A new Form 1099-DA draft has been released by the Internal Revenue Service (IRS) that reinforces the requirements for digital assets reporting. The form, titled “Digital Asset Proceeds from Broker Transactions,” will be active in 2025.

Overview:

The IRS published a draft of proposed regulations in August 2023, which presaged much-needed information about brokers’ potential future information reporting obligations. Even though the idea of an IRS Form 1099-DA for NFTs, cryptocurrencies, and other digital assets was first announced back in 2021, not much information was available until now.

A preview of the new Form 1099-DA was made available by the IRS on April 19th. And could be used by the cryptocurrency brokers from January 1, 2025.

What is Form 1099-DA?

To perceived gaps in tax collections, Congress added a tax information reporting requirements for digital assets within the infrastructure Investment and Jobs Act. Following this law, the IRS has introduced a draft, Form 1099-DA as a means to implement this portion of the bill. Last autumn, the Treasury and the IRS released an initial draft of the proposed regulations defining the requirements. Although those regulations have not yet been finalized, the publication of the draft Form 1099-DA signifies the rules’ practical implementation, outlining the data that must be reported and how it must be organized.

Third Party Reporting on Digital Assets

The introduction of a requirement for Brokers and other intermediaries to provide third party reporting of activity was a way to attempt to ensure proper tax collection on income generated through the trading of various digital assets such as cryptocurrency, stakes, and NFTs.

The new form 1099-DA is intended to address the difficulty that the IRS has tracking income from new investment vehicles outside traditional financial channels. And the IRS aims to increase the accessibility of cryptocurrency tax information and make sure that all bitcoin traders are disclosing their gains and losses.

New Draft for Form 1099-DA

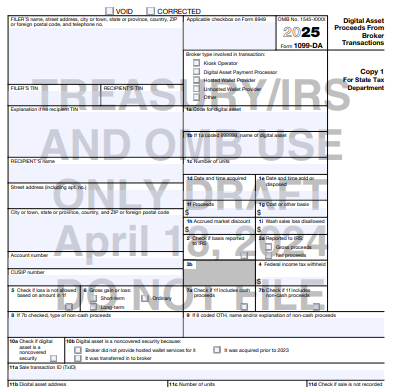

The draft form released by IRS proposes the collection of detailed information such as the type of digital asset, amount involved and transaction identifiers that currently does not exist and are unclear at this time.

Unlike its predecessors, such as Form 1099-B, the new form includes specific additions targeted specifically at these new assets:

- Business Type Identification: There’s an addition of a new checkbox to identify the filer’s type of business, including payment processors which align with digital transaction norms and regulatory changes.

A broker may select:

(1) Kiosk operator, (2) Digital asset payment processor, (3) Hosted wallet provider, (4) Unhosted wallet provider or (5) Other - Asset Reporting in Detail: The new 1099-DA is designed with separate boxes for asset identification codes, unit numbers, and a backup box for unregistered assets. This indicates the potential development of a regulated digital asset registry that currently does not exist.

These two points provide information on how the data will be used. - Box for “Explanation if no recipient TIN: This is the first 1099 form that has a separate box for explanation if there is no recipient TIN. However, no instructions are mentioned for this box in the draft. The reason for the IRS needing this information may seem unclear, but typically backup withholding kicks in when a payer does not have proper information such as current TIN to support proper information reporting.

- Gross Proceeds Reporting: Very similar to Form 1099-B, the draft of Form 1099-DA also includes specific requirements covering the reporting regarding the sale of digital assets by brokers. They are required to mention the gross proceeds in box 1f, cost basis of assets sold in Box 1g, if available, and indicate gain or loss was short term or long term in Box 6.

Conclusion

Form 1099-DA aims to improve compliance for taxpayers involved with digital asset investments, which is a kind of activity that is historically difficult without third-party reporting. This proposed new form, and its associated regulations are intended to improve verification and compliance.

The draft has provided some valuable guidance on the direction of digital asset reporting may be heading. But it’s important to remember that the draft can undergo significant changes based on the feedback from public and that full regulations and instructions are not yet final. When the proposed reporting rules were revealed, there were varying opinions from the crypto community. Different stakeholders expressed both support and opposition to the proposed rules.

Ready to Optimize Your Compliance with IRS Form 1099-DA?

Tax1099 is here to guide you for the upcoming digital asset reporting and its compliance. Contact our experts today and Subscribe to your Newsletter to know all the latest updates around cryptocurrency tax and IRS regulatory changes.