IRS Form 1099-K: Myths vs. Facts

“Each new year kicks off another tax season, and all that holiday joy is quickly replaced with a looming feeling of dread.” -Tony Drake.

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Home » Form 1099-K

“Each new year kicks off another tax season, and all that holiday joy is quickly replaced with a looming feeling of dread.” -Tony Drake.

Not all income is created equal—especially when it comes to tax reporting. Whether you’re getting paid through a payment app

The world of business is highly digital in most aspects, including finances. Gone are the days when small business owners

After two years of delay, the 1099-K threshold changes to $5000 for the 2024 tax year, which might impact your

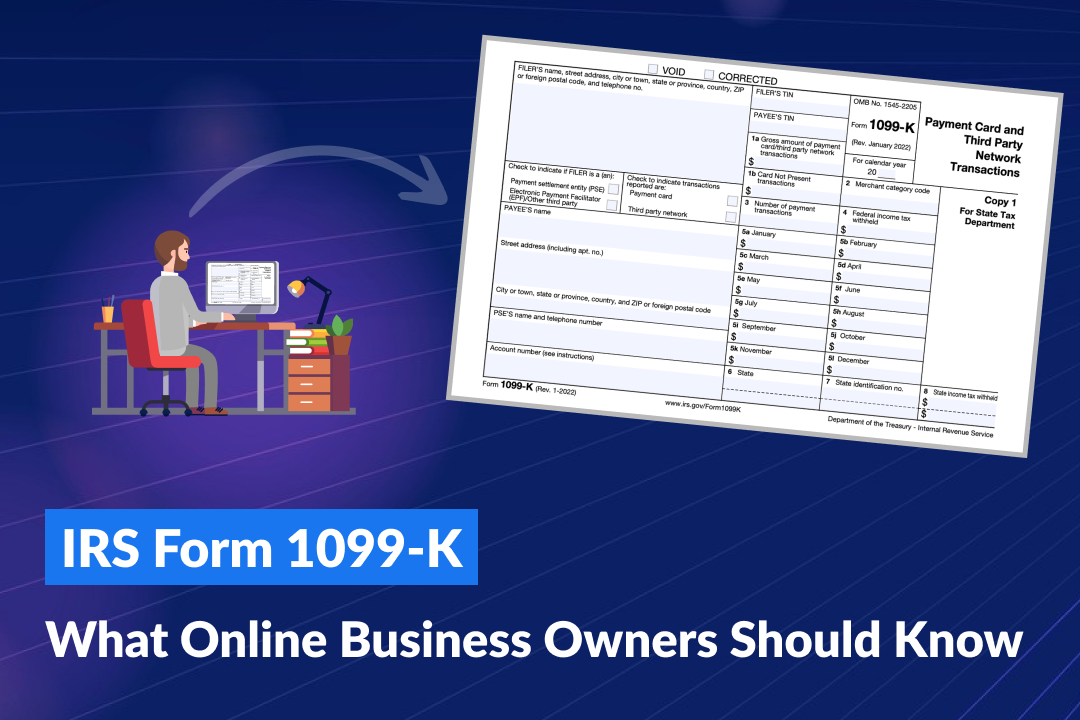

Overview IRS Form 1099-K is crucial for individuals and businesses that receive payments from third-party networks. The 1099-K, also known

The IRS has postponed the introduction of the $600 threshold for 1099-K reporting by third-party settlement organizations for the calendar year 2023,

Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K remains at $20,000 with

Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K remains at $20,000 with

Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K remains at $20,000 with

What is Form 1099-K? Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!

with Tax1099 before April 30 to avoid penalties.