Businesses need to complete and submit Form 1099-NEC by January 31 (or the following business day if it’s a weekend or holiday) to report payments of $600 or more to non-employee service providers from the previous tax year.

Additionally, businesses must file Form 1099-MISC by March 1 (for paper filing) or March 31 (for electronic filing) to report payments of at least $10 in royalties or a minimum of $600 for services like rent or medical payments made to nonemployees and specific vendors in the previous tax year.

In case a business fails to provide the required forms by the deadline, penalties range from $60 to $310 per form, depending on how long past the deadline the forms are issued.

If a business deliberately neglects the obligation to furnish accurate Form 1099-NEC or Form 1099-MISC, it faces a minimum penalty of $630 per form, or 10% of the income reported on the form, without an upper limit.

Changes in Form 1099-MISC

The Form 1099-MISC has undergone several changes in recent years. 2020 saw the reintroduction of Form 1099-NEC for reporting non-employee compensation, moving that reporting off of the 1099-MISC form where it had been since 1983.

Another significant change is the difference in filing deadlines for the two forms. Form 1099-NEC has a deadline of January 31st, while Form 1099-MISC maintains a deadline of February 28th (or March 31st if filed electronically). Failure to file the correct form or complete the work by the designated deadlines may result in penalties or fines from the IRS.

Changes in Form 1099-NEC

This form brings an accelerated filing deadline, with January 31st being the cutoff date for submission, compared to February 28th (or March 31st if electronically filed) for Form 1099-MISC. Awareness of these changes and adherence to the appropriate form is vital for businesses seeking to report non-employee compensation faithfully.

What are the penalties for missing the deadline?

| Form Type |

Deadline for Filing |

| Form 1099-NEC |

January 31 (or next business day if Jan 31 is a weekend/holiday) |

| Form 1099-MISC |

February 28 (paper filing) or March 31 (electronic filing) |

The penalties for missing the filing deadline for 1099 NEC and 1099 MISC forms can vary. The IRS may impose penalties based on the number of forms not filed and the duration past the deadline. The penalties range from $60 – $310 per form (tax year 2023), depending on lateness. Timely filing or seeking an extension is crucial to avoid potential penalties.

Charges for Each Information Return or Payee Statement

| Year Due | Up to 30 Days Late | 31 Days Late Through August 1 | After August 1 or Not Filed | Intentional Disregard |

| 2024 | $60 | $120 | $310 | $630 |

| 2023 | $50 | $110 | $290 | $580 |

| 2022 | $50 | $110 | $280 | $570 |

| 2021 | $50 | $110 | $280 | $560 |

| 2020 | $50 | $110 | $270 | $550 |

The maximum penalty is different for small businesses and large businesses including government entities. There is no maximum penalty for intentional disregard.

Avoid a Penalty

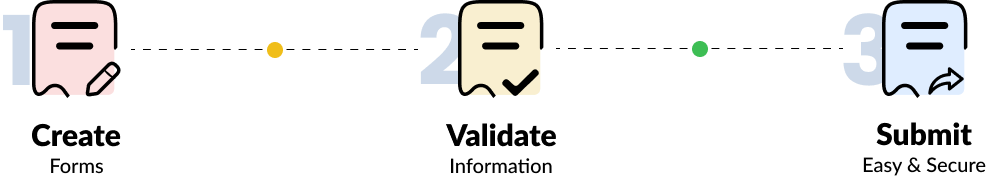

To steer clear of penalties, adhere to the following guidelines:

- Timely Filing of Information Returns: Ensure that you submit information returns and provide payee statements to the IRS before the designated due date.

- Accuracy is Key: Double-check the returns and payee statements for accuracy, ensuring all information provided is correct.

- Check that you have validated the Name/TIN combination for each form recipient using either the IRS TIN matching system or a third-party product like Compliancely.

Request for time extension

To request an extension of time for filing an information return and providing payee statements, follow these steps:

- Information Returns:

Use Form 8809 – Application for Extension of Time to File Information Returns to request an extension.

- Payee Statements:

If you need an extension for furnishing payee statements to recipients, you can request it by faxing the extension of time request.

You can find details on the penalties from the IRS here.

How to eFile 1099-MISC or 1099-NEC with Tax1099?