The IRS has released its latest update to Publication 6961 is revised annually to update detailed calendar year projections of information and withholding documents to be filed at the U.S. and campus levels. Projections are also available by submission method. The projections incorporate the latest changes in legal, regulatory, administrative, and recent filing experiences.

Overview

Every year, the Research, Applied Analytics, and Statistics staff in the Statistics of Income (SOI) Division publish Calendar Year (CY) estimates of information and withholding papers to make sure they accurately reflect previous filing experiences. These publications also include pertinent economic and demographic trends, as well as current legislative and administrative initiatives, as applicable. IHS Markit provides a selection of the economic and demographic statistics that went into developing some of these estimates.

The Internal Revenue Service (IRS) operational and resource planning functions largely use the data and withholding document projections in this report to help them formulate their budget proposals, manpower requirements, and other studies. These forecasts take into account confirmed administrative plans and enacted tax legislation amendments.

Purpose: The IRS annually provides these projections to reflect current filing experiences and legislative initiatives, alongside economic and demographic trends.

Use: The projections in Publication 6961 showcase the operational planning, budgeting, and staffing. It allows the agency to adapt to changes in tax laws and administrative strategies.

Key Data Sources: The forecasts make use of numerous data sources, such as:

- Documents related to Information Returns Processing (IRP)

- Master Files for IRS and W-2 reports

- Many university resources, such as dedicated reports for currency transaction reports and returns of foreign information.

Major Highlights from the projections from CY 2023-2032

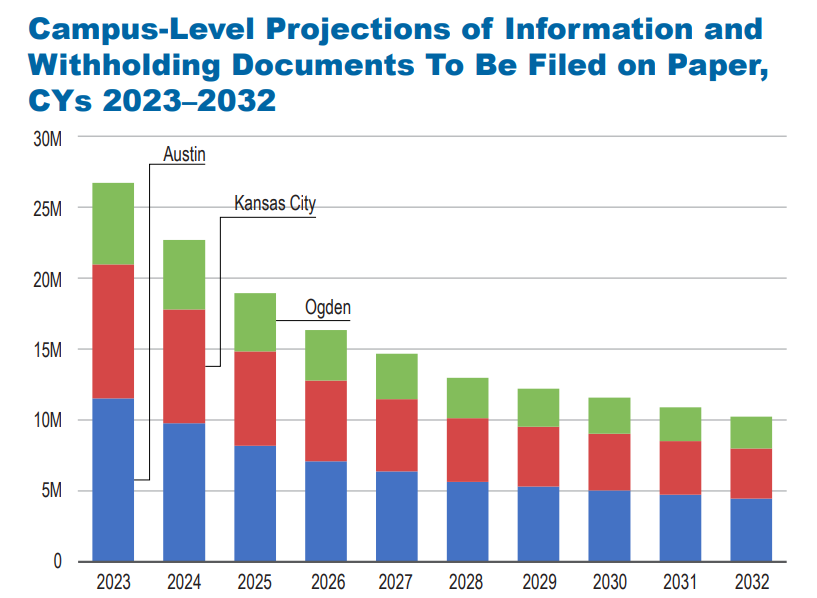

IRS Campus-Level Projections

The IRS continues to consolidate paper processing to fewer campuses—primarily in Austin, Kansas City, and Ogden—after halting operations at the Fresno campus in 2021. This consolidation aims to enhance efficiency and streamline processing capabilities.

- The grand total number of paper filings for the Austin campus in CY 2023 was 11.51 million documents. The corresponding number for the Kansas City campus was 9.56 million documents. The Ogden campus processed 5.76 million paper documents in CY 2023.

- The grand total number of paper information and withholding documents processed in CY 2023 was 26.72 million; it is projected to decrease to 22.69 million in CY 2024, then decrease to 10.22 million documents by CY 2032.

Figure: It’s a consolidated graph from table 5A to 5C of full report and the numbers of CY 2023 are actual filings.

SOURCE: IRS, Statistics of Income Division, Publication 6961, September 2024.

Projections by Form Type

Form 1099-K: Significant increase due to the lower reporting threshold, with an estimated 20 million additional forms by 2025.

Form 1099-INT: Increased filings are expected due to rising Federal Funds Rates, correlating with higher interest income.

Form 1098-E: An expected rise of 13 million returns is anticipated after the expiration of the student loan payment pause initiated under the CARES Act.

Paper vs. Nonpaper Filings

- Paper Filings: Expected to decline further as electronic filing mandates grow.

- Nonpaper Filings: Increasing significantly due to legislative pushes towards electronic submissions.

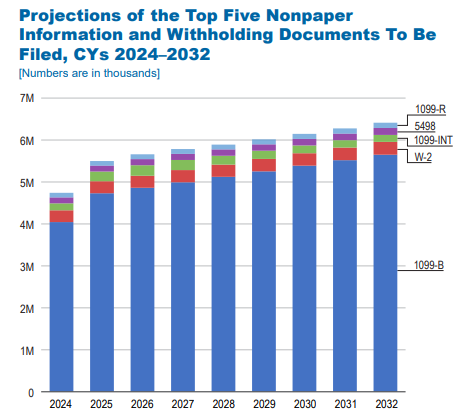

Figure: It’s a consolidated graph from table 4 of full report. The numbers of CY 2024 are actual filings.

SOURCE: IRS, Statistics of Income Division, Publication 6961, September 2024.

Key Highlights:

- Out of the 41 nonpaper information and withholding documents processed for CY 2023, the top 5 accounted for 88.19% of the total nonpaper documents processed.

- The grand total number of information and withholding documents processed in CY 2023 was 5.4 billion. The grand total after CY 2023 is projected to grow at an average annual rate of 3.58%, reaching 7.37 billion documents by CY 2032.

- The grand total number of information and withholding documents processed electronically was 5.37 billion in CY 2023. It is projected to grow at an average annual rate of 3.63%, reaching 7.36 billion documents by CY 2032.

Conclusion

The IRS Publication 6961 is a crucial document for tax professionals, businesses, and taxpayers, highlighting the evolving landscape of tax reporting and compliance. With significant increases projected for various forms, specially Form 1099-K, it’s vital to stay informed about these trends and prepare for their implications.

For more details, check: IRS Publication 6961 (2024 Update)