Important Update: Under the new rule, FinCEN has revised the definition of a "reporting company" to include only foreign entities.

As a result, domestic companies are no longer required to report BOI to FinCEN.Learn More

Save 75% on Vendor Payment Costs – Join our webinar and get 1 month free trial!

Important Update: Under the new rule, FinCEN has revised the definition of a "reporting company" to include only foreign entities.

As a result, domestic companies are no longer required to report BOI to FinCEN.Learn More

Our solution is tailored for every entity, including business owners, legal and accounting professionals, and small and medium businesses.

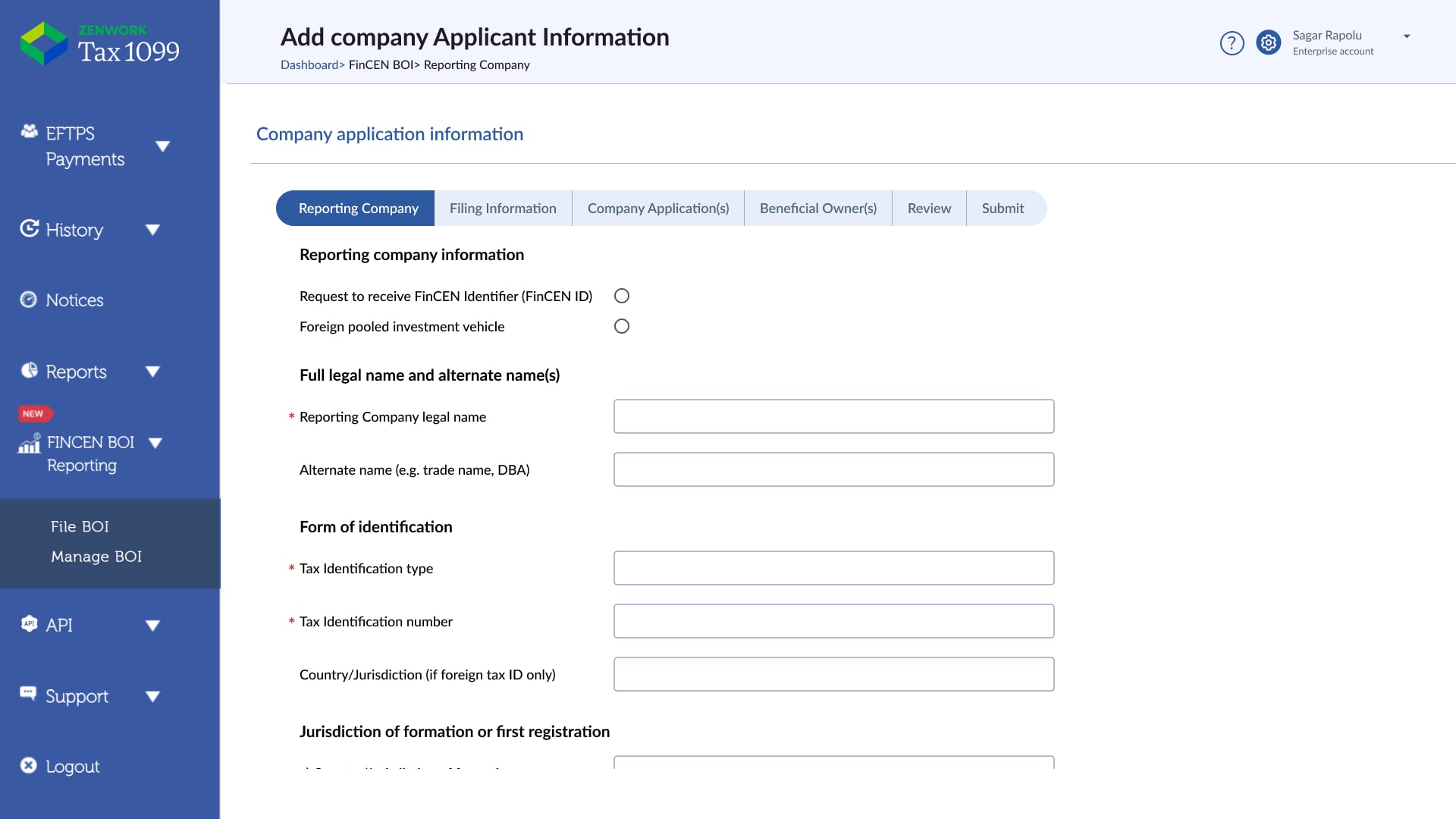

