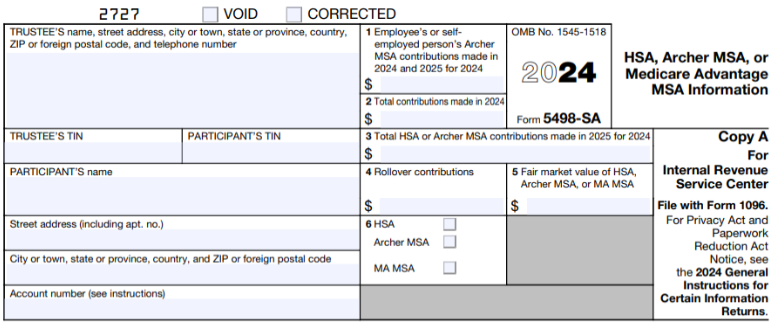

Form 5498-SA is a report of contributions to Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), and Medicare Advantage MSAs (MA MSAs). It gives details on contributions made during the tax year and is usually filed by the trustee or custodian of these accounts. Individuals who made contributions to these accounts are recipients of Form 5498-SA. However, they do not have to file the form along with their tax return; instead, they document the contributions on Form 8889 when they file their tax return.

How is Form 5498-SA different from Form 5498?

Both IRS Form 5498 and Form 5498-SA have different uses and report different kinds of contributions:

Form 5498:

It is used to cover retirement investments. Contributions to Individual Retirement Arrangements (IRAs), such as Traditional IRAs, Roth IRAs, SIMPLE IRAs, and SEP IRAs, are reported on Form 5498. It contains details on the contributions made to these accounts during the tax year, rollovers, conversions, and the account’s fair market value.

Form 5498-SA:

Used to cover money put aside for future healthcare expenses. This form reports donations made to Medicare Advantage MSAs (MA MSAs), Archer Medical Savings Accounts (MSAs), and Health Savings Accounts (HSAs). It gives information about the contributions made to these accounts during the tax year, including the employer’s and the account holder’s contributions.

In a nutshell, while both forms report contributions to tax-advantaged accounts, Form 5498 is for retirement accounts (IRAs), while Form 5498-SA is for medical savings accounts (HSAs, MSAs, and MA MSAs).

Form 5498-SA Instructions

5498-SA Filing Deadline

If you are the trustee or custodian (of an HSA, Archer MSA, or MA MSA), you must file Form 5498-SA with the IRS on or before June 2, 2025, for each person for whom you maintained a health savings account (HSA), Archer MSA, or Medicare Advantage MSA (MA MSA) during 2024.

Contributions and Designations:

Obtain the participant’s designation of the year for which HSA or Archer MSA contributions made between January 1, 2025, and April 15, 2025, are intended.

Reporting Rollovers:

Report the receipt of rollovers from one Archer MSA to another or from an Archer MSA or an HSA to an HSA in Box 4.

Transfers:

Do not report trustee-to-trustee transfers between similar accounts. Contributions and rollovers do not include these transfers.

Total Distribution, No Contributions:

Generally, if a total distribution was made from an account during the year and no contributions were made for that year, you need not file the Form.

Death of Account Holder:

In the year an account holder dies, file Form 5498-SA and furnish a statement for the decedent. Different rules apply if the surviving spouse is the designated beneficiary.

Statements to Participants:

Provide a statement to the participant by June 2, 2025, and optionally furnish a statement of the December 31, 2024, FMV of the participant’s account by January 31, 2025.

Truncating Participant’s TIN:

Filers may truncate a participant’s TIN on payee statements, but not on documents filed with the IRS.

Account Number:

Include an account number if filing multiple Forms for a recipient.

How to file Form 5498-SA?

To complete Form 5498-SA, trustees follow IRS instructions:

- Provide trustee and participant details.

- Record employee or self-employed contributions to an Archer MSA in box 1.

- Fill boxes 2* and 3 with total Archer MSA or HSA contributions for specified years.

- Report rollover contributions to an HSA or Archer MSA in box 4.

- State the fair market value of the HSA, Archer MSA, or MA MSA in box 5.

- Tick the appropriate account type (HSA, Archer MSA, or MA MSA) in box 6.

You can eFile Form 5498-SA Online for the year 2023 using Tax1099, go-to source for your 5498 filings.

Step 1: Register/Login to Tax1099

If you haven’t already, register an account on Tax1099. If you’re a returning user, log in to your account.

Step 2: Enter 5498 Information

Once logged in, enter the collected information accurately into the provided fields. This includes details such as the account holder’s name, account number, contribution amounts, and IRA type.

Before submission, thoroughly review all entered information to ensure accuracy. Mistakes could lead to penalties or processing delays.

Step 3: Submit Form to IRS

After verifying the information, submit Form 5498 through Tax1099’s platform. Follow the prompts to complete the submission process.

Don’t wait for the deadline eFile Now!