Effective January 1, 2024, companies are required to provide the Financial Crimes Enforcement Network (FinCEN) with data regarding the individuals who ultimately hold or manage them. This requirement applies to approximately 32 million businesses, including corporations, limited liability companies (LLC), as well as some partnerships and trusts.

This raises many questions: Does my company have to report its beneficial owner(s)? Who are the beneficial owners of my company? What specific information does my company need to report?

Today we are going to provide an overview of what you need to know about filing a BOI report.

What is Beneficial Ownership Information Reporting?

Beneficial ownership information encompasses the identifying details, such as names, of individuals who possess or oversee a business. Mandated by the Corporate Transparency Act (CTA) of 2021, reporting this information to the Financial Crimes Enforcement Network (FinCEN—a division of the U.S. Department of the Treasury—is required for most businesses. This measure aims to combat various illegal activities, including money laundering, terrorism financing, tax fraud, human trafficking, drug trafficking, counterfeiting, piracy, securities and financial fraud, as well as acts of foreign corruption.

What’s a reporting company?

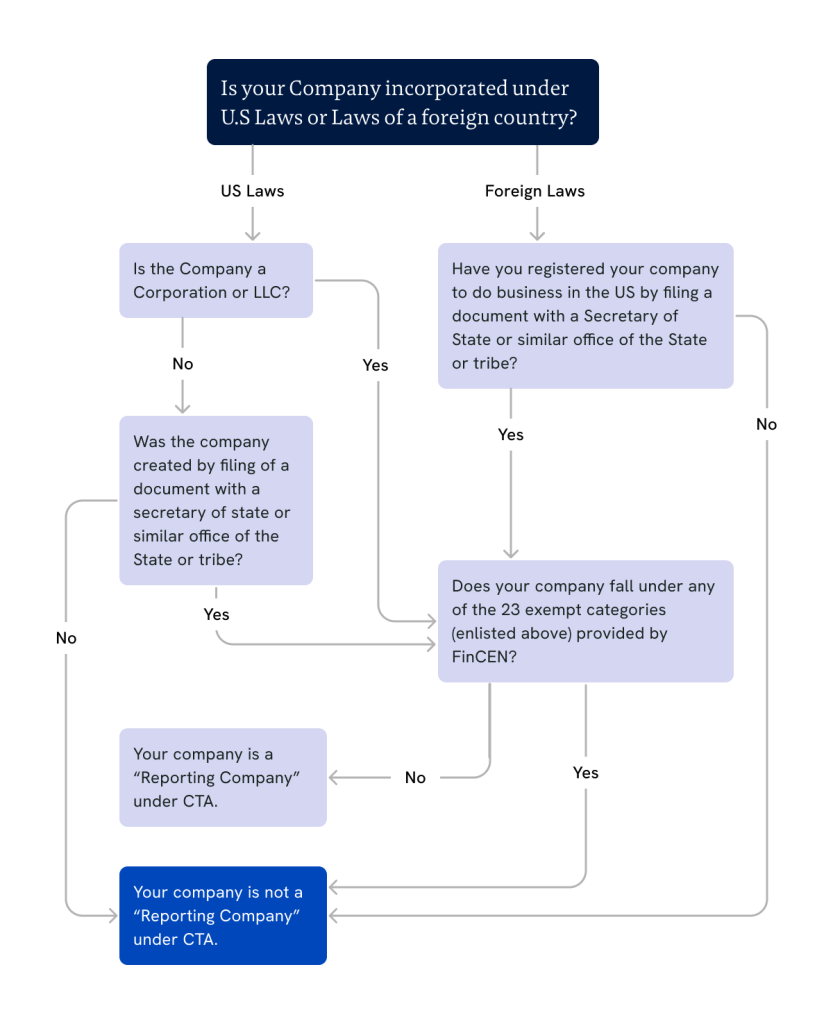

Certain domestic companies and foreign entities are categorized as “reporting companies” and are required to adhere to the beneficial ownership rule. These companies are:

Domestic companies:

- This includes U.S. businesses structured as a corporation, limited liability company (LLC), or another entity (e.g., statutory trust, business trust, or foundation).

- These entities were established by filing a document with a secretary of state or a similar office within the United States.

Foreign entities:

- Refers to companies formed under the law of a foreign country.

- These entities were established by filing a document with a secretary of state (or similar office) to conduct business activities within the United States.

Is my company exempt from the reporting requirements?

Not all companies are required to report BOI to FinCEN under the Reporting Rule. Companies are required to report only if they meet the Reporting Rule’s definition of a “reporting company” and do not qualify for an exemption

The Reporting Rule exempts twenty-three (23) specific types of entities from the reporting requirements listed below. An entity that qualifies for any of these exemptions is not required to submit BOI reports to FinCEN.

| Exemption No. | Exemption Short Title |

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

Note: If any entity meets the criteria of Exemption #18 and is formed under the laws of a foreign country, the entity is subject to a separate reporting requirement.

Does my company have to report its beneficial owner(s)?

Your company would be considered a reporting company if it meets the “reporting company” definition and does not qualify for an exemption. Have a look at the flowchart below to determine if your company is a ‘Reporting Company’ under CTA.

When must I file BOI? Is there a deadline to file BOI Reports?