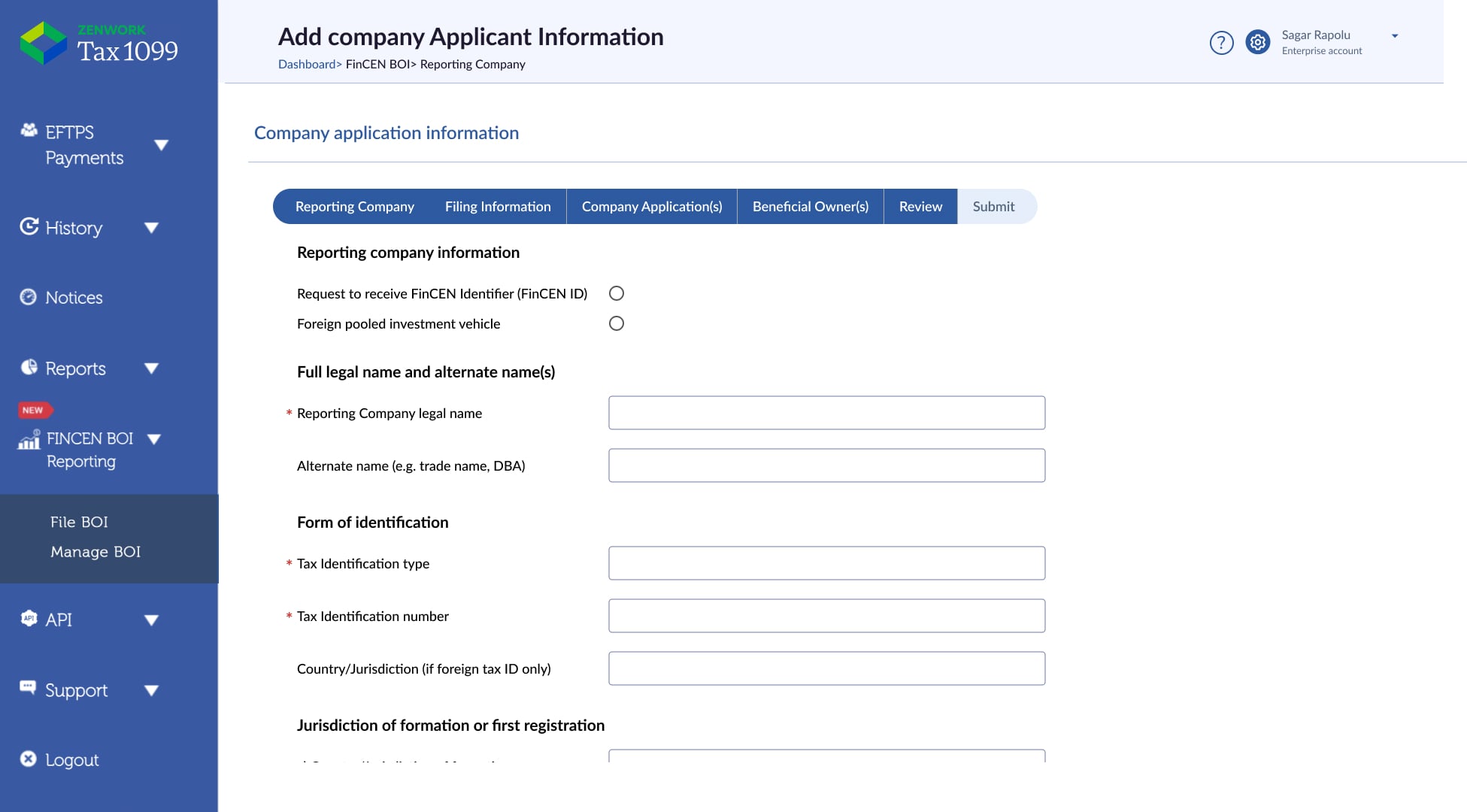

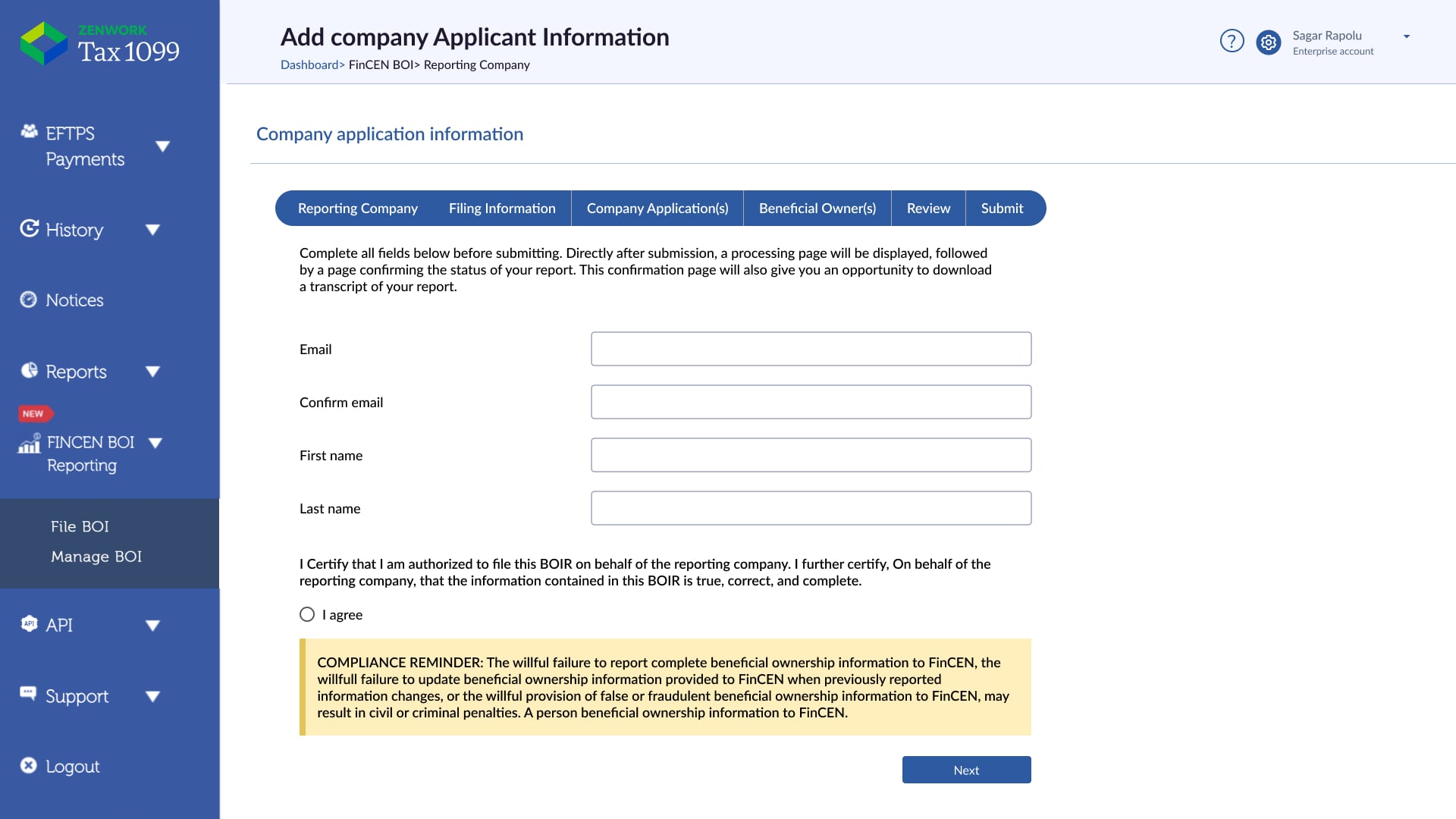

Go to Tax1099’s dashboard, select BOI Reporting, and click on file BOI.

No credit card required

| EIN | Fee per EIN | Lifetime Subscription Fee per EIN |

|---|---|---|

| up to 100 | $45.00 | $175.00 |

| 101-250 | $40.00 | $150.00 |

| 251+ | $35.00 | $120.00 |

* Exclusive of Govt. fee, if any.

