As the tax filing deadline looms, taxpayers and professionals alike are encountering confusing—and potentially costly—errors within IRS.gov’s online account system. The wrong extension date on the IRS website caused confusion, thus causing taxpayers to potentially incur penalties and miss deadlines. Learn more about how these inaccuracies impact tax filings and what steps are being taken to address them.

What’s Happening?

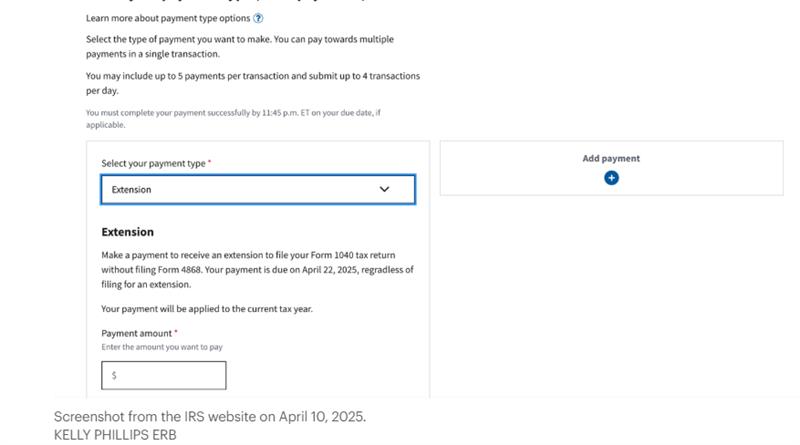

When logging into a taxpayer’s online IRS account, users see April 22, 2025, listed as the extension payment due date. This contradicts the official IRS deadline of April 15, 2025, for filing returns and making extension-related payments.

A likely explanation is that April 22 refers to the IRS’s five-business-day window to “perfect” failed e-file submissions. Where a return submitted by April 15 is rejected but can be corrected and resubmitted by April 22 without penalty. However, the system offers no explanation or context, leaving room for misinterpretation.

Why Does It Matter?

This misleading date could easily result in taxpayers delaying extension payments, wrongly assuming they’re not due until April 22. In reality, late payment penalties and interest will apply if the payment isn’t made by April 15.

Inaccurate information in the IRS’s own system undermines the trust professionals and taxpayers place in the platform. Especially during such a critical time of year.

Alongside the incorrect extension date, users are also reporting other discrepancies in the IRS account system:

- Amended returns are mislabeled as “104X” instead of the correct Form 1040-X

- Some account dashboards show that 2022 and 2023 returns are still being processed, even when they have been accepted and finalized.

What’s Being Done?

These concerns have been escalated to the IRS, with a request for immediate clarification and correction. Until official guidance is updated, tax professionals are encouraged to rely on published IRS deadlines and not what appears in the online account interface.

Reminder: April 15 Is the Real Deadline

Despite what’s displayed on IRS.gov accounts, the official deadline for filing tax returns and submitting extension payments remains April 15, 2025.

Professionals should advise clients accordingly to avoid penalties and monitor any further updates as the situation develops.

How Tax1099 Can Help?

Amid confusing messages and deadline errors on IRS.gov, Tax1099 can offer a reliable, accurate, and timely alternative for handling your IRS filing needs, so you stay compliant.

✅ Clear, Accurate Deadlines

Tax1099 is designed to guide users based on the most up-to-date and accurate IRS guidance. The platform sends reminders about upcoming due dates and provides updates on the latest IRS developments.

✅ Real-Time Filing Status

We offer real-time e-filing updates, so you know exactly when your forms are submitted, accepted, or rejected.

✅ Automatic Error Checks & Resubmissions

If an e-filed form is rejected, Tax1099 alerts you immediately and gives you tools to quickly correct and resubmit—staying well within the IRS’s perfection window (like the 5-business-day grace period that may have caused the IRS.gov confusion).

✅ Extension Filing

Do you need to file an extension? Tax1099’s sister brand EZextension, makes it simple to file Form 4868 and Form 7004 electronically, ensuring it’s done before the April 15 deadline and not delayed by misinformation.

✅ Trusted by Professionals

Used by accounting firms, tax preparers, and businesses nationwide, Tax1099 is a trusted IRS-authorized eFile provider that takes the guesswork out of compliance. Over 1 million businesses have filed with us. Check out our customer stories and testimonials to see why renowned businesses choose Tax1099 to file their forms.

While the wrong extension date on IRS website and other inconsistencies are being fixed, Tax1099 can give you the clarity and support you need—especially when time is tight, and accuracy matters most.