What is FATCA reporting? How does it apply to Form W-9?

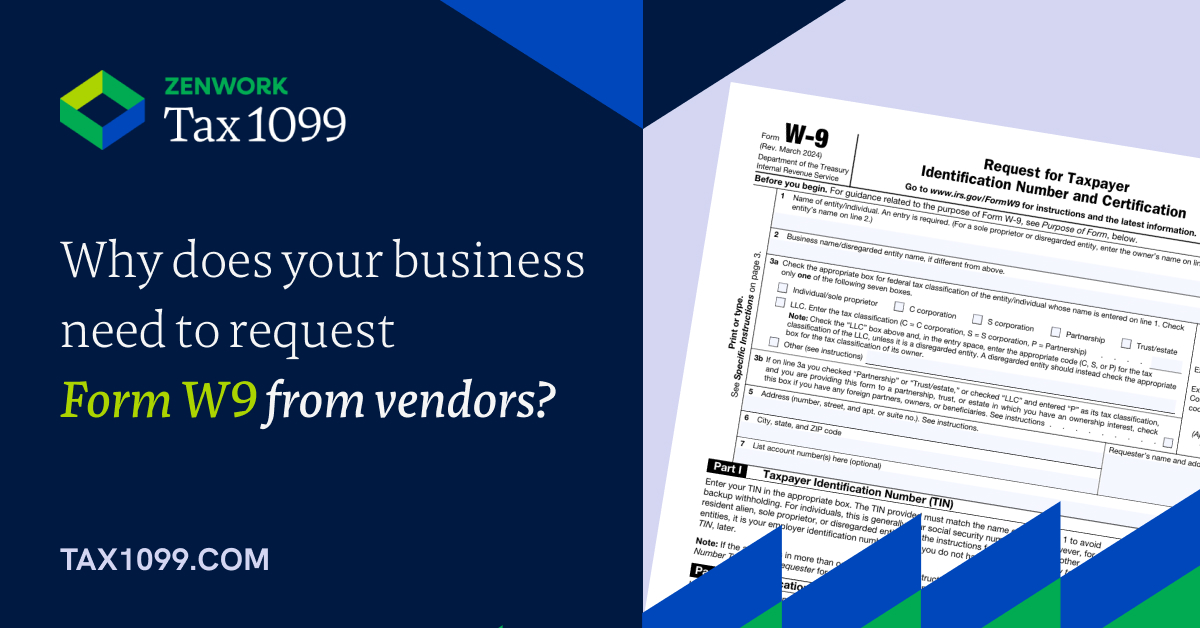

When it comes to working with vendors outside of your business, your IRS tax requirements become a bit more complex.

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Home » Form W-9

When it comes to working with vendors outside of your business, your IRS tax requirements become a bit more complex.

IRS Form W-9, officially titled Request for Taxpayer Identification Number (TIN) and Certification, is a fundamental tax document for businesses

For businesses working with independent contractors, freelancers, or vendors, IRS Form W-9 is a crucial document for tax reporting. Ensuring

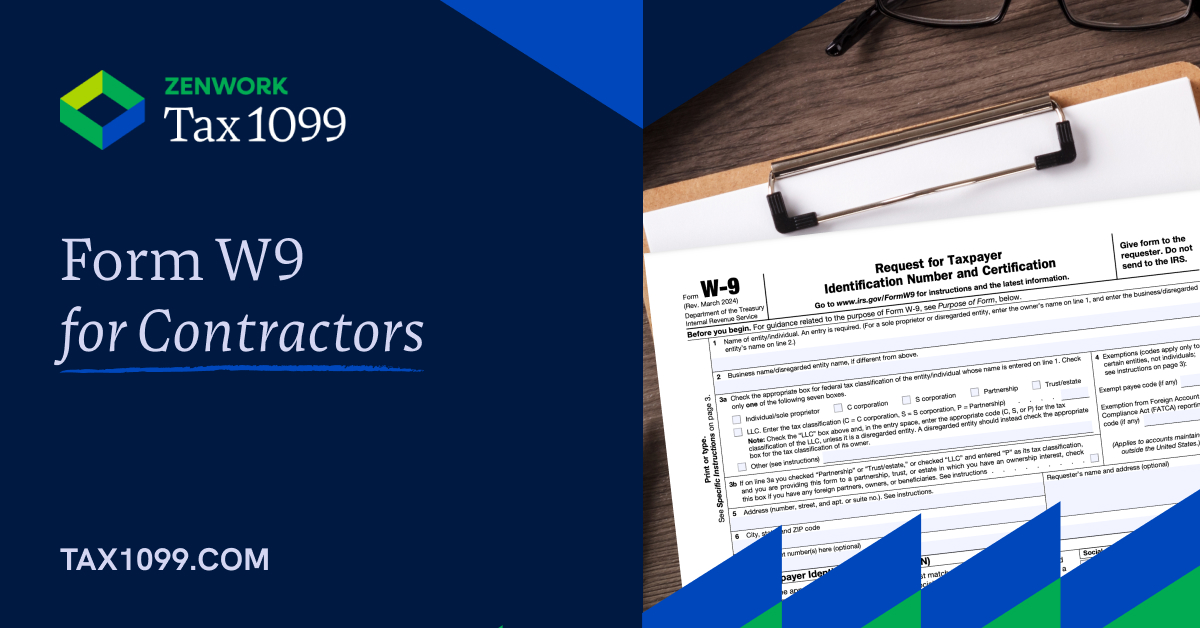

When you begin working with a contractor or freelancer that you will be paying, you should request that the contractor

Fill out, share, and print your W-9 Forms online with Tax1099! One of the most essential elements of making payments

Understanding the definition, requirements, and how to ask a form W-9 is crucial. Hiring someone has been one of the

Managing a company that balances independent contracts or employs outside contractors during tax season may be especially challenging. Form W-9

One of the most essential elements of making payments to consultants and contractors is collecting accurate W-9 information. This process

When it comes to understanding and filing taxes, a few things can be more confusing than deciphering the differences between

You must have heard about W-9 forms; they are used to report contractors’ payments. So, if you are an employer

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!

with Tax1099 before April 30 to avoid penalties.