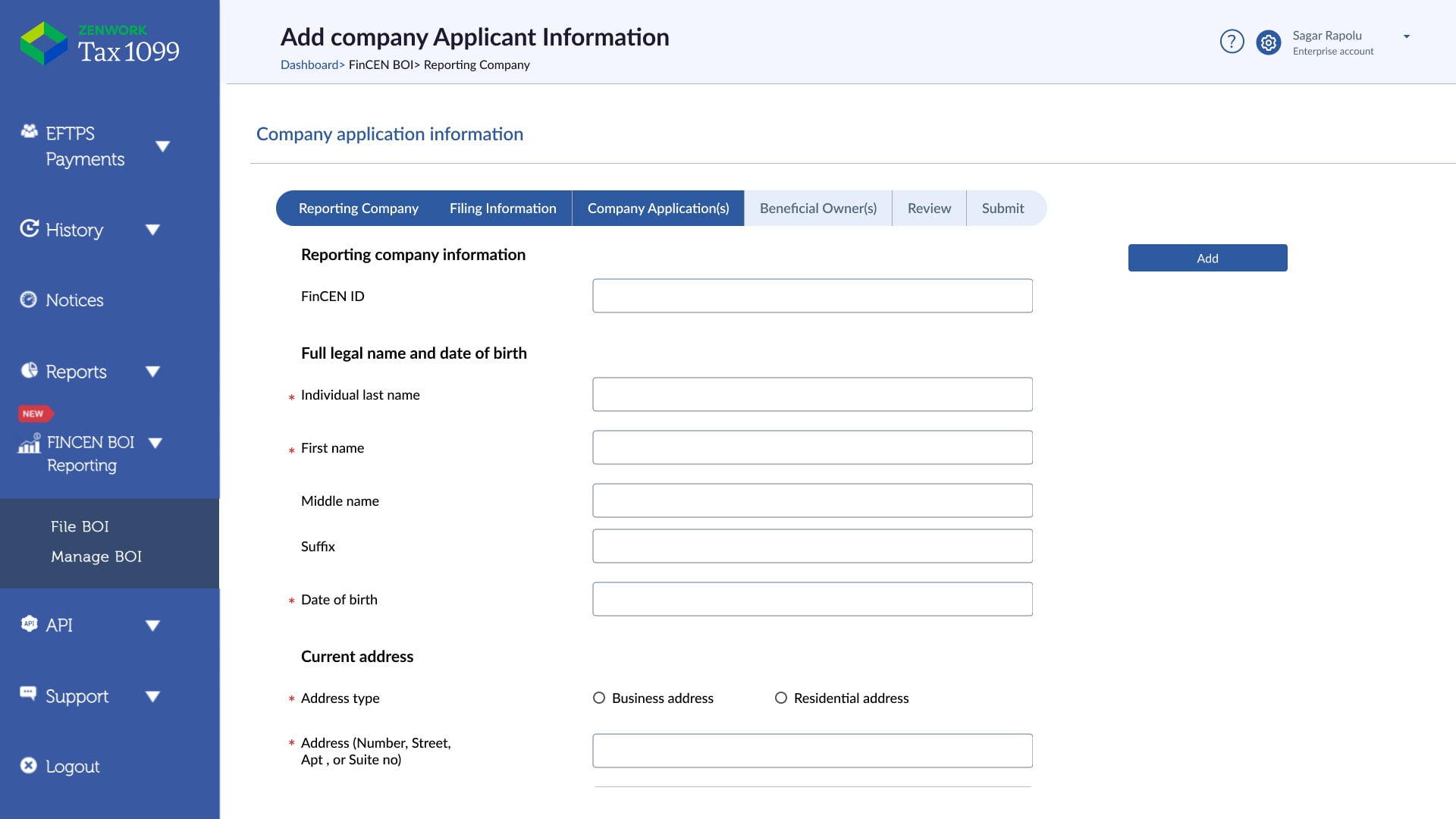

With Tax1099, you can quickly send “request info” links to your beneficial owners via email, leading them to provide all the necessary details.

The fast and automated bulk importing process of Beneficial Owners’ data entry can save you hours on each filing.

You can have a collective view of your filings at one place. Easily track the status of each report, identify those in progress or those successfully filed.

