Effortlessly onboard vendors and contractors with our intuitive and secure onboarding process.

Highlights

- Easy Setup: Invite vendors to submit W-9 forms and bank details through a secure portal.

- Automated Data Capture: Use OCR technology to extract and validate information.

- Compliance Checks: Ensure all necessary compliance documents are collected and verified.

Benefits

- Reduce manual data entry

- Ensure regulatory compliance

- Speed up the onboarding process

Generate, approve, and manage bills with ease, ensuring timely and accurate payments.

Highlights

- Invoice Automation: Automatically capture invoices from emails, uploads, or mobile app.

- Approval Workflows: Customize approval workflows to match your business processes.

- Recurring Bills: Set up and manage recurring bills effortlessly.

Benefits

- Minimize manual errors

- Enhance approval efficiency

- Ensure timely bill payments

Choose from multiple payment methods to suit your business needs and preferences.

Highlights

- ACH Payments: Secure and efficient ACH payments for vendors.

- Check Payments: Manage and issue check payments seamlessly.

- Card Payments: Enable quick and convenient card payments.

Benefits

- Flexible payment options for vendors

- Streamlined payment processing

- Secure and compliant transactions

Optimize your approval process with customizable workflows that adapt to your business needs.

Highlights

- Tailored Workflows: Design approval workflows that align with your specific business processes.

- Automated Routing: Automatically route approval requests to the right team.

- Real-Time Notifications: Keep all stakeholders informed with real-time notifications.

Benefits

- Streamline the approval process

- Streamline the approval process

- Increase accountability and transparency

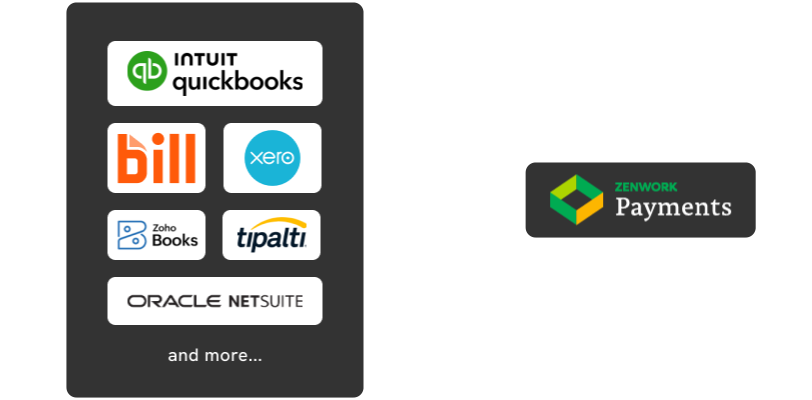

Seamlessly sync data between Zenwork Payments and your accounting software to maintain consistency and accuracy.

Highlights

- Real-Time Sync: Ensure that all vendor information, invoices, and payments are updated instantly.

- Two-way Data Flow: Ensures consistency across platforms.

- Easy Integration: Compatible with major accounting software like QuickBooks, Bill, Xero, Zoho, and Oracle NetSuite.

Benefits

- Eliminate data entry duplication

- Maintain up-to-date financial records

- Enhance accuracy and reduce errors

Empower your vendors with a dedicated portal for managing their profiles and transactions.

Highlights

- Profile Management: Vendors can update their information and compliance documents.

- Payment Tracking: Vendors can view payment statuses and history.

- Communication Hub: Centralized platform for communication and updates.

Benefits

- Enhance vendor relationships

- Provide transparency and trust

- Streamline vendor management

Ensure your payments are always compliant with tax regulations using our integrated tax compliance features.

Highlights

- 1099 Filing: Automate the preparation and filing of 1099 forms.

- TIN Verification: Verify Tax Identification Numbers to prevent errors.

- EFTPS Integration: Make secure federal tax payments through EFTPS.

Benefits

- Reduce compliance risks

- Automate tax reporting

- Ensure accurate tax submissions

Manage your AR efficiently with automated invoicing and payment tracking.

Highlights

- Automated Invoicing: Generate and send invoices automatically.

- Payment Tracking: Monitor payment statuses and follow up on overdue invoices.

- Payment Reminders: Set up automated payment reminders to clients.

Benefits

- Speed up cash collection

- Reduce overdue invoices

- Improve cash flow management