Preparing a 1042-S is challenging, and the stakes get even higher if there are incorrect filings, leading to penalties, fines, and unnecessary stress. Don’t worry! Today, we’ll tackle some of the most frequently asked questions about filing a 1042-S: What is Form 1042-S? What are the deadlines for filing a 1042-S? And are there any recent updates in the form? When should you file Form 1042-S? How and where to file 1042-S?

So, let’s quickly dive into this blog post where we have explained everything you need to know before filing Form 1042-S!

What is IRS Form 1042-S?

IRS Form 1042-S is an information return used to report income paid to foreign persons, including non-resident aliens, foreign corporations, foreign partnerships, foreign estates, and foreign trusts. It is designed to report various types of income, including wages, fellowships, royalties, and certain types of payments for services.

Here’s a list of income types (but not limited to) that reported in Form 1042-S:

- Salary

- Wages

- Rent

- Dividend

- Allowance

- Rewards

- Compensation

- Premiums

- Scholarships

- Grants

The primary purpose of Form 1042-S is to document and report income payments made to foreign persons subject to withholding to both the payee and the IRS under the Internal Revenue Code.

Who Needs to File 1042-S?

Form 1042-S must be filed by a withholding agent (US individual, business, or institution) who has paid income to a foreign person that is subject to income tax withholding, even if no amount is deducted and withheld from the income because of a treaty or code exception to taxation.

This form applies to all payments made to non-resident aliens subject to tax withholding, including foreign partnerships, corporations, trusts, as well as educational institutions in the US.

If your institution employs non-US citizens, it’s your duty to file on their behalf. This could include various roles such as cafeteria workers or college tutors, for instance. Additionally, a copy of Form 1042-S must be provided to the nonresident alien individual.

Form 1042 summarizes the information reported on a 1042-S, which is issued to students and employees. It details the withholding agent’s tax liability on the withheld or should-have-been-withheld taxes.

By filing Form 1042, you’re informing the IRS about the total cumulative amount of payments made to non-US individuals throughout the tax year.

Recent updates in the form 1042-S

- New Income Codes: For the 2023 tax year, Form 1042-S introduces two new income codes. Code 57 is for brokers to report withholding from transfers of PTP interests, while code 58 is for nominees to report PTP distribution income when its characterization is uncertain.

- Chapter 3 Status Code: A new status code 39, “Disclosing QI,” is added to Form 1042-S for payments made to Qualified Intermediaries (QIs) acting as disclosing QIs by brokers, PTPs, or nominees.

- Revised Reporting for Territory Financial Institutions: Reporting concerning territory financial institutions under Chapter 3 withholding has been revised. Status codes 03 and 04, as well as exemption code 09, have been removed for payments made to territory FIs treated as or not treated as U.S. persons.

