The wildfires sweeping through California, especially in Los Angeles County, have left a trail of unimaginable loss and disruption, deeply affecting individuals, families, and businesses.

While your primary focus is undoubtedly on safety, and rebuilding what has been lost, the added responsibility of tax compliance can feel overwhelming. That’s why we’re here to share important information about tax reporting extensions and tax relief directly available for the affected taxpayers by the California Department of Tax and Fee Administration.

Key Points

- For a 30-day tax reporting extension, request 8809 Form online.

- Affected taxpayers now have until Oct. 15 to file various federal individual and business tax returns and make tax payments.

- Wildfire-related losses can be claimed by the affected taxpayers on their 2024 or 2025 tax returns.

“The people in Los Angeles County have experienced unimaginable tragedy, and the state will continue to do everything possible to help these communities,” Gavin Newsom said in a statement.

New Deadlines for Tax Filing and Reporting

The IRS has extended certain tax filing deadlines to ease out the burden on those affected by the wildfires. Businesses now have until October 15, 2025, to submit their tax forms, including 1099s and W-2s. Additional relief may be available to affected taxpayers who participate in a retirement plan or individual retirement account.

The same relief will be available to any other counties added later to the disaster area.

The extension has provided a much-needed buffer to prioritize the well-being of your employees, clients, and community while managing compliance obligations.

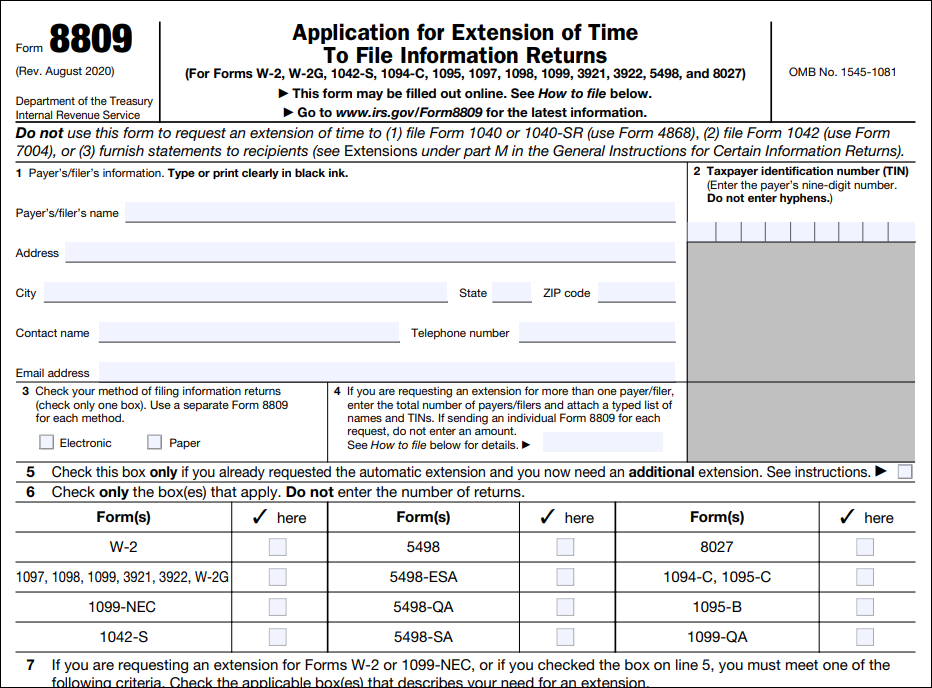

File Form 8809 for Tax Reporting Extension

If your operations have been disrupted by the California wildfires, the IRS allows for extensions to issue and file tax forms. Here’s how:

1. Requesting an Extension for Issuing Forms to Recipients

- Complete Form 8809 to apply for an extension.

- Use this form to request an extension of time to file forms:

- W-2, W-2G,

- 1042-S,

- 1094-C, 1095,

- 1097, 1098, 1099,

- 3921, 3922,

- 5498, and

- 8027

- Submit this form before the original deadline i.e. January 31, 2025, for distributing tax forms (e.g., W-2s and 1099s).

Note: You can submit the form to the IRS with Tax1099 or choose to Fax at 877-477-0572 (or 304-579-4105 for international submissions)

2. Requesting an Extension for Filing Forms with the IRS

You have multiple options to file an extension request:

- Online Submission: Use the IRS FIRE (Filing Information Returns Electronically) System to submit Form 8809 electronically.

Online submissions are the quickest method and can grant an automatic 30-day extension, provided they are submitted on time.

- Paper Submission: Mail Form 8809 to the IRS address provided below:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0209

- Electronic File Format: If you prefer, you can electronically file your extension request following the IRS specifications outlined in Publication 1220.

Special Note: For W-2s and 1099-NEC forms, extensions must be submitted on paper, and applicants are required to sign Line 7 of Form 8809 for processing.

Form 8809 Due Dates

The due dates for filing Form 8809 are shown below:

| Form | Due Date (Paper Filing) | Due Date (Electronic Filing) |

| W-2 | January 31 | January 31 |

| W-2G | February 28 | March 31 |

| 1042-S | March 15 | March 15 |

| 1094-C | February 28 | March 31 |

| 1095 | February 28 | March 31 |

| 1097, 1098, 1099 | February 28 | March 31 |

| 1099-NEC | January 31 | January 31 |

| 3921, 3922 | February 28 | March 31 |

| 5498 | May 31 | May 31 |

| 8027 | Last Day of February | March 31 |

If any due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

Who are Qualified for the Extended Deadlines?

Taxpayers considered “affected” by the wildfires are eligible for filing and payment deadline postponements. According to IRS guidelines, affected taxpayers include:

- Residents and businesses whose primary residence or main place of business is located within the federally declared disaster areas.

- Taxpayers with essential records located within the disaster area, even if they live outside it, but require those records to meet filing deadlines.

- Relief workers associated with recognized government or philanthropic organizations who are assisting in the disaster-affected areas.

- Individuals visiting the disaster zone who were injured or tragically lost their lives due to the fires.

We are here to Help!

We understand that tax reporting might not feel like a priority in the wake of such devastating events. However, taking a few proactive steps now can save you from added stress later. Our goal is to support businesses like yours with accurate and timely information to help ease the burden of compliance during this difficult time.

For further assistance, affected taxpayers can contact the IRS Disaster Hotline at 866-562-5227, or reach out to local IRS offices for specific relief options. If you need additional assistance, IRS-authorized e-filing platforms like Tax1099 are excellent starting points. Together, we can help you navigate these unprecedented circumstances with clarity and resilience.