Do you have a limited liability company (LLC) or a corporation? If so, you might have another annual filing obligation under the Corporate Transparency Act (CTA). From 2024, most companies are required to file a Beneficial Ownership Information (BOI) report.

The fines and penalties for noncompliance can be severe, which is why it’s important that you understand if you’re subject to this filing and what information you need to prepare. In this article, we’ll explore the BOI reporting requirements in more detail, helping you stay compliant with FinCEN and the Federal government.

The Background on New BOI Reporting Requirements

The new BOI reporting requirements look to combat financial crimes such as fraud, money laundering, and corruption within corporations and LLCs. These regulations mandate annual reports detailing ownership information to be submitted to the Financial Crimes Enforcement Network (FinCEN).

Under the CTA, BOI reporting requirements look to identify individuals who directly or indirectly control a company. These requirements are regardless of business size, meaning the small mom-and-pop shop will need to submit identifying information right alongside the large enterprise.

Companies Subject to the Beneficial Ownership Information Reporting Requirement

FinCEN BOI reporting requirements apply to most reporting companies. A reporting company is defined as a corporation, LLC, LLP, or any other entity created by filing business formation documents with a secretary of state.

The FinCEN further classifies reporting companies into two categories: domestic and foreign. A domestic company is a company created within the United States, while a foreign company is created outside of the United States but registered in one of the states.

There are a few types of companies that are exempt from BOI report requirements. These include banks, credit unions, investment companies, accounting firms, public utility companies, and inactive entities. For a complete list of exempt companies, visit the FinCEN’s website.

If you want to find out whether your company is eligible to participate in the BOI Reporting, just take this quiz.

What are the BOI Reporting Requirements?

If your business is subject to BOI reporting requirements in 2024, there are a few key pieces of information you will need to remit. Let’s break down each section in more detail.

1. Reporting Company Information

First, you will need to provide the basic information of your business, including:

- Full legal name

- Trade name

- U.S. address

- State of formation

- Taxpayer Identification Number or Employee Identification Number

- State of first registration for foreign reporting companies

2. Beneficial Owners

Next, you will need to outline the beneficial ownership information of the company. According to BOI reporting requirements, any individual who owns or controls more than 25% of the company needs to be reported.

Ownership refers to a capital or profit interest, equity, stock, contracts, or voting rights. In addition, any individual that can appoint or remove officers or directors is considered to have substantial control even if they do not have a direct link to ownership.

Some exemptions to these rules include minor children, employees, and creditors. For each of the beneficial owners, you will need to provide the following information:

- Full legal name

- Date of birth

- Current address

- Identifying number, such as a passport, driver’s license, or FinCEN identifier

- Image of the document with the identifying number

3. Company Applicant(s)

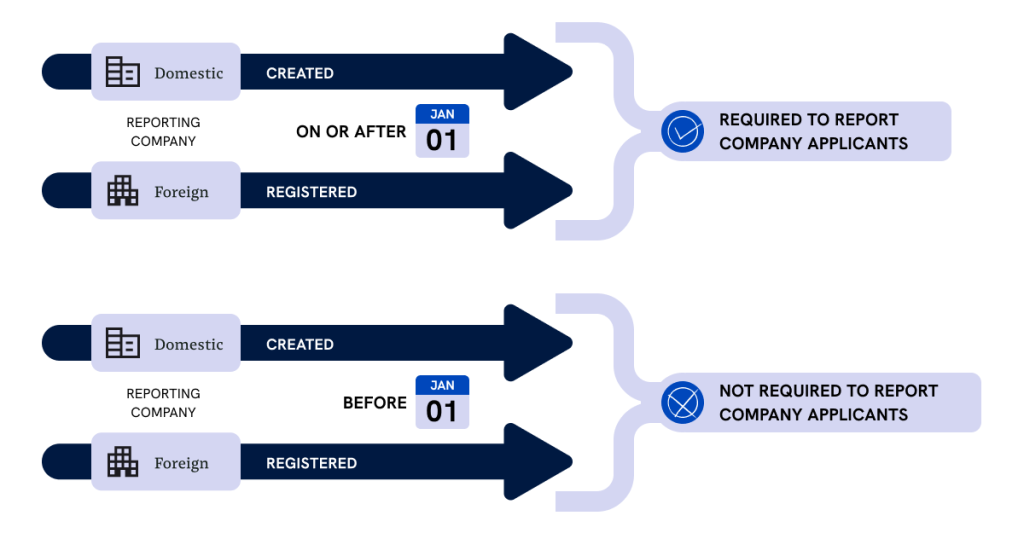

The FinCEN BOI reporting requirements also require the individual filling out the form to give the same information as the beneficial owners. The company applicant will usually be the individual who manages the reporting of your company, like an accountant, lawyer, incorporation service, or another third-party service provider.

Beneficial Ownership Information Filing Deadline

The new FinCEN BOI reporting requirement went into effect on January 1, 2024. Companies that were formed prior to January 1, 2024 will have until January 1, 2025 to file the initial BOI report.

If your company was created after January 1, 2024, Federal BOI reporting requirements give you 90 days to file your initial report. This 90-day filing timeline is reduced to 30 days for businesses formed after January 1, 2025.

Additionally, any time information changes, such as an ownership change, you have 30 days to submit an updated report.

BOI Penalties for Noncompliance

Failure to comply with Federal BOI reporting requirements carries severe fines and penalties. There are fines of $500 per day up to $10,000 and 2 years in prison for failure to file. If you file a BOI without authorization, you can also face up to $500 of fines per day up to $250,000 and five years’ imprisonment.

Staying in Compliance with BOI Reporting Requirements

Compliance is crucial with the new BOI reporting requirements to avoid harsh fines and penalties. If you are unsure where to start, contact a qualified accountant or attorney. They can help you ensure accuracy and timeliness in your filing.