Home » Understanding ACH Direct Deposit – A Complete Guide

Understanding ACH Direct Deposit – A Complete Guide

Money moves differently these days. Remember waiting for paper checks in the mail? Those days are fading fast, replaced by ACH direct deposits that zip funds straight into bank accounts.

ACH direct deposit has become the backbone of how money changes hands electronically. From Friday paychecks landing in employee accounts to monthly Social Security payments for retirees, this system quietly powers millions of transactions daily.

Why are businesses and people switching from paper checks and wire transfers? The numbers tell the story. ACH direct deposits typically cost businesses less than $1 per transaction compared to $15-50 for wire transfers and $4-20 for paper checks when you factor in processing time, materials, and postage. They’re usually settled within 1-3 business days – faster than checks but not quite as immediate as wires. And with fraud protection built into the system, they offer peace of mind that paper checks simply can’t match.

What is ACH and How Does it Work?

Definition of ACH (Automated Clearing House) – The ACH network is essentially an electronic highway system for money. It’s a nationwide network that connects financial institutions, letting them send and receive payments electronically without paper checks, wire transfers, or cash.

Think of the ACH network like the postal service for electronic money – except much faster and more reliable. Instead of sorting physical mail, it routes digital payment instructions between banks.

When money moves through this network, it happens in one of two ways:

- ACH credits: “Here’s some money I’m sending you” transactions (like your paycheck or a tax refund)

- ACH debits: “Please take this payment from my account” transactions (like when you authorize your utility company to automatically withdraw your monthly bill)

