Understanding the Difference between 1099-K and 1099-MISC

Not all income is created equal—especially when it comes to tax reporting. Whether you’re getting paid through a payment app

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Home » 1099 Forms » Page 2

Not all income is created equal—especially when it comes to tax reporting. Whether you’re getting paid through a payment app

This December, let your business shine as brightly as your holiday decor by ensuring your tax tasks are handled beforehand.

The holiday season is upon us, bringing with it a whirlwind of festivities, joy, and… oh, tax form filing preparations!

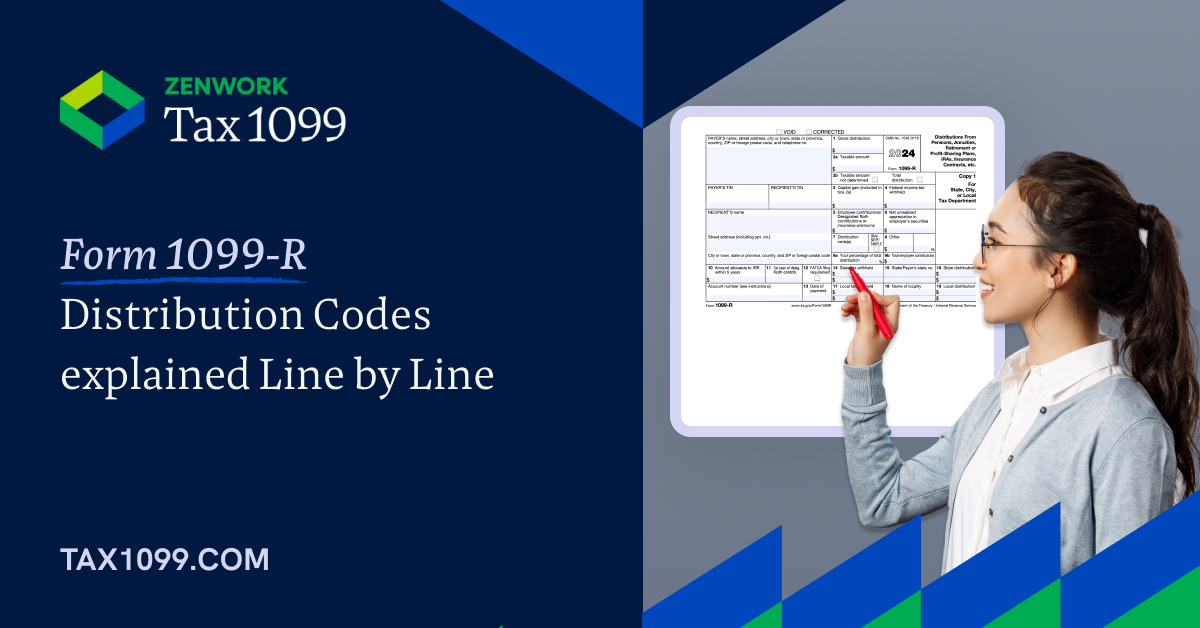

When it comes to retirement accounts and distributions, Form 1099-R is a crucial document. It reports distributions from pensions, annuities,

The IRS imposes substantial penalties for late 1099 filings. Penalties also apply if the information provided is incorrect or a

The specific IRS Form 1099 filing due date varies based on the type of form and the chosen filing method.

A guide on when and how to send someone a 1099. Explore thresholds, employer obligations, and simplified online filing options.

You may miss a deadline or submit an inaccurate return while balancing multiple deadlines and different forms to file. When

If you’re going to send a contractor a 1099 and are wondering if you may send it by email legally?

Form 1099 is significant for businesses to report the payments made to employees and non-employees. Various types of 1099 Forms

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!

with Tax1099 before April 30 to avoid penalties.