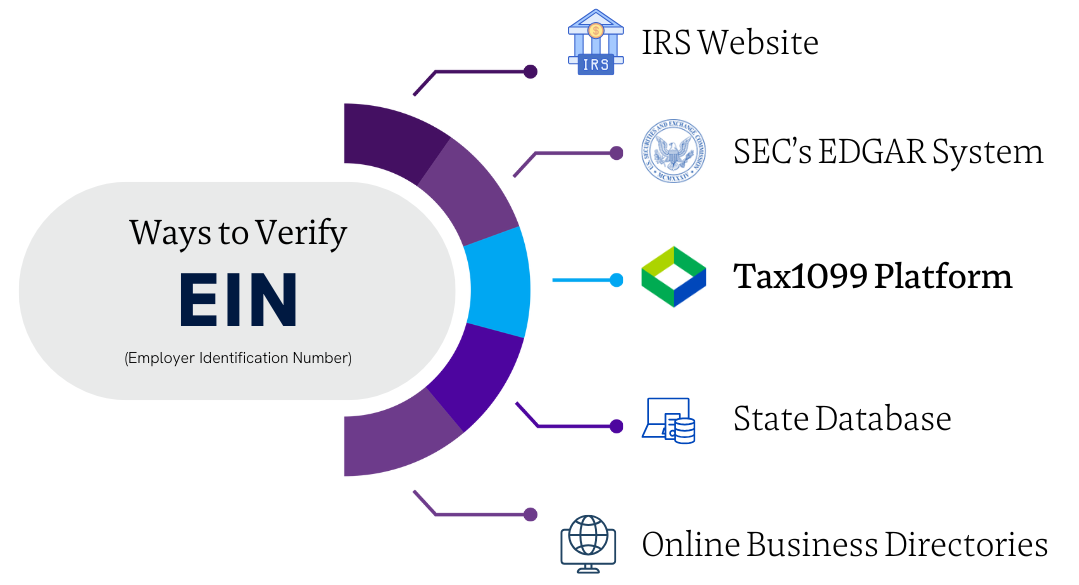

Ways to Verify Employer Identification Number for a Business

Verifying an EIN is not a big deal if you know the right way. Let’s find out:

1. IRS Database

It is one of the most trusted sources to verify an EIN. The Internal Revenue Service (IRS) offers TIN Matching tool on IRS e-Services. However, you are required to register first, and this would take some time. The service is primarily available to certain authorized users only. If you don’t fall into one of the authorized categories, you might not be able to use the service. While their interactive verification (verify up to 25 EINs) is quick, bulk verification (for large numbers of EINs) can take days, depending on the IRS’s workload.

2. EC’s EDGAR System

Using the Securities and Exchange Commission’s EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system is an essential first step in confirming an EIN number. Any company that trades its shares on a stock market open to the public must register with the SEC, produce reports, and have its data available through EDGAR.

3. State Databases

Apart from federal resources such as the IRS website, several state departments of revenue have their own online platforms for conducting EIN number searches. These websites typically feature a search tool where users can enter the company’s name or other relevant information to find its EIN. It’s important to recognize that while the IRS issues EINs, state revenue departments may also issue state-specific identification numbers under certain circumstances.

4. Tax1099 Platform

For a super-quick real-time search experience, we recommend Tax1099’s real-time TIN match feature which allows you to search 100,000+ TINs within a minute. All you need is the entity’s EIN and the legal name (as registered with the IRS) to conduct a quick EIN check. You don’t have to wait for hours or days to see the TIN match results. Being one of the most trusted eFiling platforms, Tax1099 streamlines the process of EIN verification. You can also do Bulk TIN Match by uploading the data into the system. Ensure 100% accuracy while filing tax forms, avoiding errors and IRS notices.

Need Assistance? Write to us at [email protected] or ask our AI chatbot.