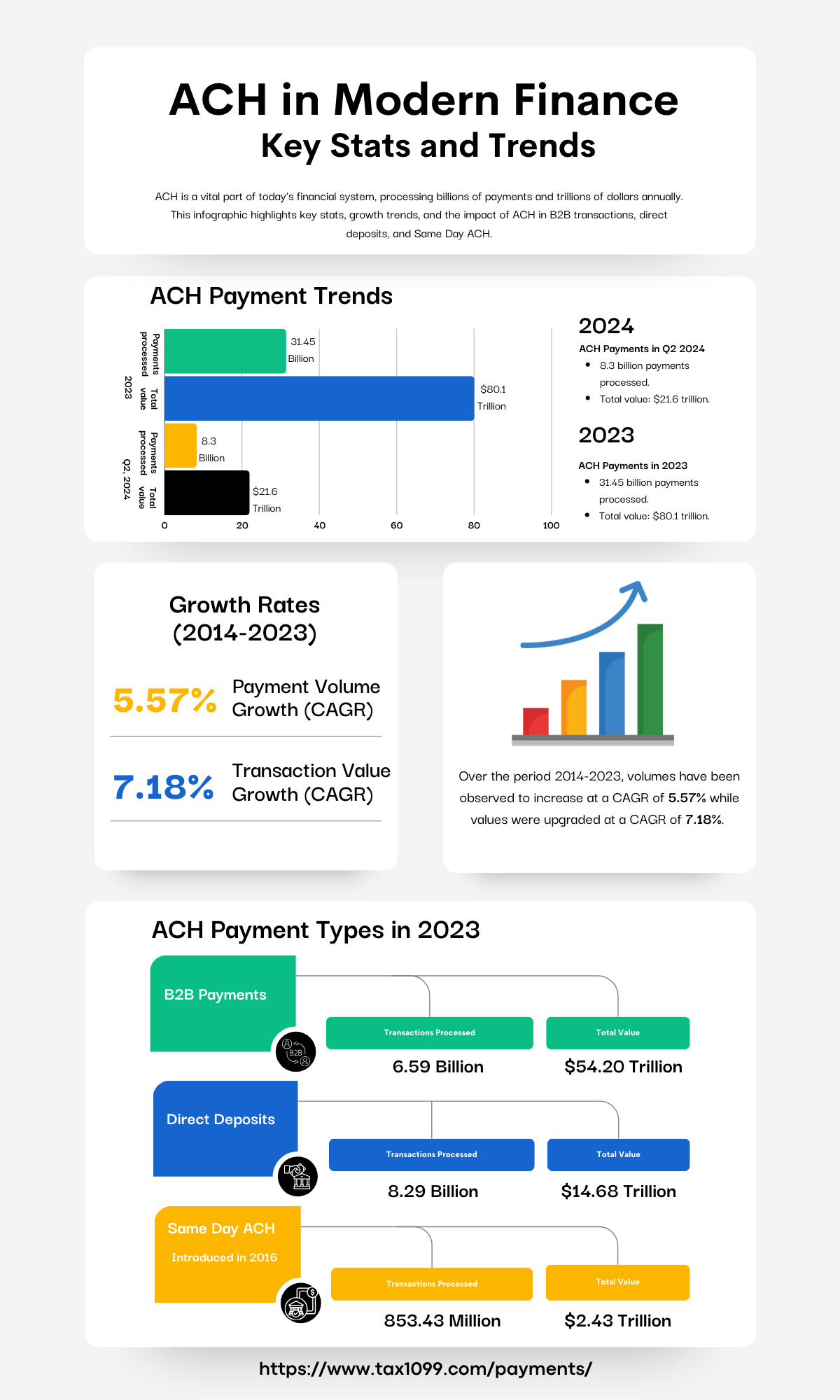

According to NACHA, the organization governing the ACH network, more than 7.8 billion ACH direct deposit payments were processed in 2023, moving over $23 trillion – a 6.7% increase from the previous year.

Suggested Reading: A Comprehensive Guide to ACH Payments for Businesses

Key Elements of ACH Payments

- Cost Effective: ACH payments are more affordable than credit card transactions and wire transfers, making them ideal for businesses handling high payment volumes.

- Bulk Processing: ACH transactions are processed in batches, allowing businesses to send multiple payments at once efficiently.

- Flexible Payment Option: ACH supports both one-time and recurring transactions, making it a reliable choice for payroll, vendor payments, and more.

How ACH Transactions Work

The journey of an ACH payment follows a specific path:

- A person or company (the originator) authorizes a payment

- Their financial institution (ODFI – Originating Depository Financial Institution) collects and forwards the payment instructions

- The ACH operator (either the Federal Reserve or The Clearing House) processes these instructions in batches

- The recipient’s bank (RDFI – Receiving Depository Financial Institution) receives these instructions and credits or debits the appropriate account

This entire process is overseen by NACHA (National Automated Clearing House Association), which creates and enforces the rules that keep the system running smoothly. They’re like the referees making sure everyone plays by the same rules.

Sam, a payroll manager at a manufacturing company with 250 employees, explains: “Before we switched to ACH for payroll, I’d spend hours printing checks, stuffing envelopes, and dealing with the inevitable ‘my check never arrived’ calls. Now our payroll service sends one file to our bank on Thursday, and everyone has their money Friday morning. No more paper, no more lost checks, no more headaches.”

What is an ACH Direct Deposit?

Definition and Overview – ACH direct deposit is the most common type of ACH credit transaction. It’s simply an electronic payment that goes straight into someone’s checking or savings account.

While many people associate direct deposit primarily with payroll, it’s used for many types of payments:

- Paychecks from employers

- Tax refunds from the IRS

- Social Security and pension payments

- Government benefits like unemployment

- Vendor and supplier payments between businesses

- Royalty and dividend payments

- Expense reimbursements

The Federal Government has been a major driver in ACH adoption. According to the Bureau of Fiscal Service, approximately 99% of federal salary payments and 98% of Social Security benefits are paid via ACH direct deposit – saving taxpayers millions in processing costs each year.

Suggested Reading: What is Business to Business ACH and How Does It Work

How an ACH Direct Deposit Works

Let’s walk through a typical payroll direct deposit:

- Your employer collects or confirms your banking details (routing and account numbers)

- On payday, they send a file to their bank (the ODFI) with instructions to pay specific amounts to each employee’s account

- The ODFI forwards these instructions to the ACH operator

- The ACH operator sorts and sends these instructions to each employee’s bank (the RDFI)

- Each RDFI credits the appropriate customer accounts with their payment

Maya, a restaurant server, shares her experience: “Getting paid by direct deposit changed everything for me. Before, I’d have to take my paper check to the bank during business hours, which was hard with my schedule. Sometimes I’d hold onto checks for weeks. Now my money’s just there Friday morning, and I can pay my bills right away. It’s one less thing to worry about.”

ACH vs Direct Deposit – What’s the Difference?

This is where things get a bit confusing for many people. The relationship between ACH and direct deposit is like the relationship between vehicles and cars – all cars are vehicles, but not all vehicles are cars.

Similarly, all direct deposits are ACH transactions, but not all ACH transactions are direct deposits.

- ACH is the overall system/network that processes various types of electronic transactions

- Direct deposit is specifically an ACH credit transaction where money is pushed into someone’s account

Here’s how they compare to other payment methods:

| Feature | ACH Direct Deposit | Wire Transfer | Paper Check |

| Speed | 1-3 business days (Same-day ACH available for additional fee) | Minutes to hours | Days to weeks |

| Cost | $0.20-$1.50 per transaction | $15-$50 per transaction | $4-$20 (processing, printing, postage, reconciliation) |

| Security | Very secure with fraud protection | Secure but difficult to recall once sent | Vulnerable to theft, forgery, and mail delays |

| Use Cases | Regular payments: payroll, benefits, vendor payments | Large or time-sensitive transfers, real estate closings | Declining use, mainly for one-time payments |

| Reversibility | Can be recalled within certain timeframes | Very difficult to reverse | Can be stopped if not yet cashed |

Tom, the controller for a mid-sized landscaping business, explains their transition: “We used to write about 200 checks a month – to employees, suppliers, tax authorities. The labor cost alone was killing us, not to mention the check stock and postage. When we moved to ACH, we cut our payment processing costs by about 80%. Now my team focuses on financial analysis instead of stuffing envelopes.”

