Home » What is Discounted Cash Flow (DCF)? – Explained with Formula and Examples

What is Discounted Cash Flow (DCF)? – Explained with Formula and Examples

Have you ever wondered how large corporations evaluate acquisitions or new equipment purchases? Or how investors assess whether a stock is undervalued? The answer often lies in a valuation method called Discounted Cash Flow (DCF).

While the term may sound complex, finance professionals frequently simplify it for teams and stakeholders. By breaking down the mechanics, even beginners can grasp its core principles. This article will explore what DCF is, how it works, and why it’s a cornerstone of financial decision-making.

What is Discounted Cash Flow (DCF)?

DCF operates on a fundamental truth: A dollar today holds more value than a dollar received in the future. Why? Because money available now can be invested to generate returns over time. This concept, known as the time value of money, is the backbone of DCF analysis.

DCF quantifies the present value of future cash flows. Companies use it to assess investment viability, while investors apply it to determine if an asset’s market price aligns with its intrinsic value. According to a PwC, 78% of financial analysts rely on DCF as their primary valuation tool for investment decisions—a testament to its real-world relevance.

For example, when a company considers purchasing new machinery or acquiring another business, DCF helps determine whether the investment will generate sufficient returns to justify the cost. Similarly, investors use DCF to evaluate whether a stock is overpriced or undervalued based on the company’s projected cash flows.

Key Components of DCF Analysis

Four elements form the foundation of DCF:

- Cash Flows: These are the expected future inflows and outflows of cash. For businesses, this could include revenue from sales, cost savings from efficiency improvements, or expenses related to the investment.

- Forecast Period: This is the timeline over which cash flows are projected. Most analyses use a 5–10 year horizon, as predicting cash flows beyond this period becomes increasingly speculative.

- Discount Rate: This percentage reflects the risk associated with the investment and the time value of money. A higher discount rate is used for riskier investments to account for uncertainty.

- Terminal Value: This represents the investment’s estimated worth beyond the forecast period. It’s often calculated using the perpetuity growth method or exit multiple approach.

Consider a real-world application: A manufacturing firm once debated purchasing a $2 million machine. Despite extensive data, the decision stalled until a DCF analysis revealed a $2.7 million present value. The investment proceeded, boosting production by 35% and validating the methodology.

