IRS 1099 Filing Deadlines for Tax Year 2023

The specific IRS Form 1099 filing due date varies based on the type of form and the chosen filing method.

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

The specific IRS Form 1099 filing due date varies based on the type of form and the chosen filing method.

Tax compliance is a necessary aspect of running a business, and for companies who issue 1099 forms, accuracy can mean

Both Form W-2 and Form 1099 have a common goal: reporting the income earned by individuals throughout the tax year.

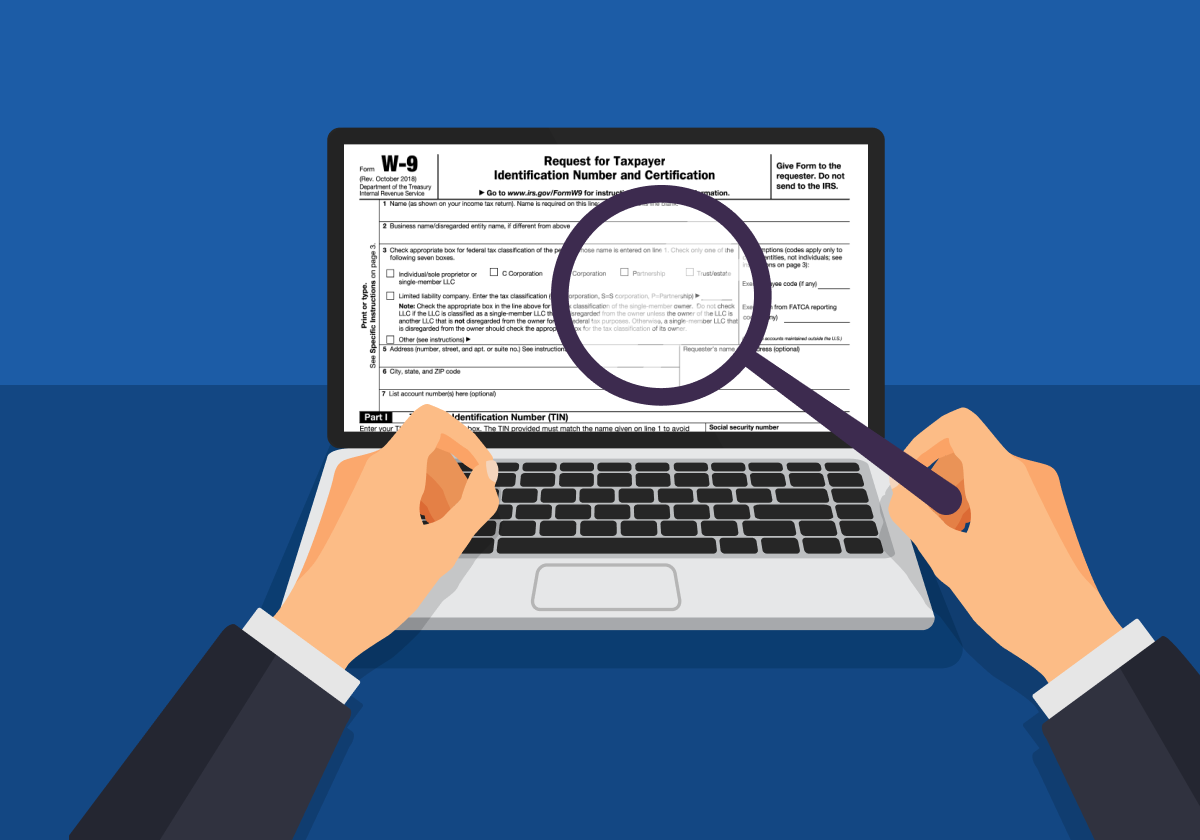

Discover how Tax1099’s powerful TIN Matching and W9/W8 request features can ensure accurate Taxpayer Identification Number verification, helping your business

Do you know a study conducted by payroll software provider Gusto in 2022, found that 34% of businesses said they

Navigating Form 1099-NEC can seem daunting, but it doesn’t have to be. In this guide, we’ll walk you through everything

A 1099 form is used as an example of a collection of documents generally referred to as “information returns” by

Organizations may want to update the W-9 form for each vendor or payee annually or whenever there is a change

Tax season is upon us, and for many organizations, that means grappling with the intricacies of Form 1099-NEC for non-employee

If you’re a business owner, you’re likely aware of the need to send 1099 forms, or you rely on your

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!

with Tax1099 before April 30 to avoid penalties.