What is IRS Form 5498: IRA Contributions Information?

Form 5498: IRA Contributions Information is an IRS tax form used to report contributions made to IRAs.

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Home » Forms

Form 5498: IRA Contributions Information is an IRS tax form used to report contributions made to IRAs.

Form 1042-S is a resource that helps the U.S. government track payments made to people or groups that are based outside

March 31, 2024 marks the end of the first quarter of tax year 2024 which means the majority of employers

Preparing a 1042-S is challenging, and the stakes get even higher if there are incorrect filings, leading to penalties, fines,

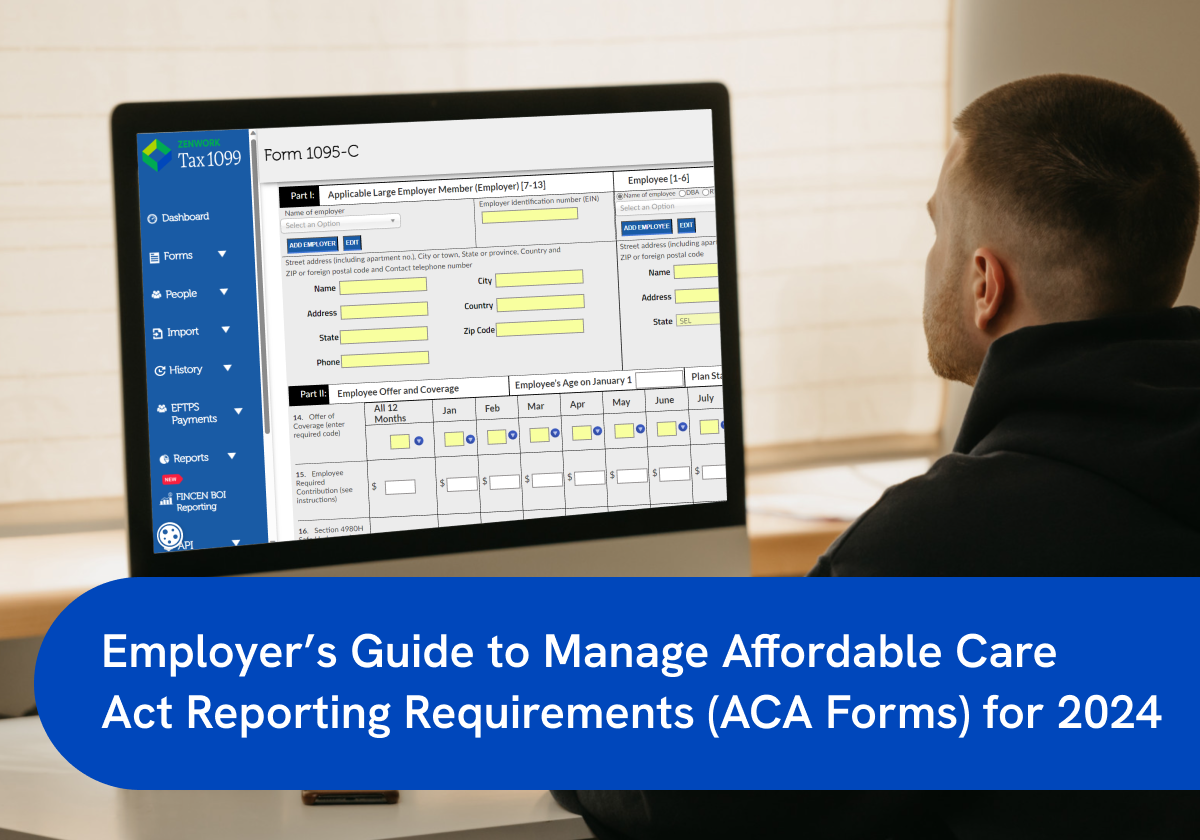

A skimming of recent headlines suggests that the ACA is not only doing what it was intended to do—increase access

According to section 6056, each year, applicable large employers are required to file Form 1095-C with the IRS and provide

As a business owner or contractor, knowing when you’re supposed to issue a 1099 form is crucial. It’s not just

When you manage a business with employees, navigating and fulfilling various tax requirements is particularly essential. Two important tax forms

As an employer, understanding the rules and regulations surrounding 1099 forms is crucial to ensure compliance with the IRS and

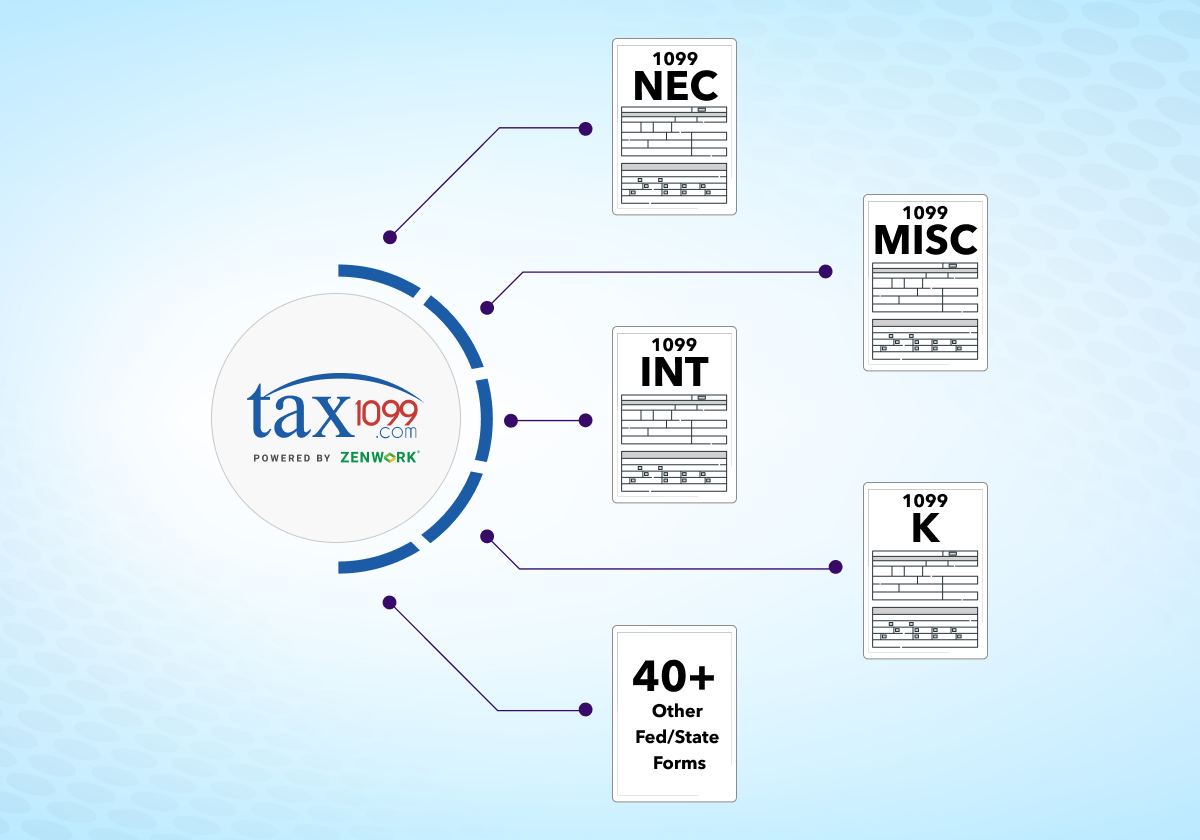

Tax time can be overwhelming, especially for professionals handling complex IRS forms and confusing state filing requirements. That’s where Tax1099

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!

with Tax1099 before April 30 to avoid penalties.