File 1099-Misc online

Why File Form 1099-Misc online with Tax1099?

- TIN-Matching against IRS database

- We support other 1099 forms - 1099-NEC, 1099-K, 1099-B, 1099-R etc.

- 24*7 Live Customer Support Available

- Bulk Upload data for faster submissions

eFiling starts at $0.65/form

Overview

Filing the form 1099-MISC online is the quickest and most efficient way to report non-employee compensation and other income. With our eFiling services, you can easily submit your forms, access IRS-approved digital copies, and receive timely confirmation, ensuring compliance and never missing deadlines. Streamline your tax reporting process today with our user-friendly platform, designed to save you time and minimize errors.

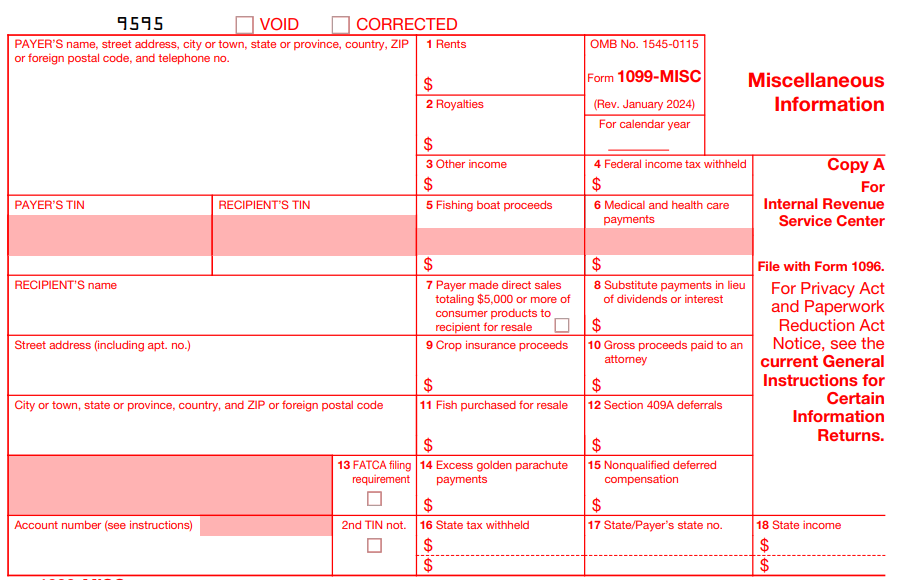

Form 1099-Misc requirements

- Payer Details: Name, EIN, and Address

- Recipient Details: Name, EIN/Social Security, and Address

- Federal Details: Miscellaneous Incomes and Federal Tax Withheld

- State Filing Details: State Income, Payer State Number, and State Tax Withheld

Who is required to file a 1099-Misc?

File Form 1099-MISC with the IRS if you’ve made payments meeting specific criteria to non-employee individuals during the year. This includes:

- Payments of $10 or more in royalties or broker payments (instead of dividends or tax-exempt interest).

- Payments of $600 or more for:

- Rents

- Prizes and awards

- Other income payments

- Medical and health care payments

- Payments to an attorney

- Crop insurance proceeds

- Cash payments from a notional principal contract to an individual, partnership, or estate

- Any fishing boat proceeds

- Section 409A deferrals

- Nonqualified deferred compensation

Additionally, you must use Form 1099-MISC to report payments made for direct sales exceeding $5,000 of consumer products for resale outside permanent retail establishments, regardless of the payment amount. Even if the payment is less than $600, if federal income tax was withheld under backup withholding, you must report it using Form 1099-MISC. Stay compliant with these filing requirements.

Why use Tax1099 to file your 1099-Misc forms online?

Discover the features and integrations that only Tax1099 can offer you to file your 1099-Misc forms online easily: Tax1099 is an award-winning IRS-authorized eFiling platform trusted by over 150,000 businesses.

With Tax1099, you can enjoy the following features

State File Compliance

Ensures adherence to state-specific tax regulations and reporting requirements, optimizing tax submissions for various jurisdictions.

USPS Address Validation

Utilizes the United States Postal Service (USPS) database to verify and standardize addresses, reducing errors and ensuring accurate delivery of tax documents.

Notice Management

Streamlines the handling of IRS and state tax agency notices, providing automated tracking and response features for efficient resolution.

TIN Check Service

Offers a Taxpayer Identification Number (TIN) verification system, validating TIN accuracy and preventing errors in tax submissions.

Integrations

QuickBooks Integration

Seamlessly sync and organize financial data, simplifying bookkeeping and ensuring accurate tax filings.

Xero Integration

Streamline financial management, enabling easy access to real-time data for efficient tax compliance and reporting.

Tipalti Integration

Automate global payment operations, reducing manual tasks and enhancing compliance, ultimately facilitating smoother tax processes.

Custom Suite Integration

Harness a comprehensive suite of accounting tools for an all-in-one solution, simplifying financial record-keeping and tax preparation.