Zenwork Payments helps banks and financial institutions handle vendor payments while ensuring regulatory compliance. Process ACH, wire, and check transactions while automating tax reporting all within a secure platform.

Get Started NowManaging payments for independent contractors can come with a set of distinct challenges

Banks must follow strict IRS regulations, including TIN Matching and 1099 reporting. Automating these processes helps institutions meet compliance requirements while reducing tax reporting errors.

Unauthorized transactions and fraud remain major concerns in banking. Zenwork Payments offers TIN Matching and bank-grade encryption to support secure vendor payments.

Manual vendor onboarding is time-consuming and increases the risk of errors. Zenwork Payments provides a self-service portal for W-8/W-9 collection, allowing banks to verify vendor details more efficiently.

Banks rely on ACH, and check processing for vendor payments. Zenwork Payments helps automate these transactions, reducing manual input and improving processing accuracy.

Unlock Faster and More Accurate AP Transactions

Banks must meet strict regulatory requirements when processing vendor payments. Zenwork Payments automates 1099 reporting and W-8/W-9 form collection, reducing administrative workload and ensuring accuracy. Real-time TIN Matching verifies vendor details, minimizing errors and supporting compliance with IRS regulations.

Handling vendor payments across multiple methods can be complex. Zenwork Payments enables banks to process ACH transfers, wire transactions, and checks within a single system. Automated payment processing reduces errors, eliminates manual reconciliations, and ensures transactions comply with banking regulations.

Ensuring proper authorization for vendor payments is essential in banking. Zenwork Payments provides custom approval workflows that align with internal compliance policies, allowing financial teams to track transactions, improve visibility, and maintain control over payment approvals.

Data protection is a top priority for banks handling sensitive financial transactions. Zenwork Payments secures payments with bank-grade encryption, multi-factor authentication, and fraud monitoring, reducing risks associated with unauthorized transactions and maintaining compliance with industry security standards.

Essential statistics on banking transactions and compliance

trillion in B2B payments flow through financial institutions each year.

of banks list compliance as a top challenge in digital payment processing.

of financial institutions have introduced automation to improve security and payment accuracy.

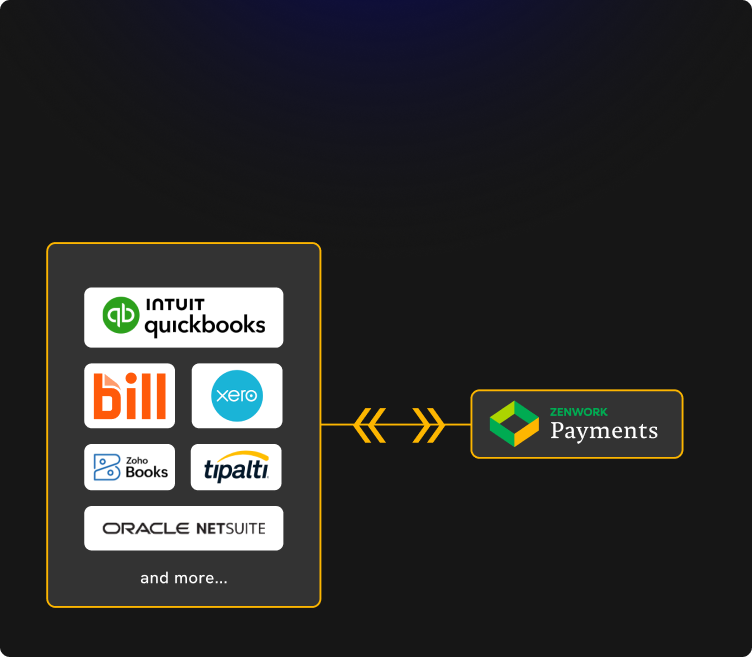

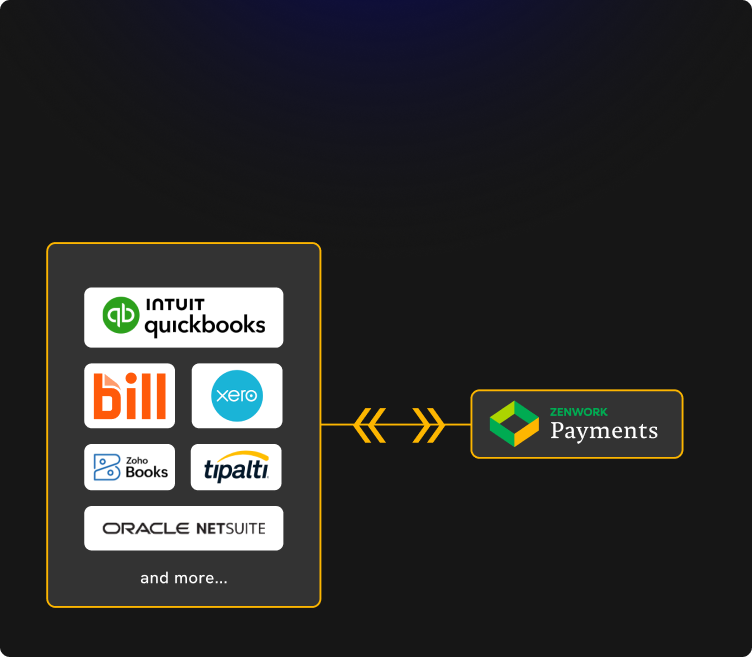

Zenwork Payments integrates with widely used banking and financial software, allowing institutions to improve payment workflows

Zenwork Payments automates TIN Matching, 1099 reporting, and vendor verification, helping banks meet IRS regulations.

The platform processes ACH transfers, wire payments, and checks, allowing banks to manage vendor transactions more efficiently.

We use real-time identity verification, multi-factor authentication, and transaction monitoring to improve security and reduce risks.

Yes, Zenwork Payments connects with Xero, QuickBooks, and enterprise banking APIs to support banking workflows.

Zenwork Payments provides data encryption, access controls, and compliance tracking to protect transactions and vendor records.

Our self-service vendor portal allows vendors to submit W-8/W-9 forms for verification, reducing onboarding time and errors.

Click to see how Zenwork Payments can help banks manage vendor payments more securely.