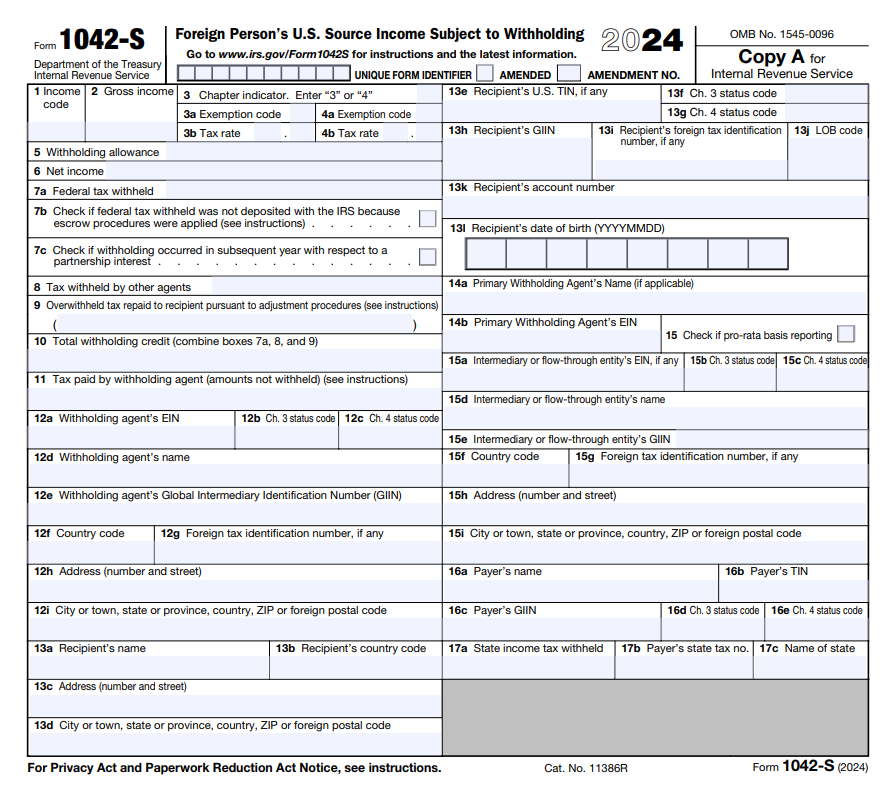

Information Reported on Form 1042-S

- Payers Details: Name, Address, Tax identification number (TIN), GIIN Number

- Recipient Information: Name, Address, Tax identification number (TIN), GIIN Number

- Income Information: This requires the income code that classifies the payment type.

- Withholding Information: This determines the amount of tax to be withheld from payments made to nonresident aliens.

- Withholding agent information: Name, EIN, GIIN

- Primary Withholding Agent information: Name (If applicable), EIN

- Intermediary or flow-through entity information: Name, GIN, EIN (if any)

- State Withholding Information

What is the difference between 1042 and 1042-S?

The primary distinction between Form 1042 and Form 1042-S lies in their purposes. Form 1042-S is employed for reporting payments made to foreign individuals, whereas Form 1042 focuses on determining the amount of tax to be withheld on specific income of nonresident aliens and other foreign individuals.

Form 1042: Annual Withholding Tax Return for U.S. Source Income of Foreign Persons.

Form 1042-S: Foreign Person’s U.S. Source Income Subject to Withholding.

| Form 1042-S | Form 1042 | |

| Who files the form? | Any US person, business, or institution that provides an income to non-citizen (the agent) | Any US person, business, or institution that provides an income to non-citizen (the agent) |

| What is reported? | Taxable revenues transferred to a foreign entity | The amount of tax deducted from taxable revenues transferred to foreign entities |

| When to file the report? | March 15, along with the annual Tax return | March 15, along with the annual Tax return |

| Where to file the report? | The IRS and the foreign entity receiving the revenues | Only to the I.R.S |

When, Where, and How to File IRS Form 1042-S?

Form 1042-S, whether submitted on paper or electronically, must be filed with the IRS and provided to the income recipient by March 15.

If March 15th falls on a Saturday, Sunday, or legal holiday in the District of Columbia or the filing location, the due date shifts to the next business day.

The threshold for eFiling Form 1042-S and other forms has been significantly reduced. Previously set at 250 or more returns, it has now dropped to just 10 or more returns. This change became effective for forms filed on or after January 1, 2024. Therefore, if you need to file 10 or more Form 1042-S, you are required to eFile them.

eFile Form 1042-S in minutes with Tax1099. We can also assist with the preparation and filing of Form 1042-S, offering features like scheduling the transmission date to the IRS and allowing for edits before the final submission.

Step 1: Create

Log in or sign up on Tax1099. Choose the tax year, select Form 1042-S, and proceed to the next step. Enter the payer’s and recipient’s details.

Tax1099 offers multiple options for data import:

- Add One at a Time: Follow simple prompts to add payers’ step by step.

- Upload Bulk Excel: Use our template to quickly add multiple payers.

- API Integration: Access full integration with any of your existing accounting software and import data.

Step 2: Verify

Review the entered details for accuracy. Utilize TIN matching, USPS Address validation, and other tools to ensure data correctness.

Step 3: Submit

Now, you are ready to efile your Form 1042-S with the IRS. After successful submission, download and deliver recipient copies via postal mail or through Tax1099’s IRS-compliant eDelivery.