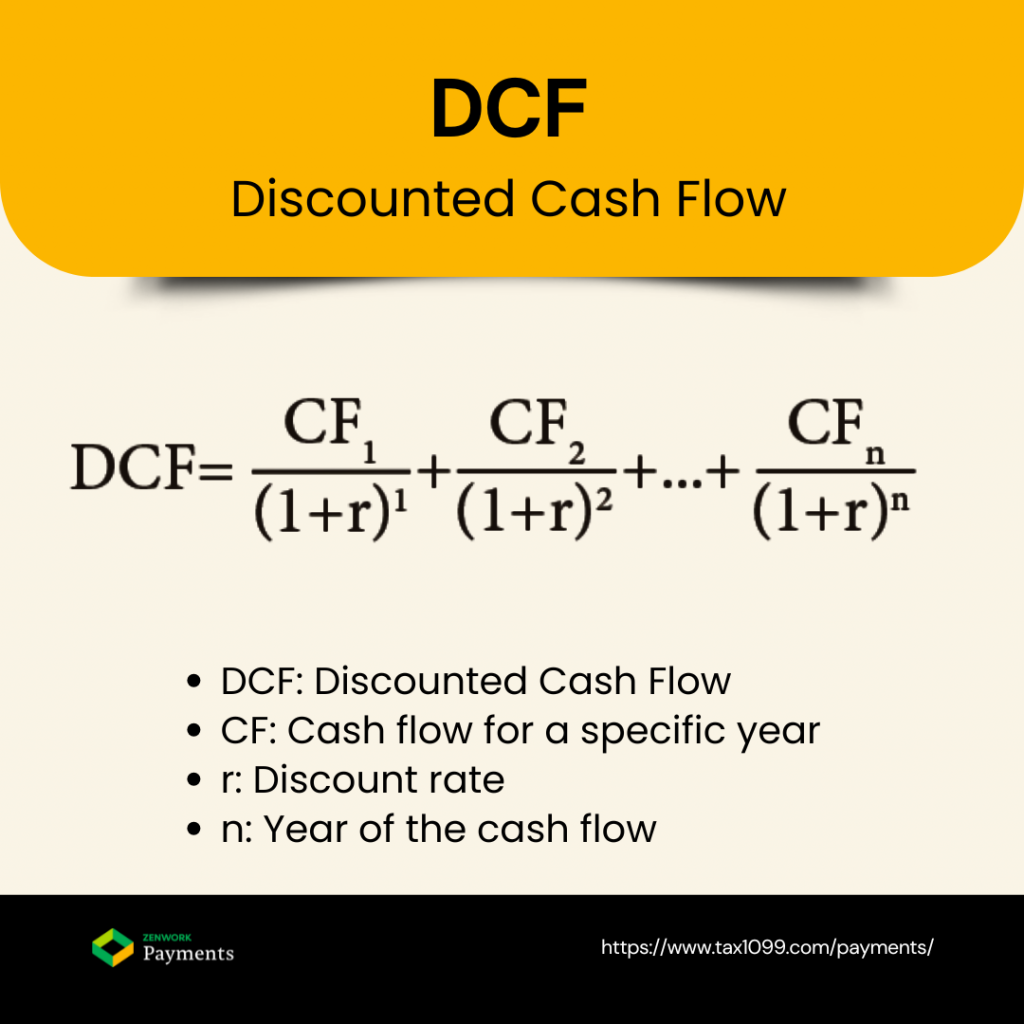

The DCF Formula Explained

The DCF formula is:

DCF = CF₁/(1+r)¹ + CF₂/(1+r)² + … + CFₙ/(1+r)ⁿ

Breaking it down:

- CF: Cash flow for a specific year

- r: Discount rate

- n: Year of the cash flow

For example, $1,000 expected in one year with a 10% discount rate calculates as:

$1,000 ÷ (1 + 0.10)¹ = $909.09

This means $1,000 in the future equates to approximately $909 today.

The formula discounts each year’s cash flow individually, reflecting the diminishing value of money over time. By summing these discounted values, the total present value of the investment is determined.

Step-by-Step DCF Calculation Process

- Forecast Cash Flows: Project future income and expenses realistically. For example, if a company is considering a new product line, it would estimate sales revenue, production costs, and operating expenses over the forecast period.

- Select a Discount Rate: This is often based on the company’s weighted average cost of capital (WACC), typically ranging from 8–15%. The discount rate accounts for the risk of the investment and the opportunity cost of capital.

- Calculate Present Values: Discount each year’s cash flow individually using the DCF formula.

- Determine Terminal Value: Estimate the investment’s value beyond the forecast period using methods like the Gordon Growth Model or exit multiples.

- Sum the Values: Add the present value of cash flows and the terminal value to arrive at the total DCF value.

Financial teams often struggle with over-engineering forecasts. Experts recommend starting with conservative estimates and refining as data evolves. For instance, a retail company might initially project modest sales growth for a new store but adjust forecasts upward if early performance exceeds expectations.

Comprehensive DCF Example: Corporate Investment Project

Imagine a company evaluating a $500,000 software system to automate invoicing. Projected annual savings are:

- Year 1: $150,000

- Year 2: $175,000

- Year 3–5: $200,000 annually

Using a 10% discount rate:

- Year 1: $150,000 ÷ 1.10 = $136,364

- Year 2: $175,000 ÷ (1.10)² = $144,628

- Year 3: $200,000 ÷ (1.10)³ = $150,263

- Year 4: $200,000 ÷ (1.10)⁴ = $136,603

- Year 5: $200,000 ÷ (1.10)⁵ = $124,184

Total present value = $692,042. Subtracting the $500,000 cost yields a $192,042 net present value (NPV), signalling a profitable investment.

This example illustrates how DCF helps quantify the financial benefits of an investment, enabling data-driven decision-making.

