Form 941 is a federal tax return that is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employee’s paychecks.

If you’re an employer, you must complete and submit IRS Form 941 every quarter. To ensure accuracy, it’s crucial to understand the instructions for the 2023 version of Form 941 and know how to fill it out line by line.

Information Required to File 941 Online

To file your IRS Form 941 online, you’ll need the following information:

Employer Details:

- Your business name, employer identification number (EIN), and address.

Employment Details:

- Number of employees you have.

- Total wages paid to your employees.

Taxes and Deposits:

- The federal income taxes withheld from employee pay.

- Medicare and Social Security taxes withheld from employee pay.

- Information from Form 941 worksheets.

- Details about any deposits you made to the IRS.

- The total tax liability for the quarter.

Signing Form 941:

- Information about the person authorized to sign the form.

- Online signature PIN or Form 8453-EMP (a form for authorizing electronic signatures).

How to fill Form 941?

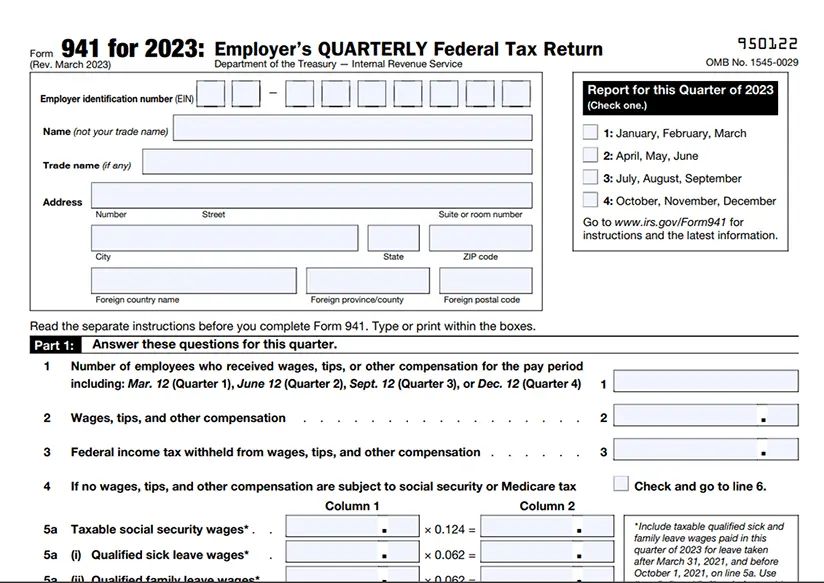

Box 1 – Entering Employer Details

Provide the following details:

- EIN (Employer Identification Number)

- Employer’s full name

- Business name

- Business address

Box 2 – Choosing Quarter

In this box, you’ll need to choose the specific quarter for which you are filing Tax Form 941. This could be the 1st quarter (January, February, March), 2nd quarter (April, May, June), 3rd quarter (July, August, September), or 4th quarter (October, November, December).

Part 1 – Questions for the Quarter

Line 1

Count the number of employees who were paid during the quarter.

Line 2

Sum up all wages, tips, and other payments made to employees.

Line 3

Calculate the total federal income tax withheld from employees’ paychecks.

Line 4

Check this box if employee wages are not subject to certain taxes. If not applicable, you can skip this line.

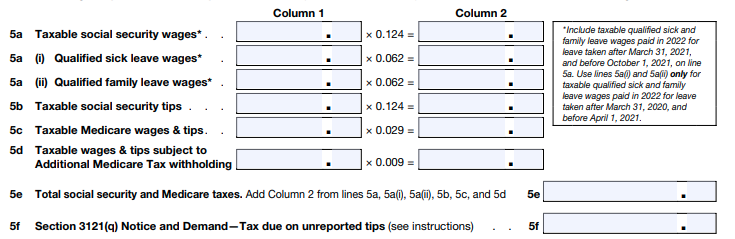

| Line 5 | Description | Information to Enter |

| 5a | Taxable Social Security Wages (*Include qualified sick and family…) | C1 multiplied by 0.124 = C2 |

| 5a (i) | Qualified Sick Leave Wages (*Only include wages paid after March…) | C1 multiplied by 0.062 = C2 |

| 5a (ii) | Qualified Family Leave Wages (*Only include wages paid after March…) | C1 multiplied by 0.062 = C2 |

| 5b | Taxable Social Security Tips | C1 multiplied by 0.124 = C2 |

| 5c | Taxable Medicare Wages & Tips | C1 multiplied by 0.029 = C2 |

| 5d | Taxable Wages & Tips subject to Additional Medicare Tax | C1 multiplied by 0.009 = C2 |

| 5e | Total Social Security and Medicare Taxes | Sum of C2 values from Lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d |

| 5f | Section 3121(q) Notice and Demand—Tax due on unreported tips | Tax due received from Section 3121(q) Notice and Demand |

Line 6:

Add up the amounts from Line 3, Line 5e, and Line 5f to get the total taxes before any adjustments.

Lines 7 to 9:

Enter any adjustments for a fraction of cents (Line 7), sick pay (Line 8), tips, and group life insurance (Line 9).

Line 10:

Sum up the amounts from Line 6 to Line 9 to get the total taxes after adjustments.

