Tax time can be overwhelming, especially for professionals handling complex IRS forms and confusing state filing requirements. That’s where Tax1099 steps in – a smart solution designed for experts like you to ease the burden of tax filing. It’s like having a professional assistant at your fingertips.

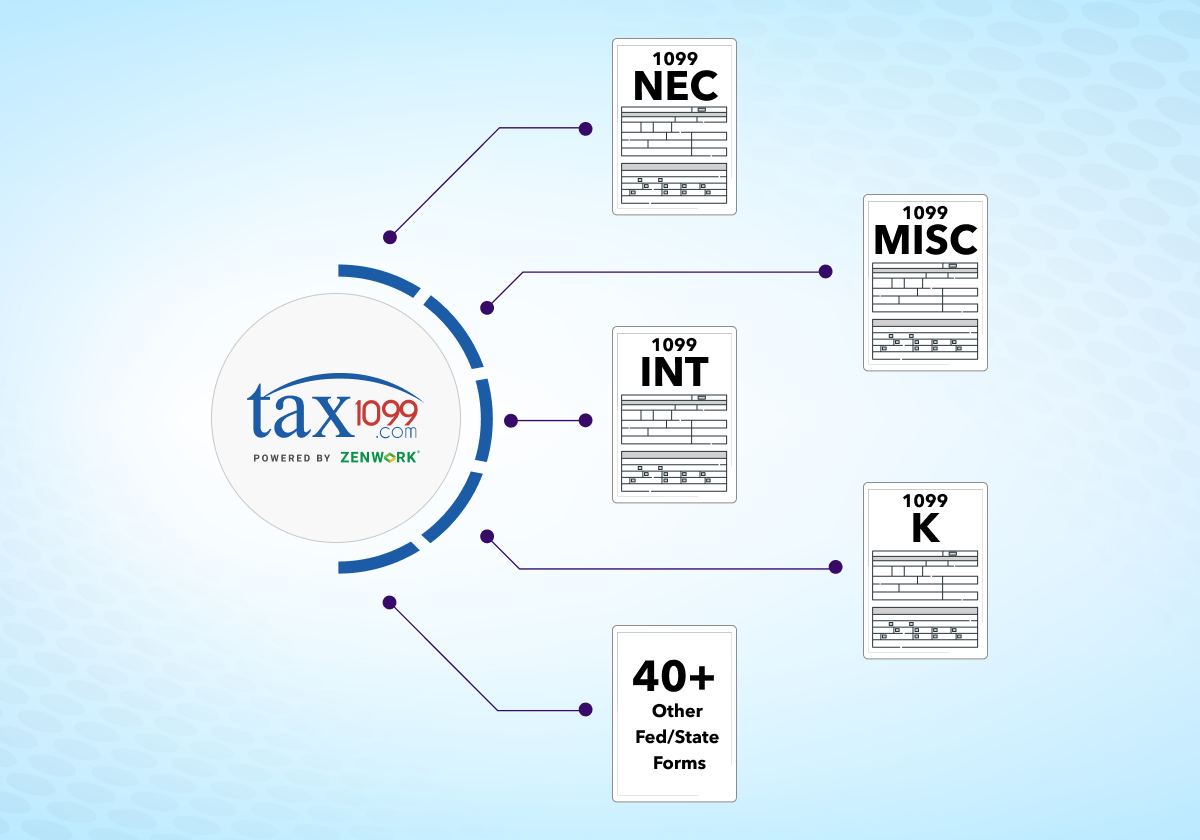

Think of Tax1099 as your trusted ally in the tax world, with over 500,000+ satisfied customers. It’s made to simplify the complex task of dealing with 1099 forms. With an easy-to-use interface and smart features, it helps handle crucial forms like the 1099-NEC, 1099-INT, 1099-K, 1099-MISC, and lots more federal and state forms.

Tax1099 Supported IRS Forms & Their Importance

Understanding the importance of various IRS forms is key to navigating tax obligations effectively. Tax1099 stands out for its comprehensive support of numerous vital federal and state forms, including:

- 1099-NEC: Handling non-employee compensation is simplified through the 1099-NEC form. It is used to report payments to independent contractors or freelancers.

- 1099-K: This form is required for reporting payment card and third-party network transactions. It’s crucial for businesses involved in such transactions, to ensure accurate payment reporting.

- 1099-INT: Reporting interest income is essential, and the 1099-INT form serves this purpose. It’s necessary to report for individuals and businesses that earn interest income above a certain threshold.

- 1099-MISC: For reporting miscellaneous income not covered by other 1099 forms, the 1099-MISC fills in many holes in the information reporting program. It covers a broad spectrum of miscellaneous income.

Tax1099 eases the burden of managing these vital forms and more. In addition to the mentioned forms, Tax1099 supports over 40 federal and state forms:

- Other 1099 Forms (1099-A, 1099-B, 1099-C, 1099-DIV, 1099-G, 1099-SA, etc.)

