The deadline for the 5498 Series forms is fast approaching.

Need to file one? Now is the time to get started and file form 5498.

What is Form 5498?

Form 5498: IRA Contributions Information is an IRS tax form used to report contributions made to Individual Retirement Accounts (IRAs), including Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. It is filed by financial institutions, such as banks or brokerage firms, to report these contributions to the IRS.

What is the purpose of form 5498?

IRS Form 5498 is used to inform the IRS of money transferred into retirement investment vehicles by taxpayers. It provides a baseline for later reporting of distributions from those retirement plans on form 1099-R.

- Reporting Contributions:

Contributions to all types of IRAs including Traditional Roth, SIMPLE, SEP, and other forms of retirement accounts all require the filing of Form 5498.

- Track Rollovers and Conversions:

It facilitates the monitoring of rollovers and conversions between various retirement accounts, including 401(k) rollovers from employer-sponsored plans to individual retirement accounts (IRAs).

- Providing Fair Market Values (FMV):

To help with calculating taxable distributions and required minimum distributions (RMDs), the form provides the retirement account’s fair market value (FMV) as of the end of the tax year.

- Ensuring Compliance:

Form 5498 assists in ensuring compliance with tax laws and regulations pertaining to retirement savings by requiring financial institutions to report retirement account activities to the IRS and taxpayers.

- Verification of Contributions:

By enabling the IRS to confirm that people are funding their retirement accounts within the permitted amounts, it helps to avoid overfunding accounts and the potential for tax penalties.

- Documentation for Taxpayers:

Form 5498 is used by taxpayers as documentation, allowing them to ensure accuracy in tax filings by balancing their own records with those of financial institutions.

- Facilitating Retirement Planning:

Form 5498 assists taxpayers in making well-informed decisions about their savings plans and in effectively planning for retirement by giving clear information on retirement account activity.

Deadline to file 5498 Tax Forms

The deadline for filing 5498 tax forms to the IRS is May 31, 2024. This is the deadline for account trustees to file with the IRS and distribute copies to the account holders.

| Filing Type | Due Date |

| Recipient Copy: (Only for FMV & RMD) by | Jan 31, 2024 |

| Recipient Copy:(Other types of IRAs) by | May 31, 2024 |

| IRS eFile | May 31, 2024 |

| IRS Paper Filing | May 31, 2024 |

It’s important to remember that starting January 1, 2024, the IRS has lowered the e-file threshold from 250 to 10. Therefore, businesses filing over 10 forms are required to file electronically. You can easily file your 5498 Forms with Tax1099, an IRS-authorized platform, within minutes and transmit your form to the IRS.

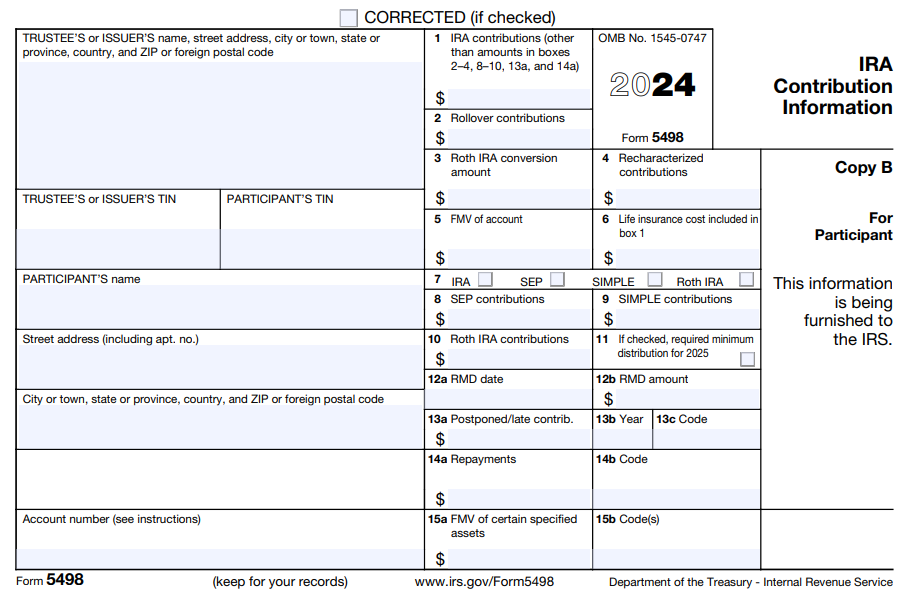

Information Required on Form 5498

File form 5498 for the following types of IRAs:

- Traditional IRAs

- ROTH IRAs

- SIMPLE IRAs

- SEP IRAs

While 5498 forms are used to report information about different types of accounts, there is general information that is required to file any of these forms. Some of this information includes:

Trustees or Issuers’ Details: Name, TIN, Address, and Contact information

Participant’s Details: Name, TIN, Address, and Contact information

Financial Activities & Information Reported on Form 5498:

- Rollovers

- Contributions

- Fair Market Value of the account

- Recharacterizations

- Changes to the Conversion Rate for ROTH IRAs

How to e-File 5498 for the Year 2023?

Collect all the necessary information regarding the contributions made to IRAs (Individual Retirement Accounts) that you manage. This includes details such as the account holder’s name, account number, contribution amounts, and the type of IRA (traditional, Roth, SEP, SIMPLE). The IRS encourages electronic filing of Form 5498. You can e-File Form 5498 Online for the year 2023 using Tax1099, your go-to source for 5498 filings.

Register/Login to Tax1099: If you haven’t already, register an account on Tax1099. If you’re a returning user, log in to your account.

Enter 5498 Information: Once logged in, enter the collected information accurately into the provided fields. This includes details such as the account holder’s name, account number, contribution amounts, and IRA type.

Before submission, thoroughly review all entered information to ensure accuracy. Mistakes could lead to penalties or processing delays.

Submit Form to IRS: After verifying the information, submit Form 5498 through Tax1099’s platform. Follow the prompts to complete the submission process.

After successful submission, furnish a copy of form 5498 to each IRA account holder by May 31, 2024. And don’t forget to keep the copies of all filed 5498 for your records.

Don’t wait for the deadline e-File Now!