Line 11

- Line 11a:

Put the amount you’ve calculated in Form 8974 and attach it. This is for the qualified small business payroll tax credit related to increasing research activities. - Line 11b:

Put the amount from Worksheet 1, step 2, line 2j for the nonrefundable portion of the credit for qualified sick and family leave wages taken before April 1, 2021. - Line 11c:

Enter the nonrefundable portion of the employee retention credit. - Line 11d:

Input the amount from Worksheet 3, step 2, line 2r, for the nonrefundable portion of the credit related to qualified sick and family leave wages taken after March 31, 2021. - Line 11e:

Reserved for future use, regarding the nonrefundable portion of the COBRA Premium Assistance Credit.

- Line 11f:

Reserved for future use, regarding the number of individuals provided COBRA Premium Assistance. - Line 11g:

Sum up the amounts from lines 11a, 11b, 11c, and 11d to get the total nonrefundable credits.

Line 12:

Calculate the total taxes after adjustments and nonrefundable credits by subtracting the total nonrefundable credits (from Line 11g) from the total taxes after adjustments (from Line 10). The amount on Line 12 cannot be less than zero.

Line 13:

- Line 13a: Include all deposits made for this quarter, including overpayments from a previous quarter and overpayments applied from specific forms filed in the current quarter.

- Line 13b: Reserved for future use, previously for deferred social security tax, now held for future purposes.

- Line 13c: Record the refundable portion of the credit for qualified sick and family leave wages taken before April 1, 2021, from Worksheet 1, step 2, line 2k.

- Line 13d: Reserved for future use regarding the refundable portion of the Employee Retention Credit.

- Line 13e: Note down the refundable portion of the credit for qualified sick and family leave wages taken after March 31, 2021, from Worksheet 3, step 2, line 2s.

- Line 13f: Reserved for future use, concerning the refundable portion of the COBRA Premium Assistance Credit.

- Line 13g: Calculate the total by adding the amounts from lines 13a, 13c, 13d, and 13e.

- Line 13h: Reserved for future use, previously for total advances received from filing Form(s) 7200 for the quarter.

- Line 13i: Calculate the total deposits and refundable credits less the advances (subtract Line 13h from Line 13g).

Line 14:

If the amount you calculated in Line 12 (total taxes after adjustments and nonrefundable credits) is greater than the total deposits and refundable credits minus advances (from Line 13i), enter this difference in Line 14 as the balance due.

Line 15:

If the total deposits and refundable credits (Line 13g) is more than the total taxes after adjustments and nonrefundable credits (Line 12), put this difference in Line 15. You can choose how you want to handle this overpayment: either apply it to your next return or request a refund. Select the appropriate box based on your preference.

Form 941 Part 2 – Deposit schedule and tax liability

Line 16:

Choose the box that fits your tax situation:

- Box 1: If your Line 12 tax amount is less than $2,500 on this Form 941 or the previous quarter. Also, if you didn’t have a hefty $100,000 next-day deposit during this quarter.

- Box 2: If you deposited taxes monthly for the entire quarter. Specify your tax liability for each month (Month 1, Month 2, and Month 3) to match Line 12 on your Form 941.

- Box 3: If you deposited taxes semiweekly at any point during the quarter. Include your tax liability on Schedule B (Form 941) and attach it if you followed the semiweekly deposit schedule.

Form 941 Part 3 – About your business

If lines 17 and 18 aren’t relevant to your business, simply leave Part 3 empty and proceed to Part 4.

Line 17: If you closed your business or ceased wage payments this quarter, mark this line and note the final wage payment date.

Line 18a: If you’re a seasonal employer and don’t file Form 941 every quarter, mark this box under line 18.

Line 19: Record health plan expenses for qualified sick leave wages before April 1, 2021 (Worksheet 1, step 2, line 2b).

Line 20: Note health plan expenses for qualified family leave wages before April 1, 2021 (Worksheet 1, step 2, line 2f).

Line 23: Input sick leave wages taken after March 31, 2021 (Worksheet 3, step 2, line 2a).

Line 24: Include health plan expenses for the sick leave wages reported on line 23 (Worksheet 3, step 2, line 2a).

Line 26: Enter family leave wages taken after March 31, 2021 (Worksheet 3, step 2, line 2g).

Line 27: Record health plan expenses for the family leave wages reported on line 26 (Worksheet 3, step 2, line 2h).

Line 25, 28: Include amounts under specific collectively bargained agreements for sick and family leave wages (Worksheet 2 and 3, step 2, respective lines).

Part 4, titled “Third-Party Designee

- Select “Yes”: If you want to discuss this return with the IRS, provide the designee’s name, phone number, and a 5-digit PIN to use during these discussions.

- Select “No”: If you do not wish to discuss this return with the IRS through a third-party representative.

Part 5: Signatures

Make sure the designated person signs in the appropriate section to complete the form accurately.

- Sole Proprietorship: The individual who owns the company.

- Corporation or LLC treated as a corporation: President, Vice President, or another principal officer.

- Partnership or LLC treated as a Partnership: Partner, Member, or Officer.

- Single-Member LLC: Owner of the LLC or a principal officer.

- Trust or Estate: The fiduciary.

Due Date for Filing Form 941

The Due Dates for filing Form 941 are at the end of the month following the respective quarter.

| Quarter | Due Date |

| 1st Quarter (Jan-Mar) | May 1, 2023 |

| 2nd Quarter (Apr-Jun) | July 31, 2023 |

| 3rd Quarter (Jul-Sep) | October 31, 2023 |

| 4th Quarter (Oct-Dec) | January 31, 2024 |

Electronically filed 941 forms are directly transmitted to the IRS from Tax1099.

You should receive an email of the status of your 941 filng on the same day it is submitted to the IRS. Please note that the 941X, an amended version of the 941, is not accepted via eFile by the IRS. You will need to print and mail that in.