Suggested Reading: ACH vs Wire Transfer: Key Differences for Business Payments

Key Components of ACH Direct Deposit

- ODFI (Originating Depository Financial Institution)

- RDFI (Receiving Depository Financial Institution)

- Network Administration Fees

ODFI (Originating Depository Financial Institution)

The ODFI is the financial institution that receives payment instructions from its customers and forwards them into the ACH network. For a payroll direct deposit, this would be the employer’s bank.

The ODFI has significant responsibilities in the ACH system:

- Verifying the legitimacy of the originator (their customer)

- Ensuring transactions follow NACHA rules

- Managing the timing of payments

- Handling any returns or rejections

RDFI (Receiving Depository Financial Institution)

The RDFI is the financial institution that receives ACH instructions from the network and posts transactions to their customers’ accounts. For a payroll direct deposit, this would be each employee’s bank.

The RDFI’s responsibilities include:

- Processing incoming ACH files promptly

- Posting transactions to the correct customer accounts

- Handling exceptions like insufficient funds

- Managing any disputes or unauthorized transaction claims

Network Administration Fees

ACH transactions typically involve several types of fees:

- Processing fees charged by the ODFI to the originator

- Interchange fees between financial institutions

- Return fees for rejected transactions

These fees are significantly lower than those for wire transfers or check processing. According to AFP’s Payments Cost Benchmarking Survey, the median cost to issue an ACH payment is $0.29, compared to $1.57 for a check and $14.42 for a wire transfer.

How to Set Up ACH Direct Deposit

For Employers & Businesses

Setting up ACH direct deposit capabilities isn’t as complicated as many businesses fear. Here’s the typical process:

- Contact your business bank about their ACH services

- Complete their ACH origination agreement

- Set up the technical connection (often through your accounting or payroll software)

- Collect required information from employees or vendors

- Run a test file before your first live payments

For many small businesses, the simplest approach is using a payroll service provider that already has ACH capabilities built in.

The minimum information needed to set up direct deposit includes:

- Employee/recipient name as it appears on their account

- Bank routing number

- Account number

- Account type (checking or savings)

- Authorization form signed by the employee

Rachel, an HR manager for a home healthcare company, shares: “When we first looked into direct deposit, I thought it would be this huge project. But our payroll provider handled most of the technical setup. The biggest job was just collecting everyone’s banking information and consent forms. Within two weeks, we were up and running.”

Suggested Reading: ACH vs SWIFT: Understanding the Key Differences for Business Payments

For Employees & Individuals

From the recipient’s perspective, enrolling in direct deposit is straightforward:

- Obtain a direct deposit form from your employer, government agency, or payor

- Provide your account information (can usually be found on checks or in your banking app)

- Submit the completed form along with a voided check or bank verification letter

- Wait for confirmation that the setup is complete

Many banks now offer “direct deposit switch kits” that make it easy to update your payment information with multiple payors when you change banks.

Benefits of ACH Direct Deposit

For Employers & Businesses

The benefits of ACH direct deposit have made it the payment method of choice for businesses of all sizes:

- Cost savings: The Electronic Payments Association estimates businesses save $1.22 per payment by switching from checks to ACH

- Reduced administrative burden: No more printing, signing, and mailing checks

- Improved cash flow management: Precise control over when funds leave your account

- Enhanced security: Less risk of fraud compared to paper checks

- Environmental benefits: Reduced paper, ink, and transportation impacts

A NACHA study found that businesses using ACH for payroll save an average of $3.15 per payment compared to paper checks when considering all costs.

For Employees & Individuals

Recipients enjoy equally compelling benefits:

- Immediate access to funds: No trips to the bank or waiting for checks to clear

- Reliability: Payments arrive even during weather events, postal delays, or when you’re traveling

- Safety: Reduced risk of lost or stolen checks

- Convenience: Automated savings through split deposits

- Financial inclusion: Even those without traditional bank accounts can often use direct deposit with prepaid cards

A Federal Reserve study found that 99% of consumers who use direct deposit report being satisfied with it, citing convenience and reliability as the top benefits.

Suggested Reading: How to Set Up ACH Payments for My Business A Complete Guide

FAQs About ACH Direct Deposit

- Is ACH the same as direct deposit?