You can file your BOI reports starting January 1, 2024. Mentioned below are the deadlines for respective companies who are filing for the first time:

- Companies registered before January 1, 2024

– have until January 1, 2025, to report it

- Companies registered between January 1, 2024, to January 1, 2025.

– must report it within 90 calendar days after companies register in state

- Companies registered after January 1, 2025

– must report it within 30 calendar days after companies register in state

Note: Reporting companies created or registered on or after January 1, 2025, will have 30 calendar days from actual or public notice that the company’s creation or registration is effective to file their initial BOI reports.

Who is a Beneficial Owner? What information should a reporting company report about a beneficial owner?

A beneficial owner is an individual who either directly or indirectly:

(1) exercises substantial control (individual holds a senior officer position, has authority over officer appointments/removals or a majority of directors, and is a key decision-maker for the reporting company) over the reporting company, or

(2) owns or controls at least 25% of the reporting company’s ownership interests.

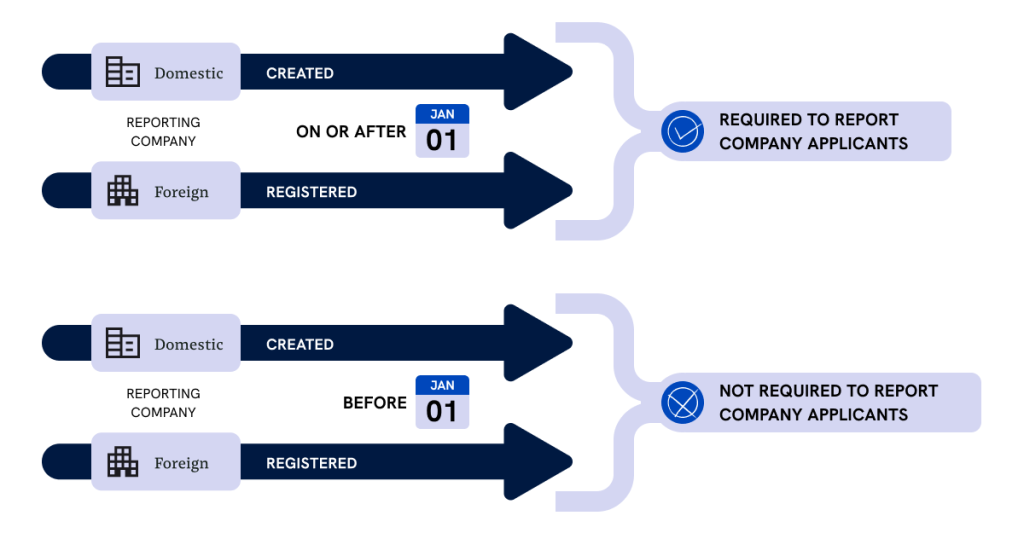

Who is a Company Applicant? Is my company required to report its company applicants?

The term “company applicant” refers to either an individual or an entity tasked with submitting the necessary documents to establish or register a business with state authorities, Indian tribes, or other jurisdictions within the United States.

Suppose you have started a company in New York City on January 25, 2024. In this case, the company applicant would be the individual or organization submitting the required documents to the New York Department of State.

Not all companies are required to provide their company applicants to the FinCEN. Only the businesses established on or after January 1, 2024, are required to do so. Businesses formed before January 1, 2024, are exempted from disclosing their company applicant information.

Note: Companies or legal entities cannot be company applicants and no reporting company will have more than two company applicants.

What are the penalties for BOI reporting non-compliance?

Being compliant not only helps in adhering to legal obligations but also plays a part in the broader effort to prevent financial crimes and enhance corporate transparency. If you miss your filing deadline or provide incorrect information, you can face serious penalties. These include:

- Civil penalty of up to $500 per day

- Criminal penalty – prison for up to 2 years and up to $10,000 fine

How to File BOI Reports Online?

FinCEN has estimated that it takes around 3 hours to file each BOI report. However, with Tax1099, you can effortlessly file your FinCEN BOI Reports for your business within minutes.

To file BOI reports online, go to the Tax1099’s dashboard, select BOI reporting, and click on file BOI.

Step 1: Reporting Company Information

Begin by providing detailed information about your reporting company. At this stage, you have an option to request a FinCEN ID. Every business should have it and it’s as important as your EIN. You can request and receive your FinCEN ID at no additional cost.

Step 2: Add Filing Information

Next, select either “Initial Report” if this is your first-time reporting, or “Correct/Update Prior Report” if you need to make revisions to a previous filing.

Step 3: Fill in Company Applicant(s) and Beneficial Owner(s)

Details In this step, input the necessary information regarding beneficial owners and company applicants, if applicable, as required by the reporting process.

Step 4: Review a Summary of the Application

Take a moment to carefully review a summary of the application, ensuring that all details provided are accurate and complete before proceeding.

Step 5: Submit for Filing

Finally, complete all the required fields, including your first name, last name, email ID, and check the ‘I Agree’ box to confirm acceptance of the terms, then submit the application for filing.

Bottom Line

The Corporate Transparency Act marks a significant change in corporate governance and the process of business formation. To adapt smoothly to this shift and comply with the regulations, businesses should take proactive measures, including seeking guidance from legal experts, utilizing eFiling software like Tax1099 to save hours on each reporting, keep sensitive data safe, and reduce risk of non-compliance.