Common Mistakes to Avoid While Filing Form 1099-NEC

Form 1099 NEC is one of the important 1099 forms for businesses. When any organization pays $600 or more to

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Home » Form 1099-NEC

Form 1099 NEC is one of the important 1099 forms for businesses. When any organization pays $600 or more to

Gig economy employers are required to file the 1099 forms with the IRS.

Individuals & businesses are required by the IRS to report all types of nonemployment compensations of $600 or more. This

TIN matching is essential for businesses to verify the accuracy of taxpayer identification numbers provided by vendors and contractors. Reduce

Navigating Form 1099-NEC can seem daunting, but it doesn’t have to be. In this guide, we’ll walk you through everything

Tax season is upon us, and for many organizations, that means grappling with the intricacies of Form 1099-NEC for non-employee

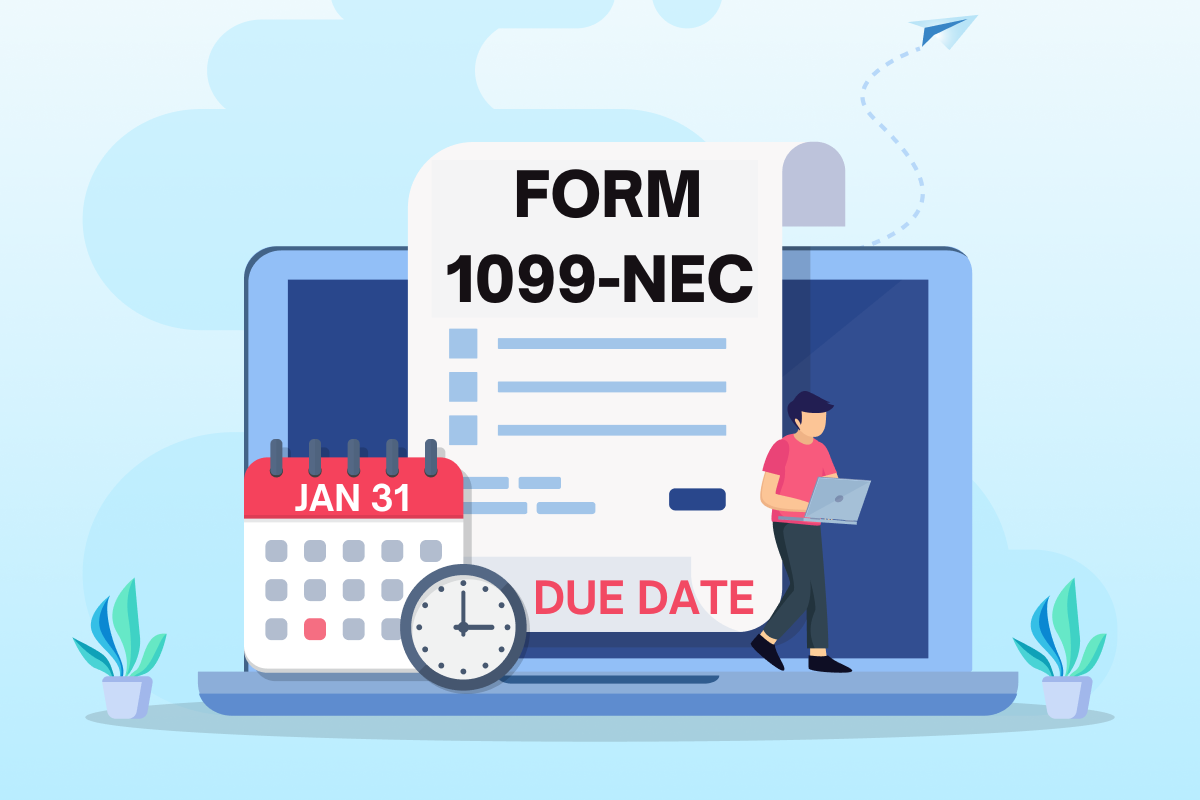

Businesses need to complete and submit Form 1099-NEC by January 31 (or the following business day if it’s a weekend

Business taxpayers are required to file Form 1099-NEC by the due date to avoid late filing penalties. Form 1099 NEC Deadlines /

Businesses need to complete and submit Form 1099-NEC by January 31 (or the following business day if it’s a weekend

The Internal Revenue Service (IRS) classifies workers into two categories. 1099 and W-2 employees have different rights, responsibilities, and tax

Master tax filing with timely updates, expert tax tips, step-by-step video guide and exclusive insights!