Not exactly. Direct deposit is a type of ACH transaction – specifically, an ACH credit. The ACH network handles many other types of transactions too, including automatic bill payments (ACH debits), person-to-person payments, and business-to-business transfers.

- How long does an ACH direct deposit take?

Standard ACH direct deposits typically settle in 1-3 business days. However, same-day ACH service is now available (for an additional fee), allowing funds to be available on the same business day if submitted by the deadline.

The ACH network has three processing windows each business day:

- Morning submission deadline: 10:30 AM ET

- Afternoon submission deadline: 2:45 PM ET

- Evening submission deadline: 4:45 PM ET (settling the next morning)

- What information is needed to set up direct deposit?

At minimum, you’ll need:

- The recipient’s full legal name as it appears on their bank account

- Bank routing number (the 9-digit ABA number identifying their bank)

- Account number

- Account type (checking or savings)

- Signed authorization

Many organizations also request a voided check or bank verification letter to confirm account details.

- Can ACH payments be reversed?

Yes, under specific circumstances. Unlike wire transfers (which are nearly impossible to recall), ACH transactions can be reversed if:

- The payment was for an incorrect amount

- The payment was sent to the wrong account

- The payment was duplicated

- The authorization was revoked

However, there are strict timeframes for these reversals – typically 5 business days for consumer accounts and 24 hours for business accounts.

- How does ACH differ from wire transfers?

While both move money electronically, they use different networks and have different characteristics:

- Speed: Wire transfers typically complete within hours; ACH usually takes 1-3 business days

- Cost: Wires typically cost $15-$50; ACH transactions usually cost under $1

-

Finality: Wires are nearly immediate and difficult to reverse; ACH has built-in return processes

- Batch processing: Wires are processed individually; ACH transactions are processed in batches

- International capabilities: Wires work globally; traditional ACH is primarily domestic (though international ACH is growing)

ACH Direct Deposit Security & Compliance

ACH Fraud Risks & Prevention

While ACH is generally very secure, no payment system is completely immune to fraud. Common risks include:

- Account takeover: Criminals gain access to accounts and initiate unauthorized transfers

- Business email compromise: Fraudsters impersonate executives to request payment changes

- Social engineering: Tricking employees into changing direct deposit information

According to the AFP Payments Fraud Survey, 33% of organizations experienced attempted or actual ACH debit fraud in 2023, while 19% experienced ACH credit fraud.

Effective prevention measures include:

- Multi-factor authentication for all payment systems

- Verification procedures for any account changes

- Dual control (requiring two people to approve transactions)

- Daily reconciliation of accounts

- Employee training on social engineering techniques

Financial controller Lisa explains her company’s approach: “After a vendor’s email was hacked and we nearly sent a $50,000 payment to the wrong account, we implemented a callback verification procedure. Now, any time banking details change, we call the vendor using the phone number we have on file – not any number provided in the email – to confirm the changes before processing any payments.”

Regulatory Compliance & NACHA Rules

The ACH network operates under a comprehensive set of rules established by NACHA. These rules cover:

- Technical specifications for ACH files

- Timing requirements for processing

- Authorization requirements

- Error resolution procedures

- Data security standards

NACHA updates these rules regularly. Recent changes include:

- Expanding same-day ACH processing windows

- Increasing the same-day ACH dollar limit to $1 million per transaction

- Enhancing fraud detection requirements

- Implementing supplemental fraud detection for WEB debits

Organizations using the ACH network must stay current with these rules or risk penalties and potentially losing their ACH origination privileges.

Conclusion & Key Takeaways

The shift toward ACH direct deposit represents one of the most significant changes in how money moves in the past 50 years. Paper checks continue their steady decline, with the Federal Reserve reporting a 7.2% annual decrease in check volume, while ACH transactions grow at 6-8% annually.

For businesses still relying heavily on paper payments, the question isn’t if they should transition to ACH, but when and how. The efficiency gains, cost savings, and security improvements make a compelling case for making the switch.

For individuals, embracing direct deposit means faster access to funds, greater convenience, and reduced risk of payment problems. Those still receiving paper checks are missing out on these benefits.

As technology continues to evolve, the ACH network is keeping pace, with enhancements like:

- Real-time payment capabilities

- Improved fraud protection

- Expanded international ACH options

- Better integration with accounting systems

The future of payments is increasingly digital, automated, and invisible – working smoothly in the background while we focus on more important things. ACH direct deposit is at the center of this transformation, quietly revolutionizing how money moves in our economy.

Have you made the switch to direct deposit yet? If not, what’s holding you back?

Are You Ready To Transform Your Payments And AP Process?

Start Your 30-Day Free Trial with Zenwork Payments AP Automation Software and experience the benefits of automated AP processing.