Compliance in the Gig Economy

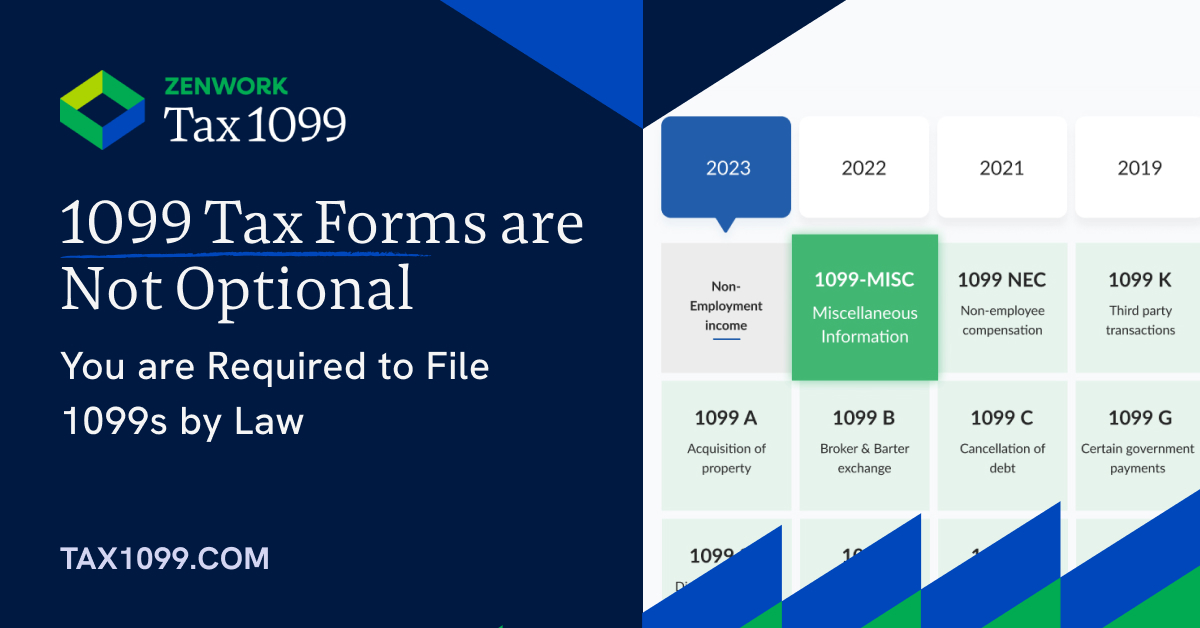

Gig economy employers are required to file the 1099 forms with the IRS.

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Home » 1099 Forms » Page 3

Gig economy employers are required to file the 1099 forms with the IRS.

Individuals & businesses are required by the IRS to report all types of nonemployment compensations of $600 or more. This

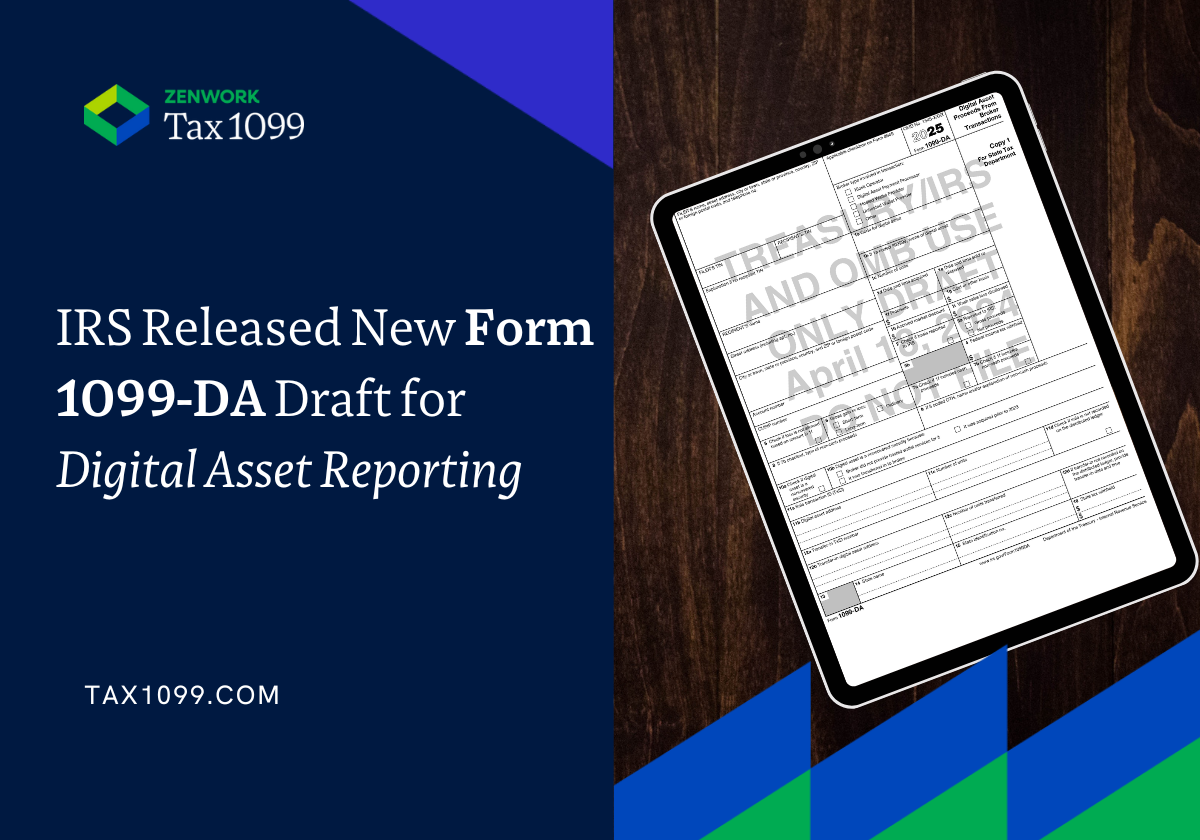

Understand how the new IRS Form 1099-DA will impact Digital Asset Reporting and what are the key considerations.

Nonprofits must stay compliant and aware of their tax responsibilities when legally engaging with independent contractors. IRS reads employees and

If you sell stocks, bonds, commodities, or other investments through a broker, you must be familiar with Form 1099-B. This

Employment laws protect workers, but they can also create a lot of headaches for startups who don’t know the ins

Being a small business owner comes with many responsibilities, one of which is understanding 1099s. Because 1099s are an important

The Internal Revenue Service (IRS) classifies workers into two categories. 1099 and W-2 employees have different rights, responsibilities, and tax

When running a successful financial business, compliance, and regulatory practices are key. However, staying up-to-date on the latest trends in

Tax credits are one of the most valuable tax savings benefits available to businesses, but many employers don’t take full

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!

with Tax1099 before April 30 to avoid penalties.