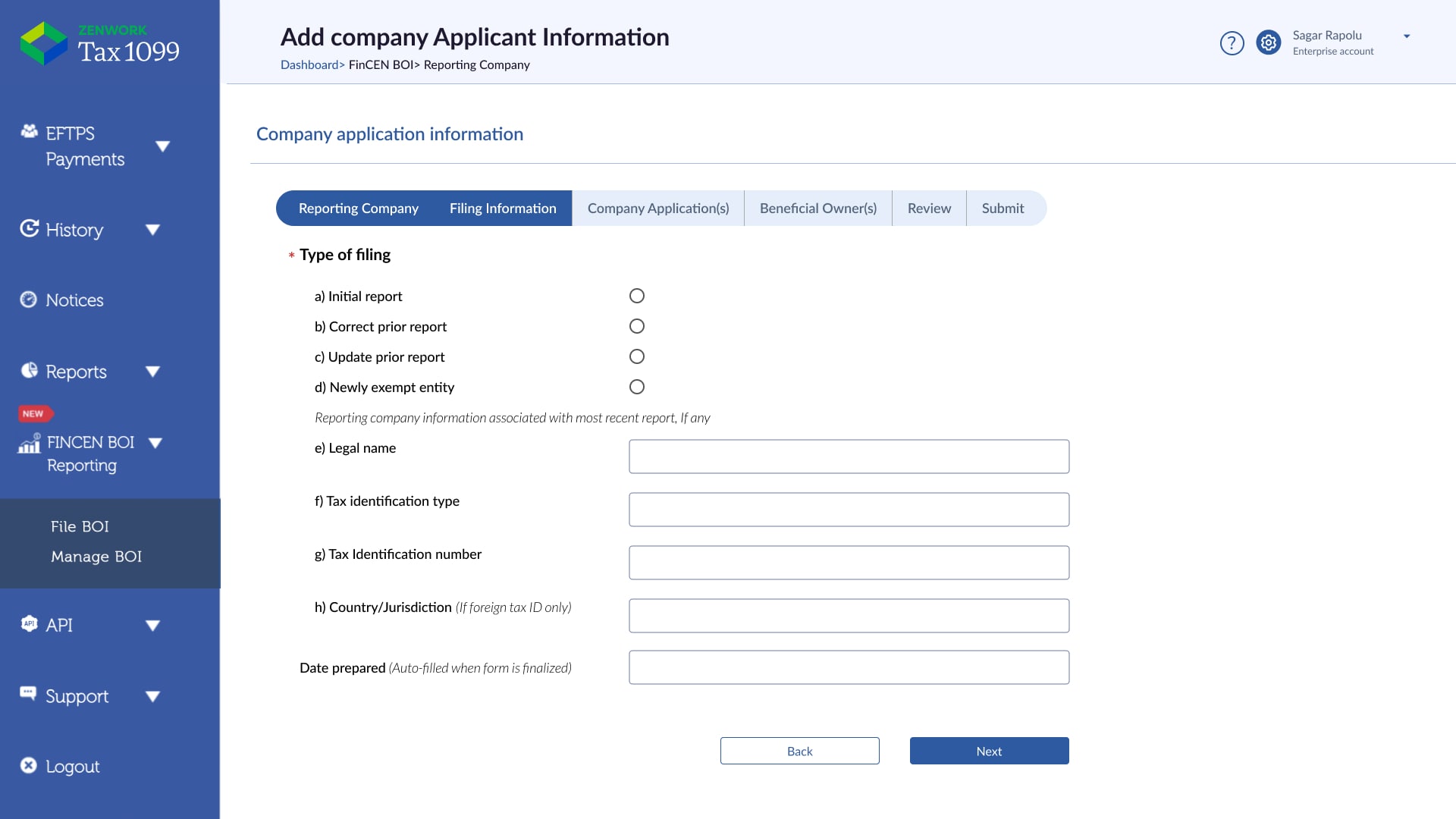

Effortlessly generate and submit both Initial and Updated BOI Reports. If changes are needed, you can also file a Corrected BOI Report with Tax1099.

When it comes to your filing records, make sure to keep them safe. Tax1099 allows you to store and access all prior filings from one location for up to 3 years.

A BOI (Beneficial Ownership Information) Report is a document that identifies the individuals who directly or indirectly own, control, or benefit from a company. This report helps ensure transparency and compliance with federal regulations, aiming to prevent financial crimes like money laundering and tax evasion.

Effective January 1, 2024, many companies in the United States must report information about their beneficial owners—the individuals who ultimately own or control the company—to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

The BOI report must be filed by certain entities known as “reporting companies.” These include:

Reporting companies may have to obtain information from their beneficial owners and report that information to FinCEN. If you are wondering whether you are eligible to file BOI reports, try this quiz to know.

Members, or owners, of a limited liability company (LLC) are likely the beneficial owners under the new BOI rule. This makes LLCs as reporting companies that need to file a new report with the federal agency and provide basic contact information about the company and its owners. This requirement applies to single-member and multi-member LLCs, all of which are considered reporting companies, and therefore also would need to identify beneficial ownership information in the BOIR.

All businesses that fall under the definition of a reporting company must file a beneficial ownership information report (BOIR) with the Financial Crimes Enforcement Network (FinCEN). Tax1099 helps you file BOI Reports

There are 23 types of entities that are exempt from the beneficial ownership information reporting requirements. These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

BOI reporting requirements are on hold for members of the National Small Business Association and an Alabama businessman, who won a summary judgment in March in their lawsuit over the CTA.