File 1099, 1098 and ACA Forms to IRS and SSA with Tax1099

Don’t Miss the Deadline! Submit 1099, 1098, and ACA Forms to IRS and SSA or opt for Filing Extension Forms

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Home » Tax1099 Updates

Don’t Miss the Deadline! Submit 1099, 1098, and ACA Forms to IRS and SSA or opt for Filing Extension Forms

Independent contractors are a valued asset to organizations because of their experience, expertise, and ability to work when needed. However,

Deadlines sneak up on the best of us, and if you’ve missed the January 31 deadline for filing your 1099s,

This December, let your business shine as brightly as your holiday decor by ensuring your tax tasks are handled beforehand.

The holiday season is upon us, bringing with it a whirlwind of festivities, joy, and… oh, tax form filing preparations!

Do you have a limited liability company (LLC) or a corporation? If so, you might have another annual filing obligation

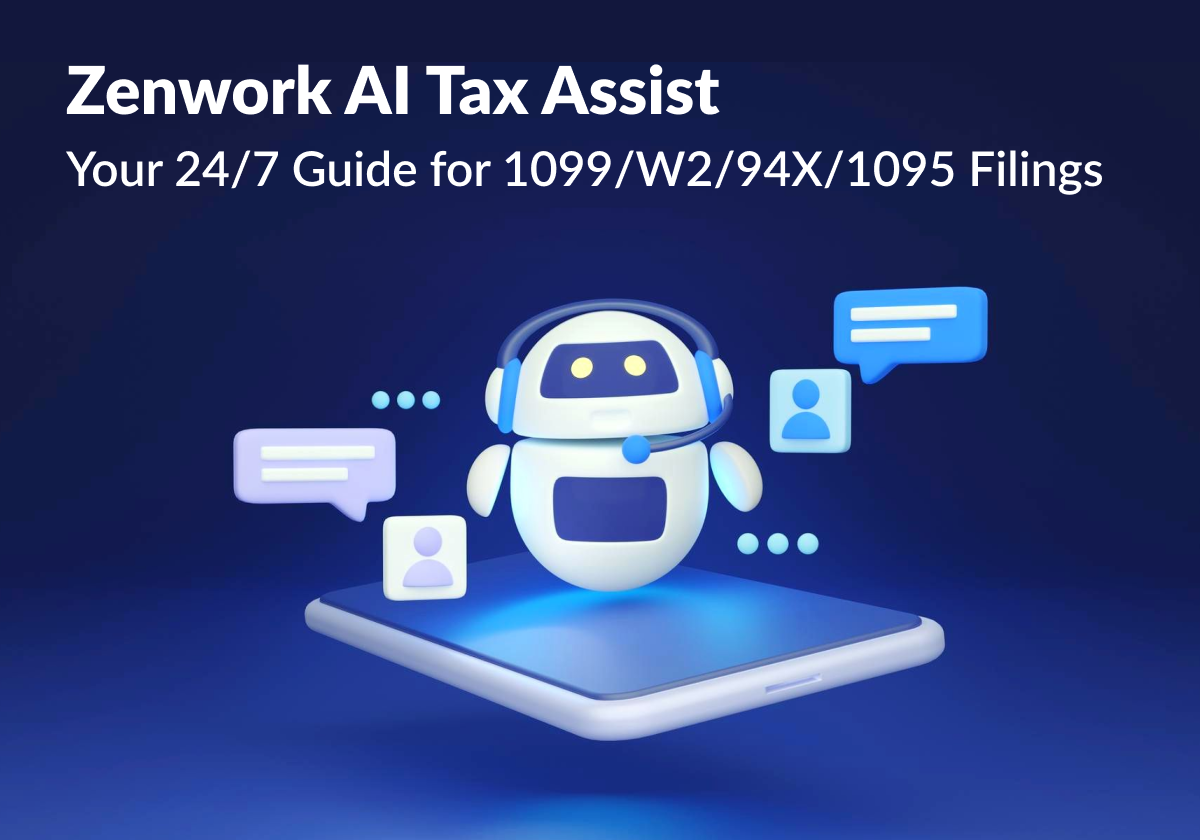

Every technological evolution presents an opportunity to propel scientific exploration, aid individuals, and enhance the overall quality of life. AI

As we approach the 2024 tax season, there’s a palpable sense of excitement at Tax1099. We’re thrilled about the prospects

October is Cybersecurity Awareness Month, a time to reflect on the importance of safeguarding our digital world. At Zenwork, we

Our goal at Tax1099 is to help our clients remain in compliance with IRS regulations. When speaking with our clients

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!

with Tax1099 before April 30 to avoid penalties.