DCF in Business Valuation: M&A Example

DCF isn’t limited to capital expenditures. In mergers and acquisitions, it’s equally critical. A distribution company once evaluated acquiring a competitor with $2 million annual earnings and 5% growth. Using a 12% discount rate over 10 years, the target’s value was estimated at $16.8 million.

Though the asking price was $15 million, the DCF model highlighted risks: If growth fell to 3%, value would drop to $14.2 million. This insight facilitated negotiations, incorporating performance-based terms to mitigate risk.

DCF vs. Net Present Value (NPV): Understanding the Relationship

Though often conflated, DCF and NPV differ:

- DCF: The method of discounting future cash flows.

- NPV: The result (present value minus initial investment).

In the software example, DCF produced a $692,042 present value. NPV, the profitability metric, was $192,042. Positive NPV indicates value creation.

Implementing DCF in Financial Software and Tools

Modern tools streamline DCF calculations:

- Excel: Functions like NPV() and XIRR() automate computations.

- ERP systems: Many integrate DCF modules for real-time modeling.

- AP platforms: Some include built-in ROI calculators using DCF logic.

One AP manager leveraged their software’s DCF tool to visualize cash flows, successfully justifying a system purchase to executives.

Advantages of DCF Analysis

DCF remains popular because it:

- Prioritizes actual cash flows over accounting profits.

- Incorporates the time value of money.

- Enables apples-to-apples comparison of disparate investments.

- Delivers concrete, quantitative outputs.

In contentious financial discussions, DCF models often cut through subjectivity, grounding decisions in data.

Limitations and Challenges of DCF Analysis

DCF has drawbacks:

- Sensitivity to inaccurate forecasts or discount rate changes.

- Limited applicability for volatile cash flows.

- Exclusion of non-financial factors (e.g., brand value).

A tech company nearly rejected a customer service platform due to a negative NPV. However, they overlooked intangible benefits like customer retention, which later drove significant ROI.

Best Practices for Finance Teams Using DCF

To optimize DCF effectiveness:

- Document assumptions transparently.

- Model multiple scenarios (optimistic, pessimistic, baseline).

- Update forecasts quarterly with actual performance data.

- Combine DCF with qualitative assessments.

- Collaborate cross-functionally for realistic inputs.

One firm habitually overestimated projection by 10%. Applying a “reality adjustment” to their models significantly improved accuracy.

DCF in Modern Financial Decision-Making

Contemporary applications include:

- Real-time DCF updates via automated systems.

- Evaluating SaaS subscriptions with recurring revenue models.

- Integrating DCF into broader financial planning tools.

Gartner research notes companies using automated DCF achieve 23% higher returns on invested capital, underscoring its evolving utility.

The Bottom Line: When to Use DCF Analysis

DCF excels when:

- Evaluating long-term projects (5+ years).

- Cash flows are predictable.

- Comparing multiple investment options.

- Determining fair business valuation.

It’s less reliable for:

- Early-stage ventures with no financial history.

- Short-term investments.

- Highly cyclical industries.

Many organizations report that adopting structured DCF frameworks transformed their capital allocation strategies.

FAQ Section

- Is DCF the same as NPV?

No. DCF calculates present value; NPV subtracts the initial investment from that value.

- How accurate are long-term DCF projections?

Accuracy declines beyond 5–10 years. Terminal value often bridges the gap.

- What discount rate should businesses use?

Most use WACC. Small businesses may opt for 10–20%, depending on risk.

- How does inflation impact DCF?

Either adjust cash flows for inflation or raise the discount rate—consistency is key.

- Can DCF work for startups?

It’s challenging due to unpredictable cash flows. Alternatives like scorecard valuation may suit better.

Conclusion

DCF demystifies complex investment decisions by answering: “What is future cash worth today?” Whether assessing equipment purchases, acquisitions, or stocks, it provides a systematic approach to quantifying value.

By mastering DCF basics, finance teams gain a critical lens for evaluating opportunities. As tools evolve, integrating automated DCF models into decision-making processes continues to enhance outcomes.

What investment will your organization evaluate next? Applying DCF could reveal insights that reshape perspectives—and strategies.

Ready to transform your AP process?

Start Your 30-Day Free Trial with Zenwork Payments AP Automation Software and experience the benefits of automated AP processing.