Form 1099-K Reporting Requirement for TY 2024

The world of business is highly digital in most aspects, including finances. Gone are the days when small business owners

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Home » Form 1099-K

The world of business is highly digital in most aspects, including finances. Gone are the days when small business owners

Gig economy employers are required to file the 1099 forms with the IRS.

Individuals & businesses are required by the IRS to report all types of nonemployment compensations of $600 or more. This

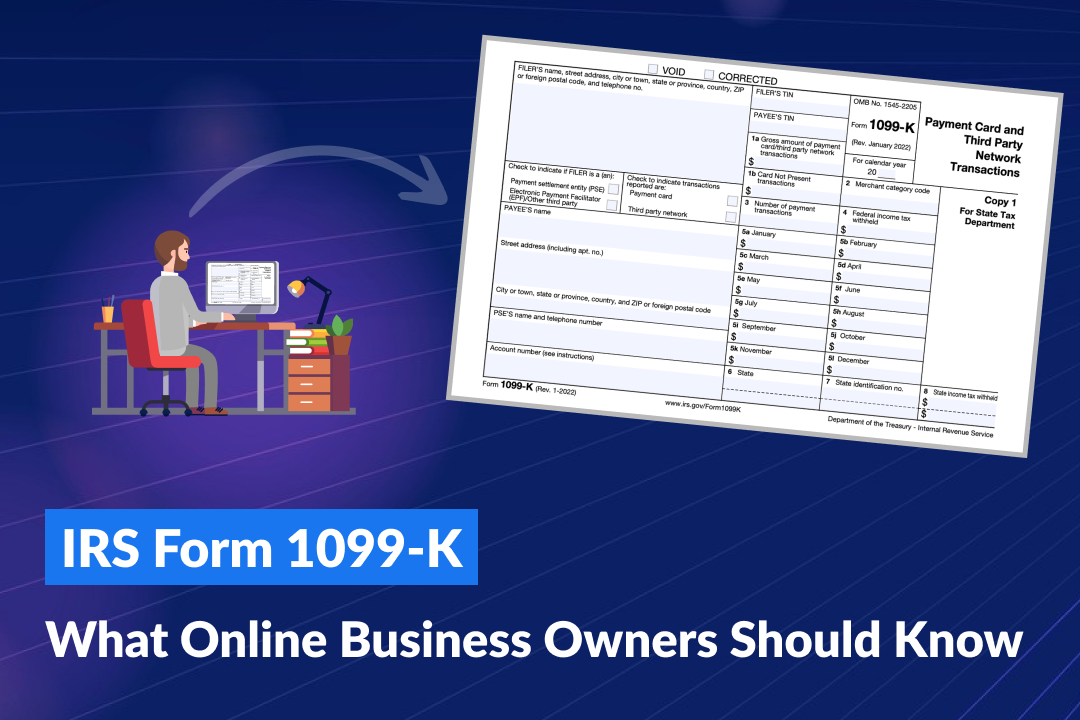

The IRS has postponed the introduction of the $600 threshold for 1099-K reporting by third-party settlement organizations for the calendar year 2023,

Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K remains at $20,000 with

Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K remains at $20,000 with

Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K remains at $20,000 with

What is Form 1099-K? Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K

Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K remains at $20,000 with

Note: IRS delays the rollout of the $600 threshold for 1099-K reporting.The threshold for Form 1099-K remains at $20,000 with

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!