- 1098 Forms (1098, 1098-C, 1098-T, 1098-E)

- 1042 Forms (1042, 1042-S)

- Stock Options (3921, 3922)

- Payroll Forms (940, 941, 943, 944, 945, etc.)

- 480 Forms (480.6A, 480.6B, 480.7A)

- ACA Forms (1095-B, 1095-C)

- State-specific forms, including Form MA 1099-HC and various W-2 forms (W-2, W-2C, W-2VI, W-2GU)

This extensive support ensures that Tax1099 caters to diverse tax reporting needs, simplifying the process for individuals, businesses, and tax professionals dealing with a wide range of federal and state obligations.

Introducing Tax1099 Features for Smooth Filing

Tax1099 excels in providing a suite of robust features, designed to streamline the tax filing process and ensure accuracy and efficiency. Some of its standout features include:

Integration with Leading Accounting Software

Tax1099 seamlessly integrates with over 11 leading accounting software systems, including QuickBooks Desktop, QuickBooks Online, Xero, Bill.com, Accounting Suite, Oracle NetSuite, W2 Apex technologies PDF Import, and more. This integration simplifies data import and streamlines the filing process.

API Availability

The availability of an API facilitates enhanced connectivity and allows for customized integrations, catering to diverse user needs and workflows.

eFiling with IRS, SSA, and CFSF

Tax1099 enables electronic filing (eFiling) directly with the IRS (Internal Revenue Service), SSA (Social Security Administration), and CFSF (Combined Federal/State Filing) agencies, ensuring compliance and timely submissions.

Smart eFiling with AI

Leveraging artificial intelligence (AI), Tax1099 offers smart eFiling capabilities, automating processes and enhancing accuracy while reducing manual intervention.

Corrected/Void Form eFiling

Users can easily file corrected or void forms electronically through the platform, simplifying the process of rectifying errors or outdated submissions.

Scheduled eFile

Tax1099 allows users to schedule their eFiling, ensuring timely submissions and providing flexibility in managing filing deadlines.

W-9/W-8 solicitation

The platform facilitates the collection of W-9 and W-8 forms electronically, streamlining the solicitation process for necessary taxpayer information.

Statement Delivery Electronically or via Print and Mail

Tax1099 offers the convenience of handling delivey form directly within the platform. Electronic form delivery consent can be collected and an easy parotal used by your recipients to retrieve their forms when needed. If the recipient does not opt into electronic delivery we have integrated printing and mailing forms directly from the platform, catering to users preferring traditional paper records.

Seamless Integration and Customization: Exploring Tax1099’s API Capabilities

Tax1099 API offers a robust set of features designed to enhance integration capabilities and streamline tax-related processes:

- W-9 Collection: Seamlessly collect W-9 forms via email or directly through your platform, simplifying the acquisition of essential taxpayer information.

- Real-Time TIN Check: Conduct real-time checks of Social Security Numbers (SSNs) and Employer Identification Numbers (EINs) paired with names directly within the IRS database, ensuring accuracy and validity.

- Tax-Exempt Check: Instantly verify if an organization is recognized by the IRS as tax-exempt, providing crucial information for compliance purposes.

- Real-Time Status: Access real-time status updates on W-9 form completion and checks through endpoints and webhooks, allowing for efficient monitoring and updates.

- Form Filing: Utilize the API to electronically file informational tax returns to both the IRS and various states, with the option for USPS mailings available.

- PDF Generation: Seamlessly generate PDF copies of filed forms and completed W-9 forms, allowing for convenient access and storage within your platform.

- Available Forms: The Tax1099 API supports a wide array of forms essential for tax filing, including 1099-MISC, 1099-NEC, 1099-K, 1042-S, 1099-INT, 1099-DIV, 1099-B, 1098, 1099-G, W-2, 940, 941, 1095-C, 1095-B, 1099-R, and 1099-S, catering to various tax reporting needs.

By leveraging Tax1099’s API features, businesses, and platforms can streamline processes, ensure accuracy, and facilitate seamless integration for efficient tax compliance and filing procedures.

Ensuring Trust and Compliance: Tax1099’s Robust Security and Compliance Standards

At Tax1099, your information’s security is our top priority. We ensure your data stays safe by using top-notch measures like strong encryption, high-end security standards, and annual third party audits to obtain both SOC2 type II certification as well as ISO27001 certification.

Our systems undergo regular checks to meet industry standards and keep your data protected. With advanced 256-bit bank-grade security and smart techniques like TIN masking, we make sure your and your recipients details are safe from unauthorized access.

Conclusion

Tax1099 is your ultimate partner in streamlining tax filing. With broad support for various IRS and state forms and robust security measures, we ensure a smooth and secure tax journey for you.

Ready to simplify your taxes? Trust Tax1099 for efficient filing and data security. Start your hassle-free tax season today!

Take charge of your taxes with Tax1099’s seamless solutions. Get started now!